- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

February 2025's Top Growth Companies With Insider Influence

Reviewed by Simply Wall St

As global markets navigate geopolitical tensions and consumer spending concerns, investors are increasingly focused on the resilience of specific sectors and companies. In this environment, growth companies with high insider ownership can offer unique insights into potential opportunities, as insiders often have a deep understanding of their company's prospects and challenges.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Clinuvel Pharmaceuticals (ASX:CUV) | 10.4% | 26.2% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 43.2% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Underneath we present a selection of stocks filtered out by our screen.

VusionGroup (ENXTPA:VU)

Simply Wall St Growth Rating: ★★★★★★

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America, with a market capitalization of €2.64 billion.

Operations: The company's revenue segment includes Installing and Maintaining Electronic Shelf Labels, generating €830.16 million.

Insider Ownership: 13.4%

Earnings Growth Forecast: 73.1% p.a.

VusionGroup's revenue is forecast to grow at 20.1% annually, outpacing the French market's growth. Analysts expect the company to achieve profitability in three years, with a very high return on equity of 45.4%. The stock trades at 27.1% below its estimated fair value, with analysts predicting a price increase of 27%. A significant partnership with The Fresh Market enhances VusionGroup's North American presence through digital solutions, improving efficiency and inventory management across all stores.

- Click here and access our complete growth analysis report to understand the dynamics of VusionGroup.

- Our comprehensive valuation report raises the possibility that VusionGroup is priced lower than what may be justified by its financials.

Xgimi TechnologyLtd (SHSE:688696)

Simply Wall St Growth Rating: ★★★★☆☆

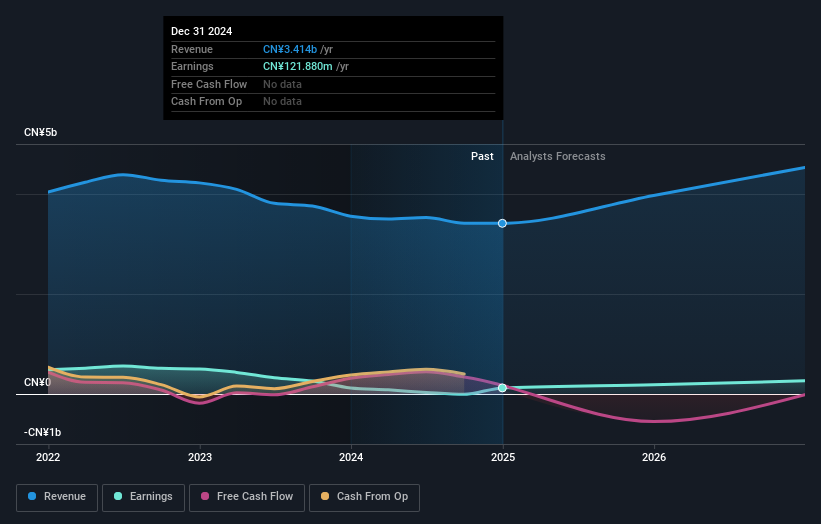

Overview: Xgimi Technology Co., Ltd. designs, manufactures, and sells multi-functional smart projectors and laser TVs in China, with a market cap of CN¥8.89 billion.

Operations: The company generates revenue from the design, manufacture, and sale of multi-functional smart projectors and laser TVs in China.

Insider Ownership: 30.3%

Earnings Growth Forecast: 54.3% p.a.

Xgimi Technology Ltd. is poised for substantial earnings growth, forecasted at 54.3% annually, outpacing the Chinese market's average. Despite a modest revenue increase of 14.1%, its recent financial results show stable performance with net income of CNY 121.88 million for 2024. The company completed a share buyback worth CNY 164.3 million and saw a strategic acquisition of a 2.83% stake by prominent investors, indicating strong insider confidence and potential future value creation.

- Dive into the specifics of Xgimi TechnologyLtd here with our thorough growth forecast report.

- The analysis detailed in our Xgimi TechnologyLtd valuation report hints at an inflated share price compared to its estimated value.

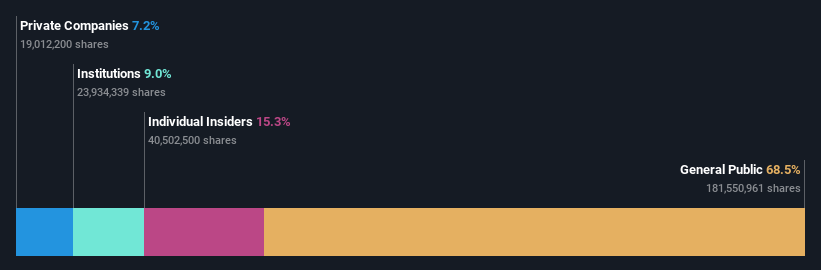

Qingdao Gon Technology (SZSE:002768)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Qingdao Gon Technology Co., Ltd. is involved in the research, development, production, and sale of modified plastic particles and products, as well as functional plastic plates both in China and internationally, with a market cap of CN¥6.55 billion.

Operations: The company generates revenue through its activities in the development, production, and sale of modified plastic particles and functional plastic plates across domestic and international markets.

Insider Ownership: 15.3%

Earnings Growth Forecast: 29.6% p.a.

Qingdao Gon Technology is projected to achieve significant earnings growth of 29.6% annually, surpassing the Chinese market's average. Although revenue growth is slower at 14.5%, it still exceeds the market rate. The company completed a share buyback worth CNY 130.27 million, reflecting strategic capital allocation despite an unstable dividend history and low future return on equity forecast of 15.5%. Its price-to-earnings ratio of 12x suggests good value compared to peers and industry standards.

- Navigate through the intricacies of Qingdao Gon Technology with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Qingdao Gon Technology's shares may be trading at a discount.

Key Takeaways

- Click this link to deep-dive into the 1453 companies within our Fast Growing Companies With High Insider Ownership screener.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Engages in the provision of digitalization solutions for commerce in Europe, Asia, and North America.

Exceptional growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives