- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:VU

A Look at VusionGroup (ENXTPA:VU) Valuation After Major Morrisons Deal and Raised Earnings Outlook

Reviewed by Simply Wall St

VusionGroup (ENXTPA:VU) just landed a high-profile partnership with UK grocer Morrisons, who will roll out electronic shelf labels across all its stores. This comes as VusionGroup reconfirms its upbeat earnings guidance and expects record Q4 revenue.

See our latest analysis for VusionGroup.

VusionGroup’s win at Morrisons and strengthened guidance have caught investor attention, with the company’s share price up 25.3% year-to-date and a one-year total shareholder return of 58.3%. Momentum has built steadily over the past three and five years as well, which points to ongoing growth optimism.

If recent news has you rethinking your watchlist, now could be the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

The question now is whether VusionGroup’s recent surge leaves further room for upside, or if investors are already factoring in all the future growth. Is there still a buying opportunity, or has the market already priced it in?

Most Popular Narrative: 19% Undervalued

The narrative’s fair value sits well above the last closing price, suggesting notable upside potential if the growth blueprint is delivered. Here is what is driving the excitement and the uncertainty under the surface.

VAS (Value Added Services) is projected to grow at twice the rate of overall revenues, around 80%, due to the accelerated adoption of VusionCloud and EdgeSense technology. This is expected to improve earnings as VAS typically has higher margins than the core ESL business.

Want to know the story behind this bold valuation? The narrative hinges on a high-growth engine and a future profit margin turn that is rarely seen in this sector. Curious what aggressive assumptions drive today’s fair value estimate? Dive in to see what is really fueling analysts’ optimism.

Result: Fair Value of $281.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors should note that heavy reliance on major contracts, such as Walmart, along with regional revenue volatility, could alter VusionGroup’s growth trajectory.

Find out about the key risks to this VusionGroup narrative.

Another View: Multiples Raise Questions

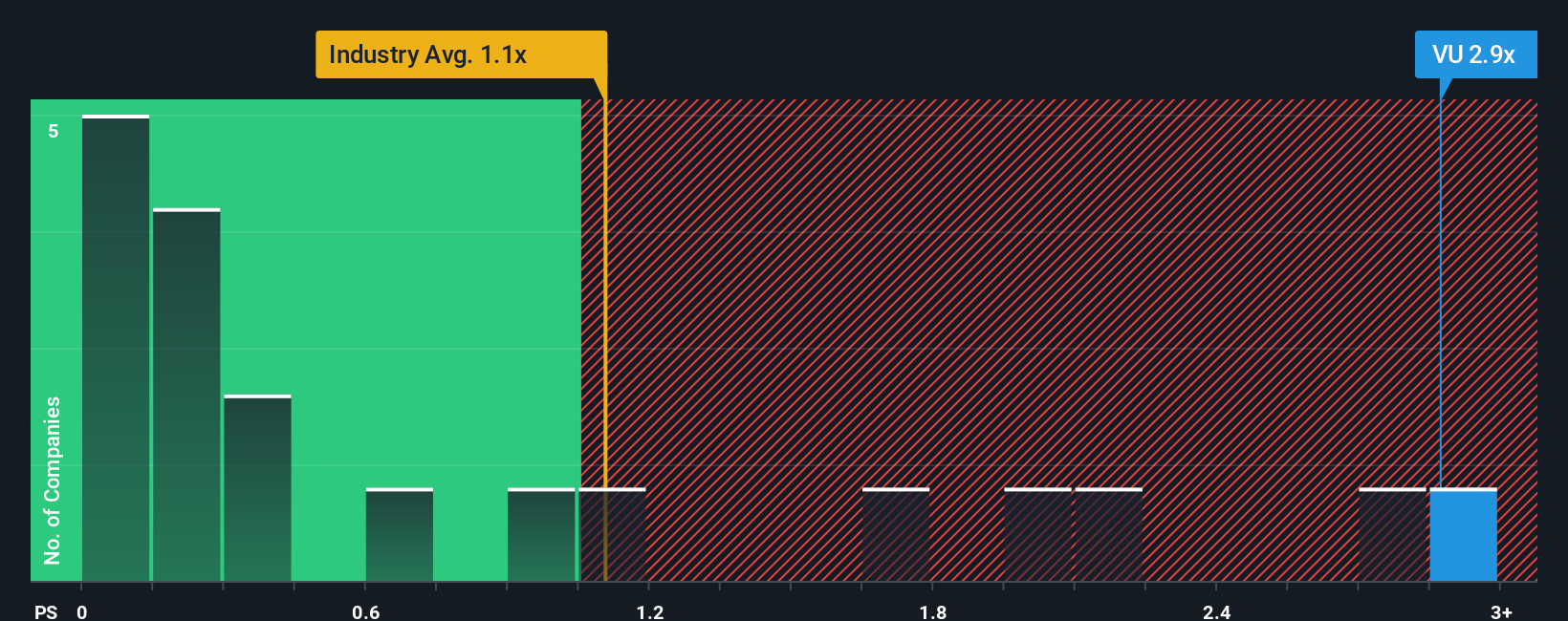

While analysts see VusionGroup as undervalued based on future growth prospects, a glance at the price-to-sales ratio tells another story. At 3.3x, it stands above both industry (1.2x) and peer (1.5x) averages, and also well above its fair ratio of 1.2x. This premium could signal valuation risk if growth stumbles, or a vote of confidence if bullish expectations prove right. Is the market too optimistic, or spot on?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own VusionGroup Narrative

If you have a different perspective or want to dig into the numbers yourself, it only takes minutes to craft your own take on VusionGroup. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding VusionGroup.

Looking for more investment ideas?

Smart investors never limit themselves to just one story. Tap into trending opportunities and make your next move with these handpicked ideas from the Simply Wall St Screener:

- Power up your portfolio with market trends by evaluating these 26 AI penny stocks, which are shaping the tech landscape and driving rapid innovation.

- Accelerate your returns and spot undervalued gems in today’s market by checking out these 833 undervalued stocks based on cash flows before the rest of the crowd catches on.

- Secure your income stream and lock in strong yields with these 24 dividend stocks with yields > 3%, offering consistent performance even in unpredictable markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VU

VusionGroup

Engages in the provision of digitalization solutions for commerce in Europe, Asia, and North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion