- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:GEA

Is Grenobloise d'Electronique et d'Automatismes Société Anonyme (EPA:GEA) A Strong Dividend Stock?

Is Grenobloise d'Electronique et d'Automatismes Société Anonyme (EPA:GEA) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. On the other hand, investors have been known to buy a stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

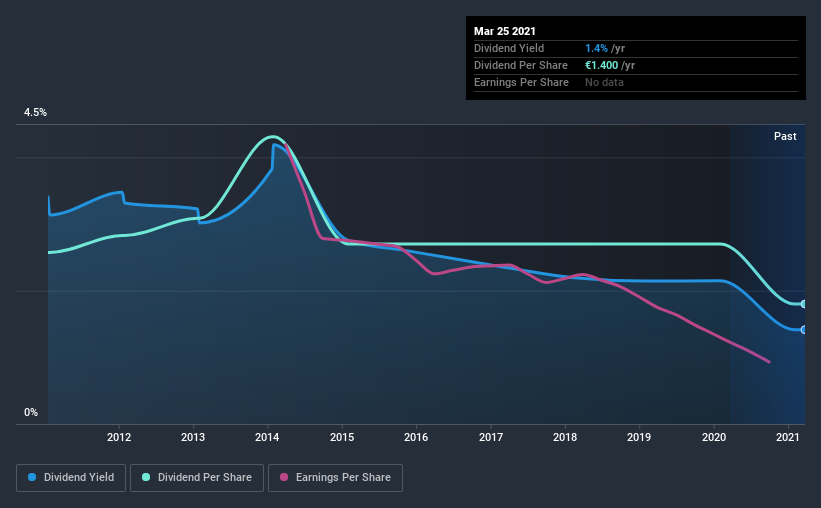

A slim 1.4% yield is hard to get excited about, but the long payment history is respectable. At the right price, or with strong growth opportunities, Grenobloise d'Electronique et d'Automatismes Société Anonyme could have potential. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Comparing dividend payments to a company's net profit after tax is a simple way of reality-checking whether a dividend is sustainable. In the last year, Grenobloise d'Electronique et d'Automatismes Société Anonyme paid out 62% of its profit as dividends. This is a healthy payout ratio, and while it does limit the amount of earnings that can be reinvested in the business, there is also some room to lift the payout ratio over time.

We also measure dividends paid against a company's levered free cash flow, to see if enough cash was generated to cover the dividend. The company paid out 79% of its free cash flow as dividends last year, which is adequate, but reduces the wriggle room in the event of a downturn. It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

While the above analysis focuses on dividends relative to a company's earnings, we do note Grenobloise d'Electronique et d'Automatismes Société Anonyme's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Consider getting our latest analysis on Grenobloise d'Electronique et d'Automatismes Société Anonyme's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. For the purpose of this article, we only scrutinise the last decade of Grenobloise d'Electronique et d'Automatismes Société Anonyme's dividend payments. The dividend has been cut on at least one occasion historically. During the past 10-year period, the first annual payment was €2.0 in 2011, compared to €1.4 last year. The dividend has shrunk at around 3.5% a year during that period. Grenobloise d'Electronique et d'Automatismes Société Anonyme's dividend has been cut sharply at least once, so it hasn't fallen by 3.5% every year, but this is a decent approximation of the long term change.

A shrinking dividend over a 10-year period is not ideal, and we'd be concerned about investing in a dividend stock that lacks a solid record of growing dividends per share.

Dividend Growth Potential

With a relatively unstable dividend, it's even more important to see if earnings per share (EPS) are growing. Why take the risk of a dividend getting cut, unless there's a good chance of bigger dividends in future? Grenobloise d'Electronique et d'Automatismes Société Anonyme's EPS have fallen by approximately 19% per year during the past five years. With this kind of significant decline, we always wonder what has changed in the business. Dividends are about stability, and Grenobloise d'Electronique et d'Automatismes Société Anonyme's earnings per share, which support the dividend, have been anything but stable.

Conclusion

To summarise, shareholders should always check that Grenobloise d'Electronique et d'Automatismes Société Anonyme's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. Grenobloise d'Electronique et d'Automatismes Société Anonyme's is paying out more than half its income as dividends, but at least the dividend is covered by both reported earnings and cashflow. Second, earnings per share have been in decline, and its dividend has been cut at least once in the past. In summary, Grenobloise d'Electronique et d'Automatismes Société Anonyme has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are a number of better ideas out there.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. For example, we've identified 2 warning signs for Grenobloise d'Electronique et d'Automatismes Société Anonyme (1 is a bit concerning!) that you should be aware of before investing.

We have also put together a list of global stocks with a market capitalisation above $1bn and yielding more 3%.

If you decide to trade Grenobloise d'Electronique et d'Automatismes Société Anonyme, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:GEA

Grenobloise d'Electronique et d'Automatismes Société Anonyme

Provides electronic toll collection systems in France, rest of the European Union, rest of Europe, Asia, the Americas, and Africa.

Excellent balance sheet with proven track record.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026