- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:ALAUR

We Think AURES Technologies (EPA:AURS) Can Stay On Top Of Its Debt

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that AURES Technologies S.A. (EPA:AURS) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for AURES Technologies

What Is AURES Technologies's Net Debt?

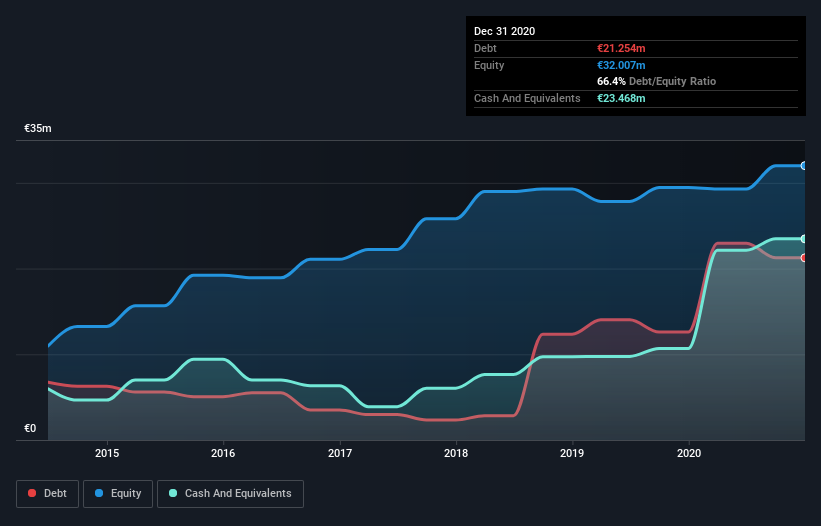

As you can see below, at the end of December 2020, AURES Technologies had €21.3m of debt, up from €12.6m a year ago. Click the image for more detail. However, it does have €23.5m in cash offsetting this, leading to net cash of €2.21m.

How Healthy Is AURES Technologies' Balance Sheet?

According to the last reported balance sheet, AURES Technologies had liabilities of €25.6m due within 12 months, and liabilities of €28.4m due beyond 12 months. On the other hand, it had cash of €23.5m and €16.0m worth of receivables due within a year. So its liabilities total €14.5m more than the combination of its cash and short-term receivables.

Given AURES Technologies has a market capitalization of €111.6m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. While it does have liabilities worth noting, AURES Technologies also has more cash than debt, so we're pretty confident it can manage its debt safely.

But the other side of the story is that AURES Technologies saw its EBIT decline by 8.1% over the last year. That sort of decline, if sustained, will obviously make debt harder to handle. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine AURES Technologies's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. While AURES Technologies has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Over the most recent three years, AURES Technologies recorded free cash flow worth 68% of its EBIT, which is around normal, given free cash flow excludes interest and tax. This free cash flow puts the company in a good position to pay down debt, when appropriate.

Summing up

Although AURES Technologies's balance sheet isn't particularly strong, due to the total liabilities, it is clearly positive to see that it has net cash of €2.21m. The cherry on top was that in converted 68% of that EBIT to free cash flow, bringing in €4.7m. So we are not troubled with AURES Technologies's debt use. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 1 warning sign for AURES Technologies you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading AURES Technologies or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALAUR

AURES Technologies

Engages in manufacture of hardware and digital application solutions for point of sale and retail industry.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026