- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:ALAUR

These Analysts Just Made An Incredible Downgrade To Their AURES Technologies S.A. (EPA:AURS) EPS Forecasts

Market forces rained on the parade of AURES Technologies S.A. (EPA:AURS) shareholders today, when the analysts downgraded their forecasts for this year. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon.

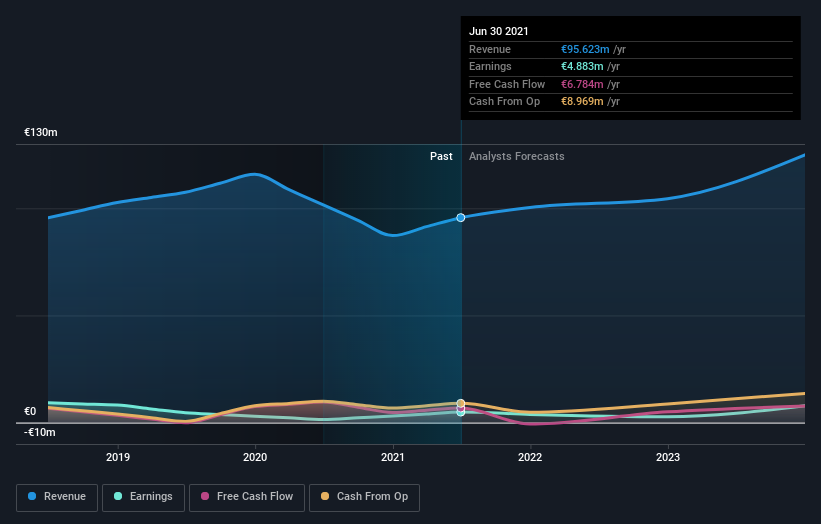

After this downgrade, AURES Technologies' twin analysts are now forecasting revenues of €105m in 2022. This would be a decent 9.3% improvement in sales compared to the last 12 months. Statutory earnings per share are supposed to nosedive 45% to €0.68 in the same period. Before this latest update, the analysts had been forecasting revenues of €119m and earnings per share (EPS) of €1.86 in 2022. It looks like analyst sentiment has declined substantially, with a substantial drop in revenue estimates and a large cut to earnings per share numbers as well.

View our latest analysis for AURES Technologies

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. The analysts are definitely expecting AURES Technologies' growth to accelerate, with the forecast 9.3% annualised growth to the end of 2022 ranking favourably alongside historical growth of 5.4% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to see revenue growth of 19% annually. It seems obvious that, while the future growth outlook is brighter than the recent past, AURES Technologies is expected to grow slower than the wider industry.

The Bottom Line

The biggest issue in the new estimates is that analysts have reduced their earnings per share estimates, suggesting business headwinds lay ahead for AURES Technologies. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. We wouldn't be surprised to find shareholders feeling a bit shell-shocked, after these downgrades. It looks like analysts have become a lot more bearish on AURES Technologies, and their negativity could be grounds for caution.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have analyst estimates for AURES Technologies going out as far as 2023, and you can see them free on our platform here.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALAUR

AURES Technologies

Engages in manufacture of hardware and digital application solutions for point of sale and retail industry.

Adequate balance sheet and fair value.

Market Insights

Community Narratives