- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:ALWEC

We.Connect's (EPA:ALWEC) Profits May Not Reveal Underlying Issues

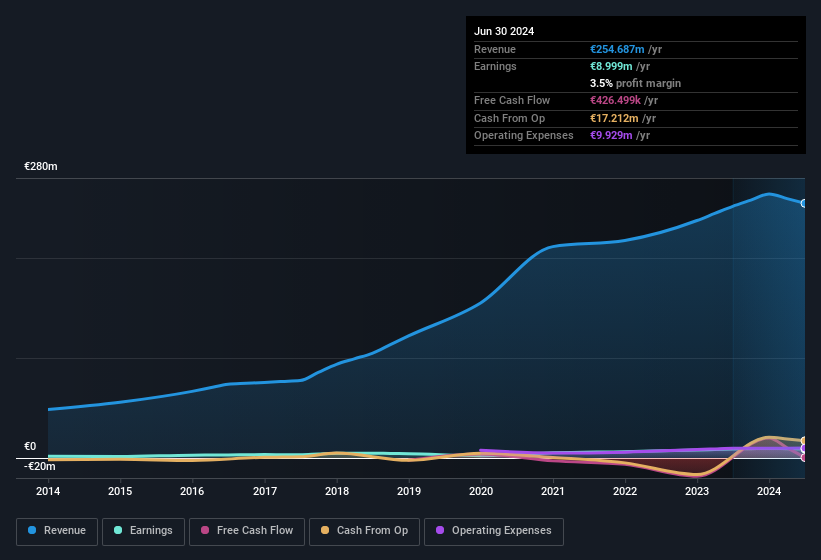

We.Connect SA's (EPA:ALWEC) robust recent earnings didn't do much to move the stock. However the statutory profit number doesn't tell the whole story, and we have found some factors which might be of concern to shareholders.

Check out our latest analysis for We.Connect

One essential aspect of assessing earnings quality is to look at how much a company is diluting shareholders. In fact, We.Connect increased the number of shares on issue by 6.2% over the last twelve months by issuing new shares. That means its earnings are split among a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. You can see a chart of We.Connect's EPS by clicking here.

How Is Dilution Impacting We.Connect's Earnings Per Share (EPS)?

As you can see above, We.Connect has been growing its net income over the last few years, with an annualized gain of 57% over three years. While we did see a very small decrease, net profit was basically flat over the last year. While EPS growth was also pretty flat, but no prizes for guessing that it looked worse than the net income. So you can see that the dilution has had a bit of an impact on shareholders.

Changes in the share price do tend to reflect changes in earnings per share, in the long run. So it will certainly be a positive for shareholders if We.Connect can grow EPS persistently. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of We.Connect.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that We.Connect's profit was boosted by unusual items worth €1.5m in the last twelve months. While we like to see profit increases, we tend to be a little more cautious when unusual items have made a big contribution. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And, after all, that's exactly what the accounting terminology implies. Assuming those unusual items don't show up again in the current year, we'd thus expect profit to be weaker next year (in the absence of business growth, that is).

Our Take On We.Connect's Profit Performance

In its last report We.Connect benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. Considering all this we'd argue We.Connect's profits probably give an overly generous impression of its sustainable level of profitability. So if you'd like to dive deeper into this stock, it's crucial to consider any risks it's facing. In terms of investment risks, we've identified 3 warning signs with We.Connect, and understanding these should be part of your investment process.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

Valuation is complex, but we're here to simplify it.

Discover if We.Connect might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALWEC

We.Connect

Designs, manufactures, assembles, and distributes hardware and computers, and peripheral and electronic equipment in France.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026