- France

- /

- Communications

- /

- ENXTPA:ALNN6

ENENSYS Technologies SA's (EPA:ALNN6) 26% Price Boost Is Out Of Tune With Revenues

Those holding ENENSYS Technologies SA (EPA:ALNN6) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. The last month tops off a massive increase of 136% in the last year.

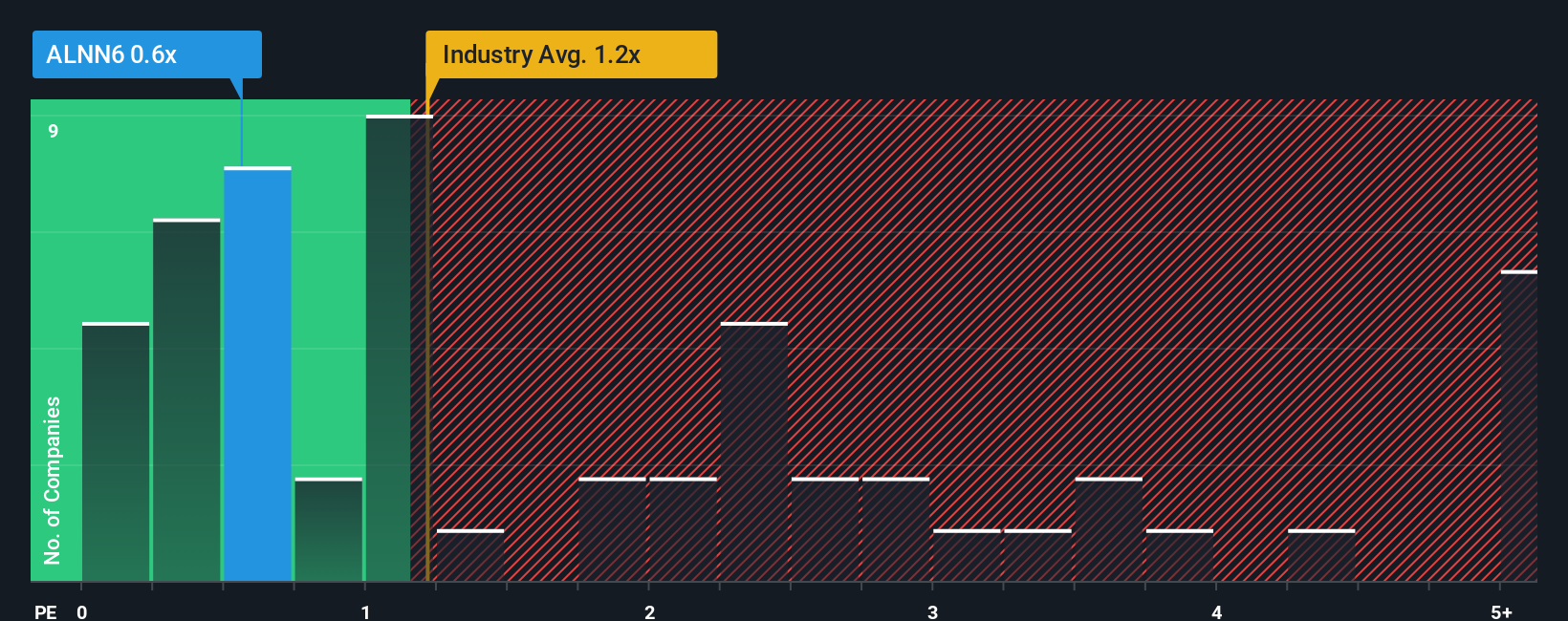

Even after such a large jump in price, you could still be forgiven for feeling indifferent about ENENSYS Technologies' P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Communications industry in France is also close to 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

See our latest analysis for ENENSYS Technologies

What Does ENENSYS Technologies' P/S Mean For Shareholders?

ENENSYS Technologies certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ENENSYS Technologies.Is There Some Revenue Growth Forecasted For ENENSYS Technologies?

In order to justify its P/S ratio, ENENSYS Technologies would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 24%. The latest three year period has also seen a 20% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 4.3% as estimated by the sole analyst watching the company. That's shaping up to be materially lower than the 7.2% growth forecast for the broader industry.

With this information, we find it interesting that ENENSYS Technologies is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What Does ENENSYS Technologies' P/S Mean For Investors?

ENENSYS Technologies appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that ENENSYS Technologies' revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

It is also worth noting that we have found 4 warning signs for ENENSYS Technologies (2 are potentially serious!) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if ENENSYS Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALNN6

ENENSYS Technologies

Engages in the design and marketing of hardware and software solutions for media distributors in France, rest of Europe, the Middle East, Africa, the Asia Pacific, North America, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026