- France

- /

- Communications

- /

- ENXTPA:ALNN6

ENENSYS Technologies SA (EPA:ALNN6) Stock Rockets 28% As Investors Are Less Pessimistic Than Expected

ENENSYS Technologies SA (EPA:ALNN6) shares have continued their recent momentum with a 28% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 52% in the last year.

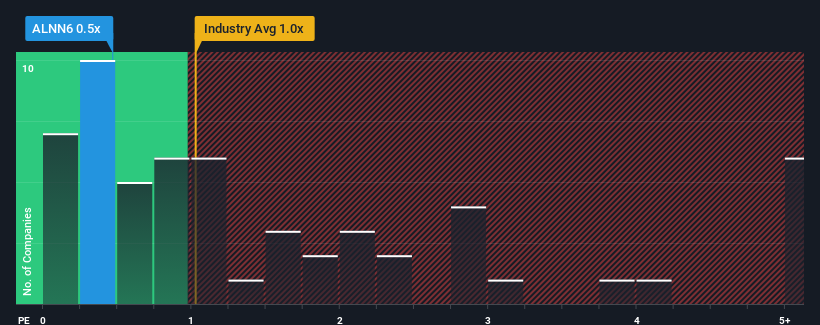

Even after such a large jump in price, it's still not a stretch to say that ENENSYS Technologies' price-to-sales (or "P/S") ratio of 0.5x right now seems quite "middle-of-the-road" compared to the Communications industry in France, where the median P/S ratio is around 0.8x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for ENENSYS Technologies

How Has ENENSYS Technologies Performed Recently?

With its revenue growth in positive territory compared to the declining revenue of most other companies, ENENSYS Technologies has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think ENENSYS Technologies' future stacks up against the industry? In that case, our free report is a great place to start.Is There Some Revenue Growth Forecasted For ENENSYS Technologies?

There's an inherent assumption that a company should be matching the industry for P/S ratios like ENENSYS Technologies' to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 12% last year. The solid recent performance means it was also able to grow revenue by 30% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue should grow by 5.4% over the next year. Meanwhile, the rest of the industry is forecast to expand by 11%, which is noticeably more attractive.

With this in mind, we find it intriguing that ENENSYS Technologies' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

Its shares have lifted substantially and now ENENSYS Technologies' P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

When you consider that ENENSYS Technologies' revenue growth estimates are fairly muted compared to the broader industry, it's easy to see why we consider it unexpected to be trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. Circumstances like this present a risk to current and prospective investors who may see share prices fall if the low revenue growth impacts the sentiment.

And what about other risks? Every company has them, and we've spotted 4 warning signs for ENENSYS Technologies (of which 3 shouldn't be ignored!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if ENENSYS Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALNN6

ENENSYS Technologies

Engages in the design and marketing of hardware and software solutions for media distributors in France, rest of Europe, the Middle East, Africa, the Asia Pacific, North America, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026