- France

- /

- Communications

- /

- ENXTPA:ALNN6

ENENSYS Technologies SA (EPA:ALNN6) Shares Slammed 29% But Getting In Cheap Might Be Difficult Regardless

ENENSYS Technologies SA (EPA:ALNN6) shareholders won't be pleased to see that the share price has had a very rough month, dropping 29% and undoing the prior period's positive performance. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 27% share price drop.

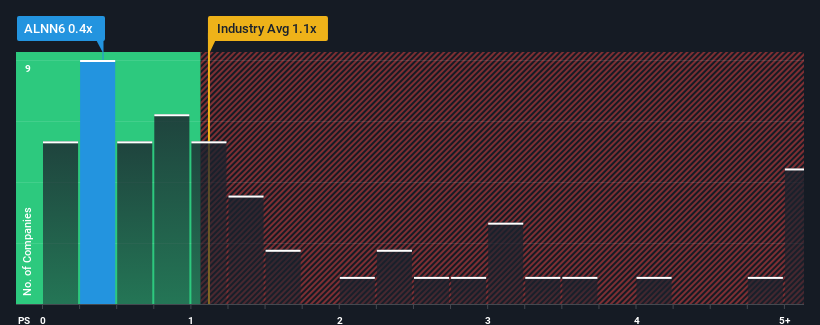

Although its price has dipped substantially, it's still not a stretch to say that ENENSYS Technologies' price-to-sales (or "P/S") ratio of 0.4x right now seems quite "middle-of-the-road" compared to the Communications industry in France, where the median P/S ratio is around 0.7x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for ENENSYS Technologies

What Does ENENSYS Technologies' Recent Performance Look Like?

ENENSYS Technologies could be doing better as it's been growing revenue less than most other companies lately. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ENENSYS Technologies.How Is ENENSYS Technologies' Revenue Growth Trending?

In order to justify its P/S ratio, ENENSYS Technologies would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 5.9%. The solid recent performance means it was also able to grow revenue by 6.9% in total over the last three years. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the one analyst covering the company are not great, suggesting revenue should decline by 1.2% over the next year. Meanwhile, the industry is forecast to moderate by 3.0%, which suggests the company won't escape the wider industry forces.

With this information, it's not too hard to see why ENENSYS Technologies is trading at a fairly similar P/S in comparison. Nonetheless, with revenue going in reverse, it's not guaranteed that the P/S has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Final Word

Following ENENSYS Technologies' share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As expected, we see that ENENSYS Technologies maintains its moderate P/S thanks to a revenue outlook that's pretty much level with the wider industry. Right now shareholders are comfortable with the P/S as they are confident future revenue won't throw up any further unpleasant surprises. Although, we are somewhat concerned whether the company can maintain this level of performance under these tough industry conditions. It seems that unless there's a drastic change, it's hard to imagine that the share price will deviate much from current levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with ENENSYS Technologies (at least 3 which are concerning), and understanding them should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if ENENSYS Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALNN6

ENENSYS Technologies

Engages in the design and marketing of hardware and software solutions for media distributors in France, rest of Europe, the Middle East, Africa, the Asia Pacific, North America, and Latin America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026