- France

- /

- Electronic Equipment and Components

- /

- ENXTPA:ALDRV

Easy Come, Easy Go: How Drone Volt (EPA:ALDRV) Shareholders Got Unlucky And Saw 91% Of Their Cash Evaporate

Every investor on earth makes bad calls sometimes. But you have a problem if you face massive losses more than once in a while. So take a moment to sympathize with the long term shareholders of Drone Volt SA (EPA:ALDRV), who have seen the share price tank a massive 91% over a three year period. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 51% in the last year. Shareholders have had an even rougher run lately, with the share price down 42% in the last 90 days.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

View 6 warning signs we detected for Drone Volt

Drone Volt isn't a profitable company, so it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over three years, Drone Volt grew revenue at 5.6% per year. Given it's losing money in pursuit of growth, we are not really impressed with that. But the share price crash at 55% per year does seem a bit harsh! We generally don't try to 'catch the falling knife'. Of course, revenue growth is nice but generally speaking the lower the profits, the riskier the business - and this business isn't making steady profits.

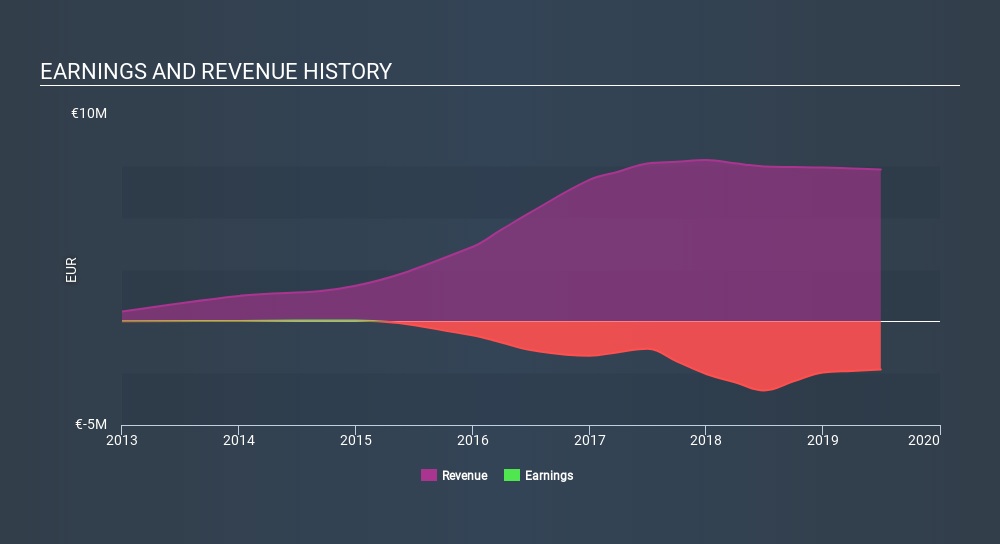

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

This free interactive report on Drone Volt's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

The last twelve months weren't great for Drone Volt shares, which cost holders 51%, while the market was up about 28%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. However, the loss over the last year isn't as bad as the 55% per annum loss investors have suffered over the last three years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:ALDRV

Drone Volt

Manufactures and sells professional civilian drones in France and internationally.

Excellent balance sheet slight.

Market Insights

Community Narratives