- France

- /

- Communications

- /

- ENXTPA:ALBPK

Subdued Growth No Barrier To Broadpeak Société anonyme (EPA:ALBPK) With Shares Advancing 30%

Despite an already strong run, Broadpeak Société anonyme (EPA:ALBPK) shares have been powering on, with a gain of 30% in the last thirty days. The last month tops off a massive increase of 113% in the last year.

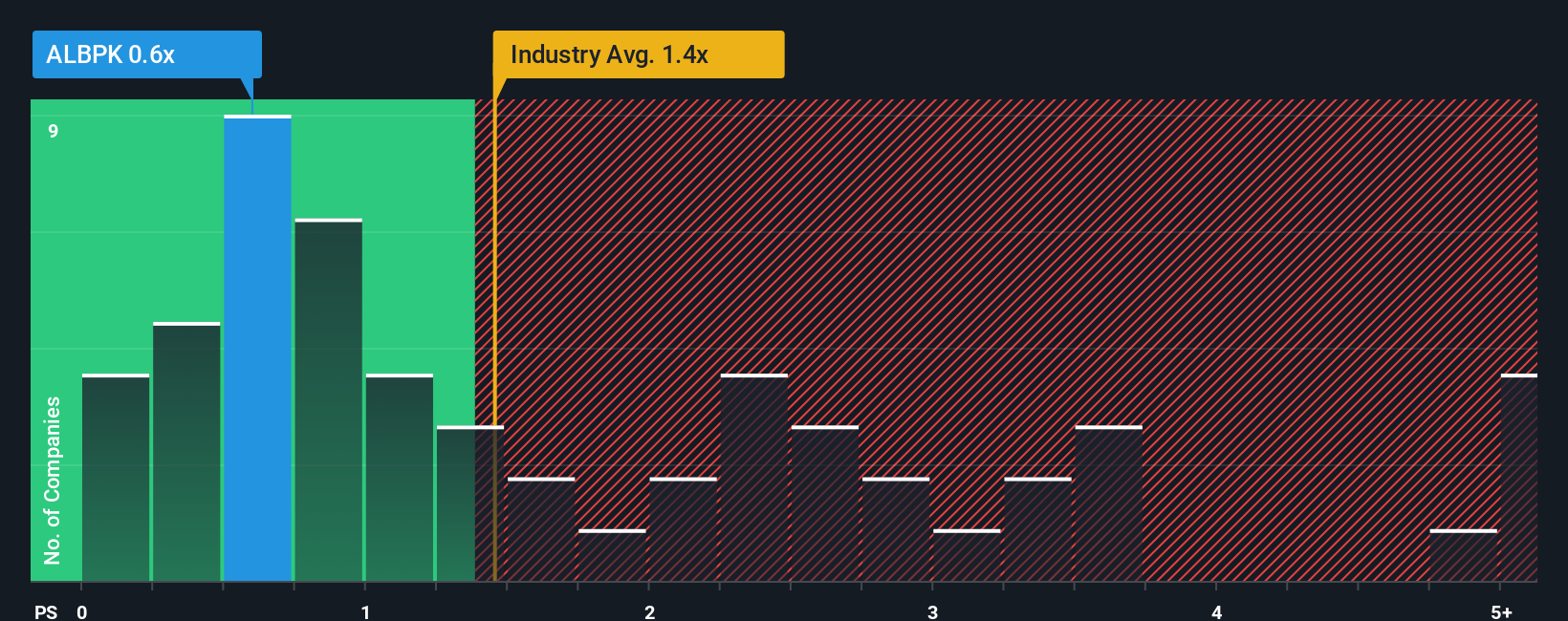

Even after such a large jump in price, there still wouldn't be many who think Broadpeak Société anonyme's price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in France's Communications industry is similar at about 0.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Broadpeak Société anonyme

How Has Broadpeak Société anonyme Performed Recently?

Recent times haven't been great for Broadpeak Société anonyme as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Broadpeak Société anonyme.Is There Some Revenue Growth Forecasted For Broadpeak Société anonyme?

The only time you'd be comfortable seeing a P/S like Broadpeak Société anonyme's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. The latest three year period has also seen a 29% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the two analysts covering the company suggest revenue growth is heading into negative territory, declining 11% over the next year. That's not great when the rest of the industry is expected to grow by 6.9%.

In light of this, it's somewhat alarming that Broadpeak Société anonyme's P/S sits in line with the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Broadpeak Société anonyme's P/S Mean For Investors?

Broadpeak Société anonyme's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our check of Broadpeak Société anonyme's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

You need to take note of risks, for example - Broadpeak Société anonyme has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Broadpeak Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALBPK

Broadpeak Société anonyme

Designs and manufactures video delivery components for content and network service providers deploying video streaming services over fixed, mobile or satellite broadband networks worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026