Investors in Verimatrix Société anonyme (EPA:VMX) from five years ago are still down 69%, even after 20% gain this past week

It's nice to see the Verimatrix Société anonyme (EPA:VMX) share price up 20% in a week. But don't envy holders -- looking back over 5 years the returns have been really bad. In fact, the share price has declined rather badly, down some 71% in that time. So we're hesitant to put much weight behind the short term increase. We'd err towards caution given the long term under-performance.

While the stock has risen 20% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for Verimatrix Société anonyme

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Verimatrix Société anonyme became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

Revenue is actually up 23% over the time period. A more detailed examination of the revenue and earnings may or may not explain why the share price languishes; there could be an opportunity.

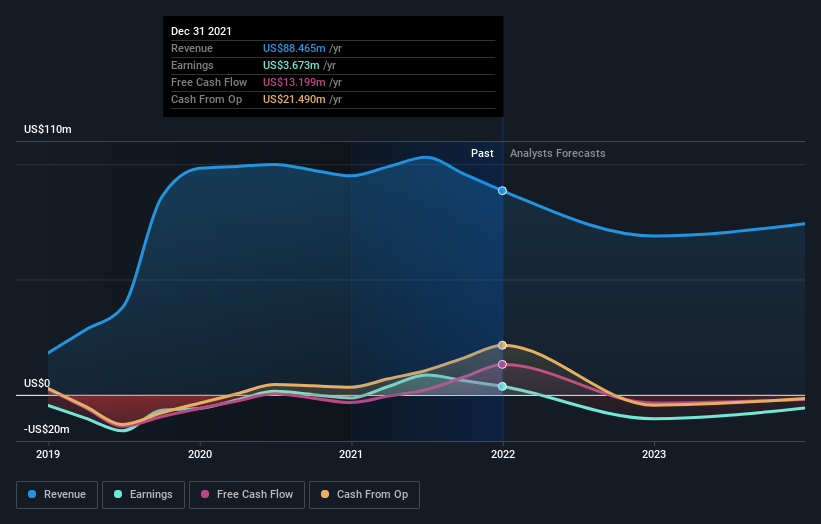

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We know that Verimatrix Société anonyme has improved its bottom line lately, but what does the future have in store? This free report showing analyst forecasts should help you form a view on Verimatrix Société anonyme

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Verimatrix Société anonyme's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Verimatrix Société anonyme hasn't been paying dividends, but its TSR of -69% exceeds its share price return of -71%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

Verimatrix Société anonyme shareholders are down 60% for the year, but the market itself is up 6.7%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 11% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. It's always interesting to track share price performance over the longer term. But to understand Verimatrix Société anonyme better, we need to consider many other factors. Case in point: We've spotted 3 warning signs for Verimatrix Société anonyme you should be aware of, and 1 of them is a bit unpleasant.

Of course Verimatrix Société anonyme may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VMX

Verimatrix

Provides security solutions that protect digital content, applications, and devices in France and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives