European Stocks Estimated To Be Trading Below Intrinsic Value In April 2025

Reviewed by Simply Wall St

Amidst heightened global trade tensions and the resulting market volatility, European stocks have experienced significant declines, with major indices like the STOXX Europe 600 Index posting its largest drop in five years. In this challenging environment, identifying stocks that are trading below their intrinsic value can offer potential opportunities for investors seeking to navigate uncertainty and capitalize on undervalued assets.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LPP (WSE:LPP) | PLN15430.00 | PLN30843.28 | 50% |

| Etteplan Oyj (HLSE:ETTE) | €10.95 | €21.70 | 49.5% |

| 3U Holding (XTRA:UUU) | €1.405 | €2.79 | 49.6% |

| Dätwyler Holding (SWX:DAE) | CHF108.40 | CHF213.94 | 49.3% |

| DigiTouch (BIT:DGT) | €1.595 | €3.12 | 48.9% |

| Norsk Titanium (OB:NTI) | NOK2.045 | NOK4.09 | 49.9% |

| Figeac Aero Société Anonyme (ENXTPA:FGA) | €7.42 | €14.70 | 49.5% |

| Wall to Wall Group (OM:WTW A) | SEK56.00 | SEK111.58 | 49.8% |

| PowerCell Sweden (OM:PCELL) | SEK24.36 | SEK48.15 | 49.4% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.48 | €6.81 | 48.9% |

Let's explore several standout options from the results in the screener.

GVS (BIT:GVS)

Overview: GVS S.p.A. and its subsidiaries manufacture and distribute filter solutions for healthcare, life sciences, energy, mobility, and health and safety sectors globally, with a market cap of €738.64 million.

Operations: The company's revenue segments include €428.50 million from Plastics & Rubber.

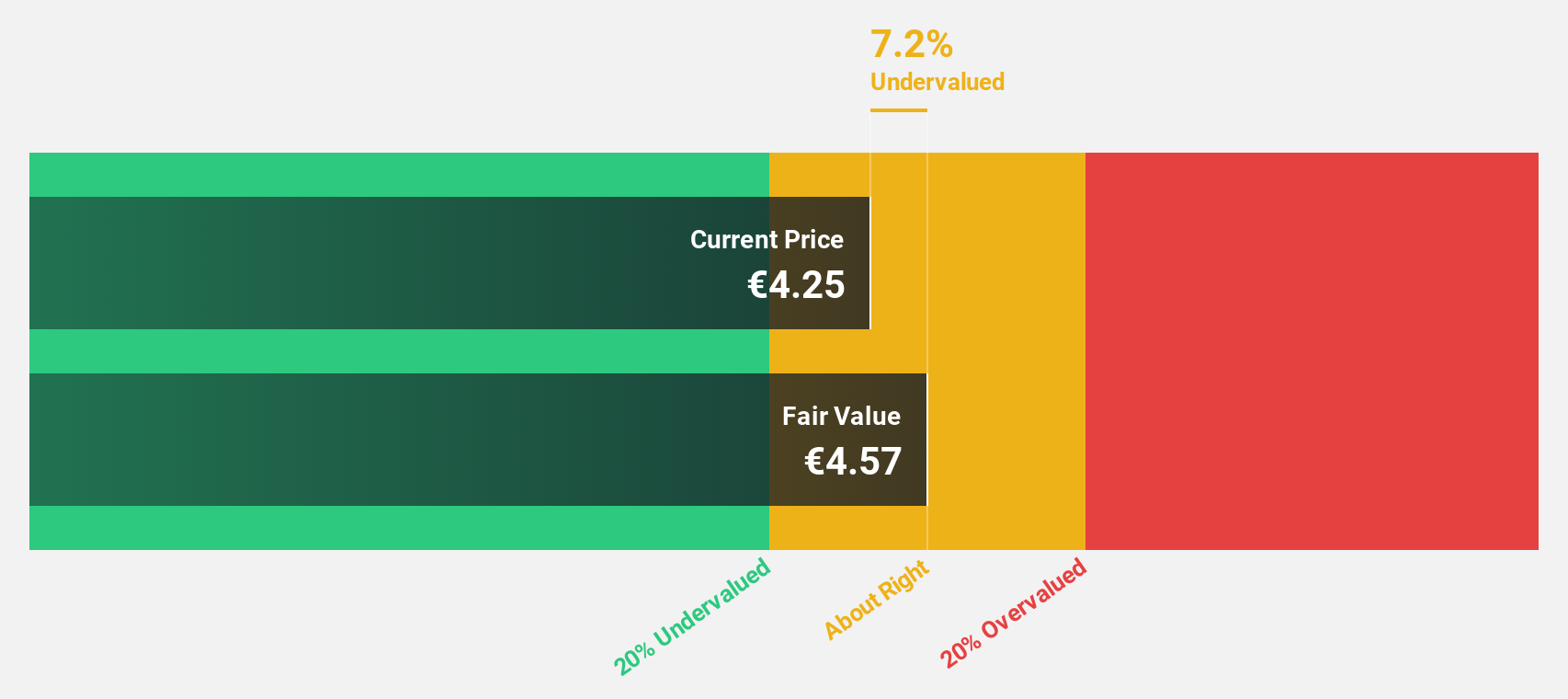

Estimated Discount To Fair Value: 10%

GVS S.p.A. is trading at €3.91, approximately 10% below its estimated fair value of €4.35, suggesting it may be undervalued based on cash flows despite a high debt level and recent share price volatility. The company reported a significant net income increase to €33.4 million in 2024 from €13.6 million the previous year, with earnings expected to grow significantly by 20.92% annually, outpacing the Italian market's growth rate of 7.5%.

- The analysis detailed in our GVS growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in GVS' balance sheet health report.

Sword Group (ENXTPA:SWP)

Overview: Sword Group S.E. offers IT and software solutions globally, with a market cap of €281.19 million.

Operations: The company generates revenue through its provision of IT and software solutions on a global scale.

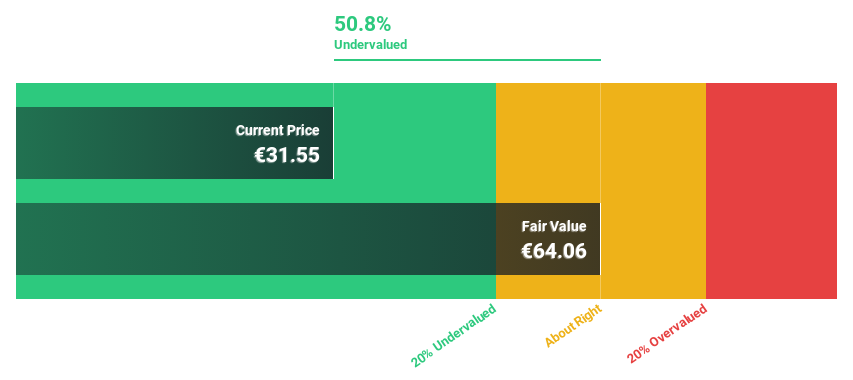

Estimated Discount To Fair Value: 42.3%

Sword Group is trading at €29.7, significantly below its estimated fair value of €51.5, highlighting potential undervaluation based on cash flows. Analysts predict a 47.6% rise in stock price and forecast earnings growth of 15.1% annually, surpassing the French market's rate of 12.7%. Recent earnings show steady sales growth to €323.02 million, though net income slightly decreased to €21.81 million from last year’s figures amidst strategic expansion with a new WHO contract.

- Upon reviewing our latest growth report, Sword Group's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Sword Group with our detailed financial health report.

Grupa Pracuj (WSE:GPP)

Overview: Grupa Pracuj S.A. is a prominent HR technology platform offering online job posting sites and HR Software SaaS solutions for recruitment, retention, and development across Poland, Ukraine, Germany, Austria, and Switzerland with a market cap of PLN3.62 billion.

Operations: The company's revenue is primarily derived from its Staffing & Outsourcing Services segment, which generated PLN756.07 million.

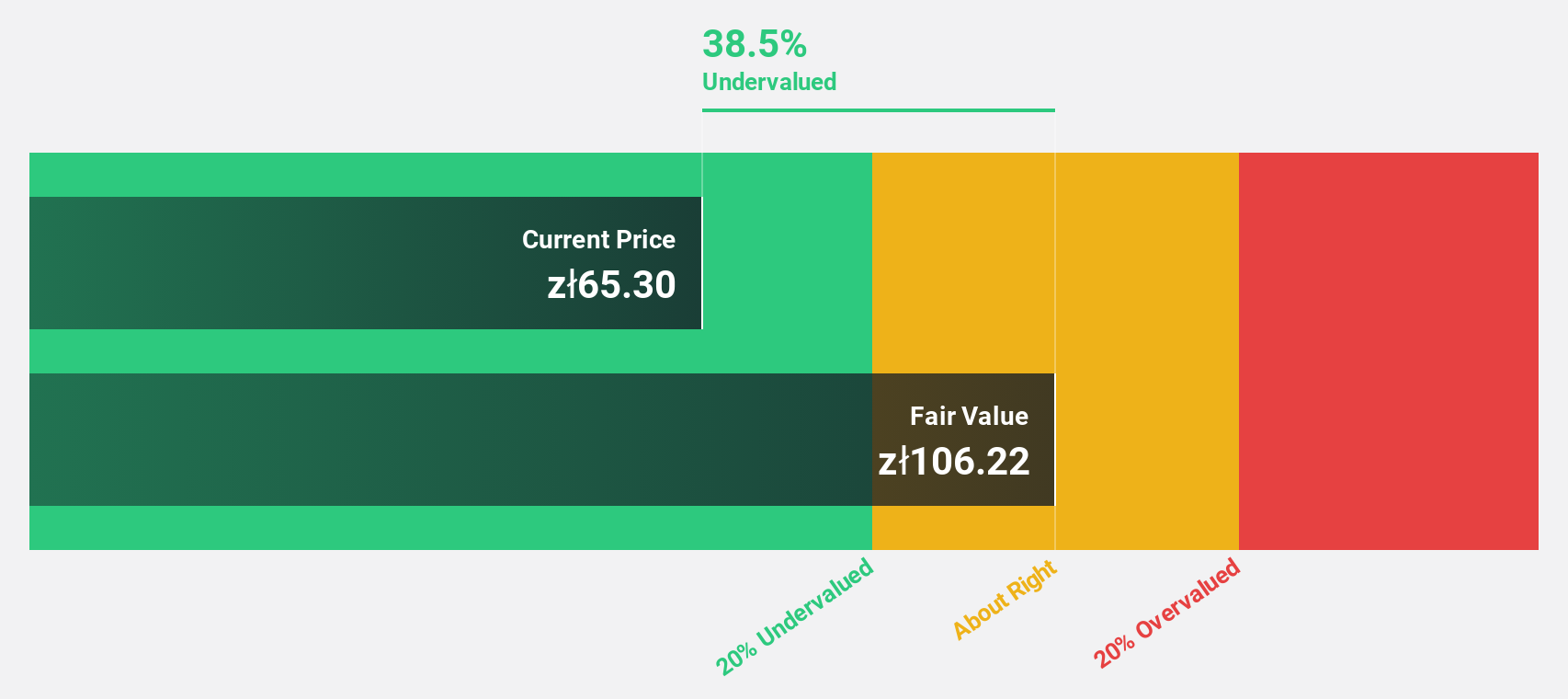

Estimated Discount To Fair Value: 46.6%

Grupa Pracuj is trading at PLN 53, well below its estimated fair value of PLN 99.33, suggesting undervaluation based on cash flows. Analysts expect a 24.5% stock price increase and forecast earnings growth of 14.1% annually, outpacing the Polish market's rate of 12.8%. The company recently announced a dividend of PLN 2.10 per share despite an unstable dividend history, indicating cautious optimism amidst steady revenue growth projections at 8.6% annually.

- The growth report we've compiled suggests that Grupa Pracuj's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Grupa Pracuj.

Key Takeaways

- Gain an insight into the universe of 188 Undervalued European Stocks Based On Cash Flows by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SWP

Very undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion