Will CEO Transition Shift Sopra Steria Group's (ENXTPA:SOP) Trajectory Amid Sector Transformation?

Reviewed by Sasha Jovanovic

- On October 8, 2025, Sopra Steria Group announced that CEO Cyril Malargé decided to step down, with the board commencing the search for a new Chief Executive Officer in line with its established succession procedures.

- This transition, overseen by a team centered around the Chief Operating Officer, places heightened attention on leadership stability during a period of ongoing sector transformation.

- We'll assess how the CEO transition could influence Sopra Steria Group's investment narrative and near-term business momentum.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Sopra Steria Group Investment Narrative Recap

To believe in Sopra Steria Group as a shareholder, you need confidence in its ability to overcome near-term revenue headwinds and margin pressures through resilient demand for digital transformation in the public sector and regulated industries. While the unexpected CEO transition places focus on leadership continuity, the existing board oversight and detailed succession plan suggest the handover will not materially disrupt the company’s biggest near-term catalyst, increased project inflows, or worsen its most pressing risk of persistent revenue contraction in key markets.

Among recent developments, Sopra Steria’s renewed full-year guidance for 2025 stands out, confirming revenue growth projections of -2.5% to +0.5% and a stable operating margin. This signals a commitment to transparency during management changes and provides a reference point for investors watching for any early warning signs that the CEO succession could affect contract momentum or margin delivery.

Yet, in contrast to the orderly leadership transition, investors should be aware that persistent revenue declines in France and key European markets mean the ongoing threat of...

Read the full narrative on Sopra Steria Group (it's free!)

Sopra Steria Group is projected to reach €6.1 billion in revenue and €373.6 million in earnings by 2028. This scenario assumes a 2.7% annual revenue growth rate and an earnings increase of €91.6 million from the current earnings of €282.0 million.

Uncover how Sopra Steria Group's forecasts yield a €217.40 fair value, a 61% upside to its current price.

Exploring Other Perspectives

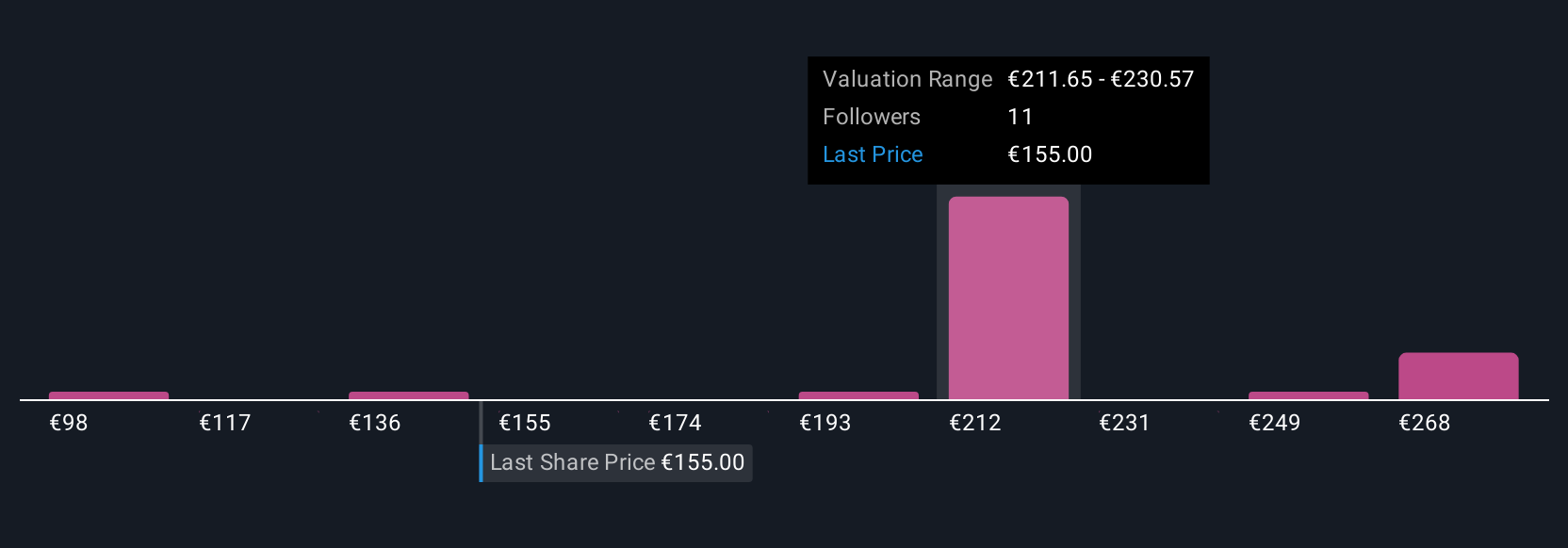

Simply Wall St Community valuations for Sopra Steria Group span €98.14 to €249.31 across seven perspectives. With some calling out persistent revenue declines in major markets, you have many distinct viewpoints worth exploring.

Explore 7 other fair value estimates on Sopra Steria Group - why the stock might be worth as much as 84% more than the current price!

Build Your Own Sopra Steria Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sopra Steria Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sopra Steria Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sopra Steria Group's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SOP

Sopra Steria Group

Provides consulting, digital, and software development services in France and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026