How Declining Revenue and CEO Search Will Impact Sopra Steria Group (ENXTPA:SOP) Investors

Reviewed by Sasha Jovanovic

- Sopra Steria Group reported consolidated revenue of €1.32 billion for Q3 2025, reflecting a 3.0% decline in total growth and a 2.9% decline on an organic basis, with an update that its major UK defense programme has just launched and will not contribute growth until 2026.

- Alongside lower-than-expected revenues, the Board of Directors has begun an external search for a new Chief Executive Officer, signaling near-term leadership transition and possible shifts in company direction.

- We will explore how the unexpected revenue decline and CEO transition could reshape Sopra Steria’s medium-term growth outlook and risk profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Sopra Steria Group Investment Narrative Recap

To be a shareholder in Sopra Steria, you have to believe in its ability to tap into Europe's digital transformation and defense modernization despite current pressures on revenues and leadership. The latest revenue dip and CEO search highlight that while long-term demand in key verticals like defense remains a catalyst, the biggest near-term risk is sustained weakness in core markets, especially if organic decline continues. These news items do not materially shift the most important short-term drivers or risks for now.

One of the most relevant corporate moves is the ongoing share repurchase program, with up to €616.43 million allocated to buybacks since August 2025. This could support per-share metrics and signals some confidence from the board, but it doesn't address the root causes of organic revenue contraction, which remain central to the company's outlook.

Yet, the sharp contrast between long-term contract wins and underlying margin pressures is something investors should particularly watch, especially as...

Read the full narrative on Sopra Steria Group (it's free!)

Sopra Steria Group's outlook anticipates €6.1 billion in revenue and €373.6 million in earnings by 2028. This is based on a projected annual revenue growth rate of 2.7% and an earnings increase of about €91.6 million from the current €282.0 million.

Uncover how Sopra Steria Group's forecasts yield a €206.80 fair value, a 55% upside to its current price.

Exploring Other Perspectives

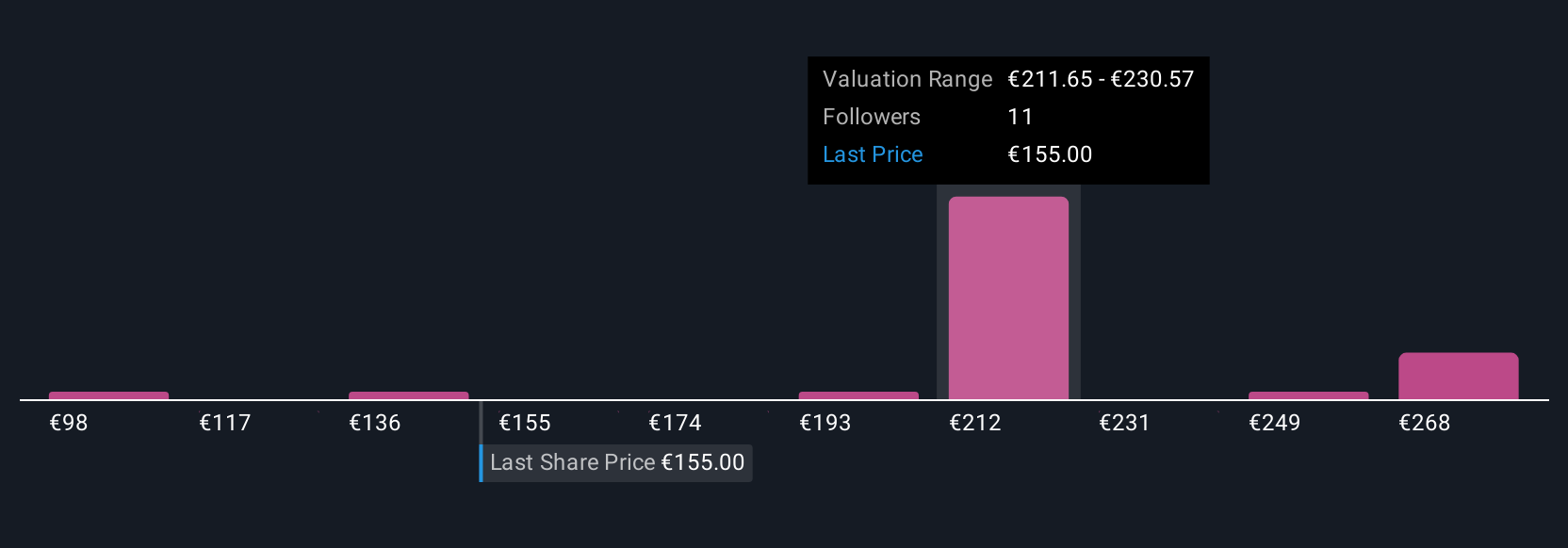

Seven community estimates for fair value cluster between €98.14 and €250.06, reflecting wide opinion on future prospects. With revenue contraction and sector concentration as ongoing risks, you should review multiple perspectives before forming your own view.

Explore 7 other fair value estimates on Sopra Steria Group - why the stock might be worth as much as 88% more than the current price!

Build Your Own Sopra Steria Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sopra Steria Group research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Sopra Steria Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sopra Steria Group's overall financial health at a glance.

No Opportunity In Sopra Steria Group?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SOP

Sopra Steria Group

Provides consulting, digital, and software development services in France and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion