3 Growth Companies With High Insider Ownership On Euronext Paris

Reviewed by Simply Wall St

As the French CAC 40 Index recently added 0.48%, reflecting a cautiously optimistic outlook amid potential European Central Bank rate cuts and economic stimulus from China, investors are keenly observing growth opportunities within the market. In this context, companies with high insider ownership often attract attention for their potential alignment of interests between management and shareholders, making them appealing prospects in a fluctuating economic landscape.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 20.6% | 36% |

| VusionGroup (ENXTPA:VU) | 13.4% | 81.7% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 33.9% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 26.6% |

| STIF Société anonyme (ENXTPA:ALSTI) | 16.4% | 22.9% |

| La Française de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

| Munic (ENXTPA:ALMUN) | 27.1% | 174.1% |

| Adocia (ENXTPA:ADOC) | 11.7% | 64% |

| S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 103.8% |

| MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

Let's explore several standout options from the results in the screener.

Exclusive Networks (ENXTPA:EXN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Exclusive Networks SA is a global cybersecurity specialist focusing on digital infrastructure, with a market cap of €2.14 billion.

Operations: The company generates revenue from various regions, including €480 million from APAC, €4.19 billion from EMEA, and €705 million from the Americas.

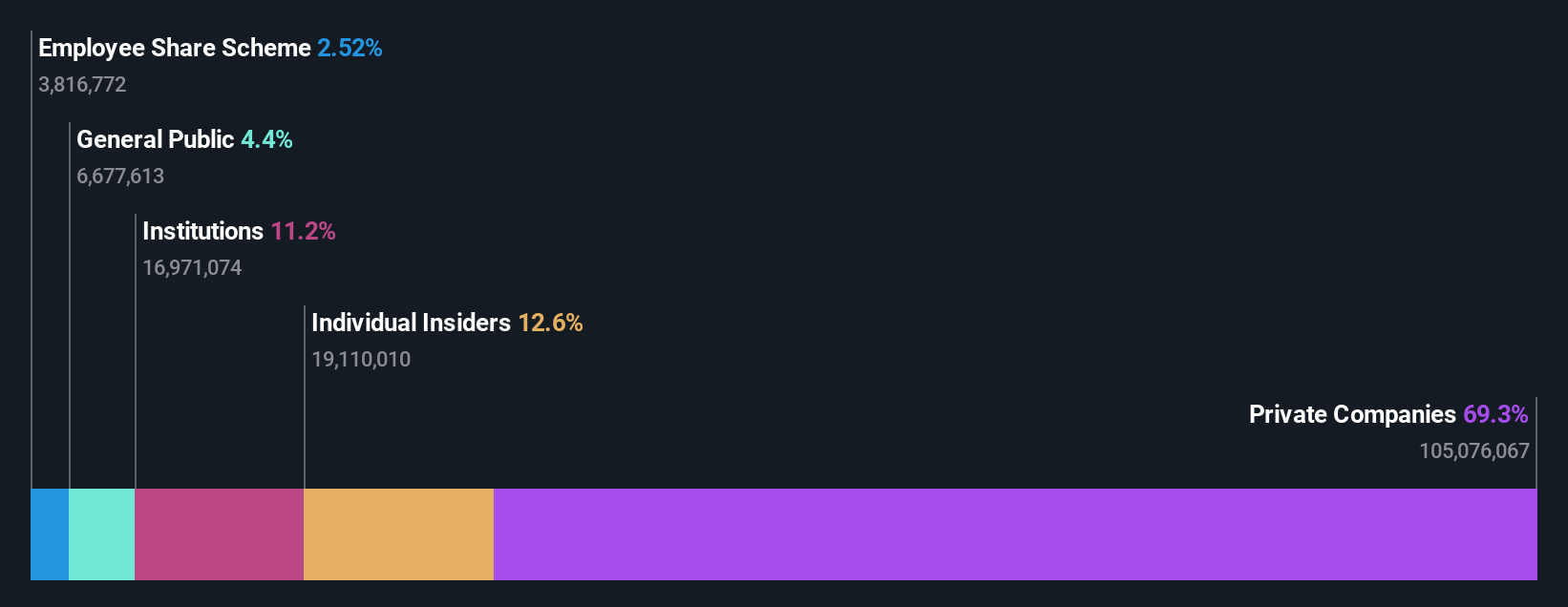

Insider Ownership: 13.1%

Earnings Growth Forecast: 33.5% p.a.

Exclusive Networks is poised for significant earnings growth, forecasted at 33.5% annually, outpacing the French market's 12%. Despite lower profit margins this year, its revenue growth of 13.1% surpasses the market average of 5.6%. The company is valued at €2.2 billion in a proposed acquisition by CD&R and Permira, offering a premium per share price with an exceptional distribution planned. This transaction underscores strong insider ownership and strategic financial restructuring potential.

- Get an in-depth perspective on Exclusive Networks' performance by reading our analyst estimates report here.

- Upon reviewing our latest valuation report, Exclusive Networks' share price might be too optimistic.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MedinCell S.A. is a pharmaceutical company based in France that specializes in developing long-acting injectables across various therapeutic areas, with a market cap of €446.20 million.

Operations: The company's revenue segment includes Pharmaceuticals, generating €11.95 million.

Insider Ownership: 15.8%

Earnings Growth Forecast: 93.9% p.a.

MedinCell is positioned for substantial growth, with revenue forecasted to increase by 46.2% annually, significantly outpacing the French market. The company trades at a considerable discount to its estimated fair value and is expected to achieve profitability within three years. Recent strategic collaborations, notably with AbbVie, bolster its innovative long-acting injectable technology platform. Despite negative shareholders' equity, MedinCell's inclusion in the S&P Global BMI Index highlights investor confidence amid executive and governance restructuring.

- Take a closer look at MedinCell's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that MedinCell is trading behind its estimated value.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of approximately €1.30 billion.

Operations: The company generates revenue from its Public Cloud (€169.01 million), Private Cloud (€589.61 million), and Web Cloud & Other (€185.43 million) segments.

Insider Ownership: 10.5%

Earnings Growth Forecast: 101.4% p.a.

OVH Groupe is poised for growth, with earnings anticipated to rise significantly by 101.37% annually and profitability expected within three years. Although its revenue growth of 9.7% per year is slower than the ideal 20%, it still surpasses the French market average of 5.6%. The stock trades at a substantial discount to its estimated fair value, though low future return on equity remains a concern. Recent participation at the OCP Global Summit underscores industry engagement.

- Dive into the specifics of OVH Groupe here with our thorough growth forecast report.

- Our valuation report unveils the possibility OVH Groupe's shares may be trading at a discount.

Seize The Opportunity

- Explore the 23 names from our Fast Growing Euronext Paris Companies With High Insider Ownership screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Exclusive Networks might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXN

Exclusive Networks

Operates as a global cybersecurity specialist for digital infrastructure.

Flawless balance sheet with reasonable growth potential.