- France

- /

- Basic Materials

- /

- ENXTPA:VCT

Top 3 Euronext Paris Dividend Stocks To Consider

Reviewed by Simply Wall St

As the French CAC 40 Index experiences modest gains amid hopes for quicker European Central Bank interest rate cuts and potential economic stimulus from China, investors are increasingly turning their attention to dividend stocks on the Euronext Paris. In such a dynamic market environment, selecting dividend stocks with a strong track record of consistent payouts can offer stability and income potential for those looking to navigate these shifting economic tides.

Top 10 Dividend Stocks In France

| Name | Dividend Yield | Dividend Rating |

| Vicat (ENXTPA:VCT) | 5.78% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.95% | ★★★★★★ |

| Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC) | 8.11% | ★★★★★☆ |

| Arkema (ENXTPA:AKE) | 4.19% | ★★★★★☆ |

| VIEL & Cie société anonyme (ENXTPA:VIL) | 3.74% | ★★★★★☆ |

| Samse (ENXTPA:SAMS) | 6.78% | ★★★★★☆ |

| Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.79% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.89% | ★★★★★☆ |

| Piscines Desjoyaux (ENXTPA:ALPDX) | 7.81% | ★★★★★☆ |

| Infotel (ENXTPA:INF) | 4.73% | ★★★★☆☆ |

Click here to see the full list of 32 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Exacompta Clairefontaine (ENXTPA:ALEXA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exacompta Clairefontaine S.A. is involved in producing, finishing, and formatting papers across France, Europe, and internationally with a market cap of €158.41 million.

Operations: Exacompta Clairefontaine S.A.'s revenue segments consist of Paper, generating €354.56 million, and Conversion, contributing €597.58 million.

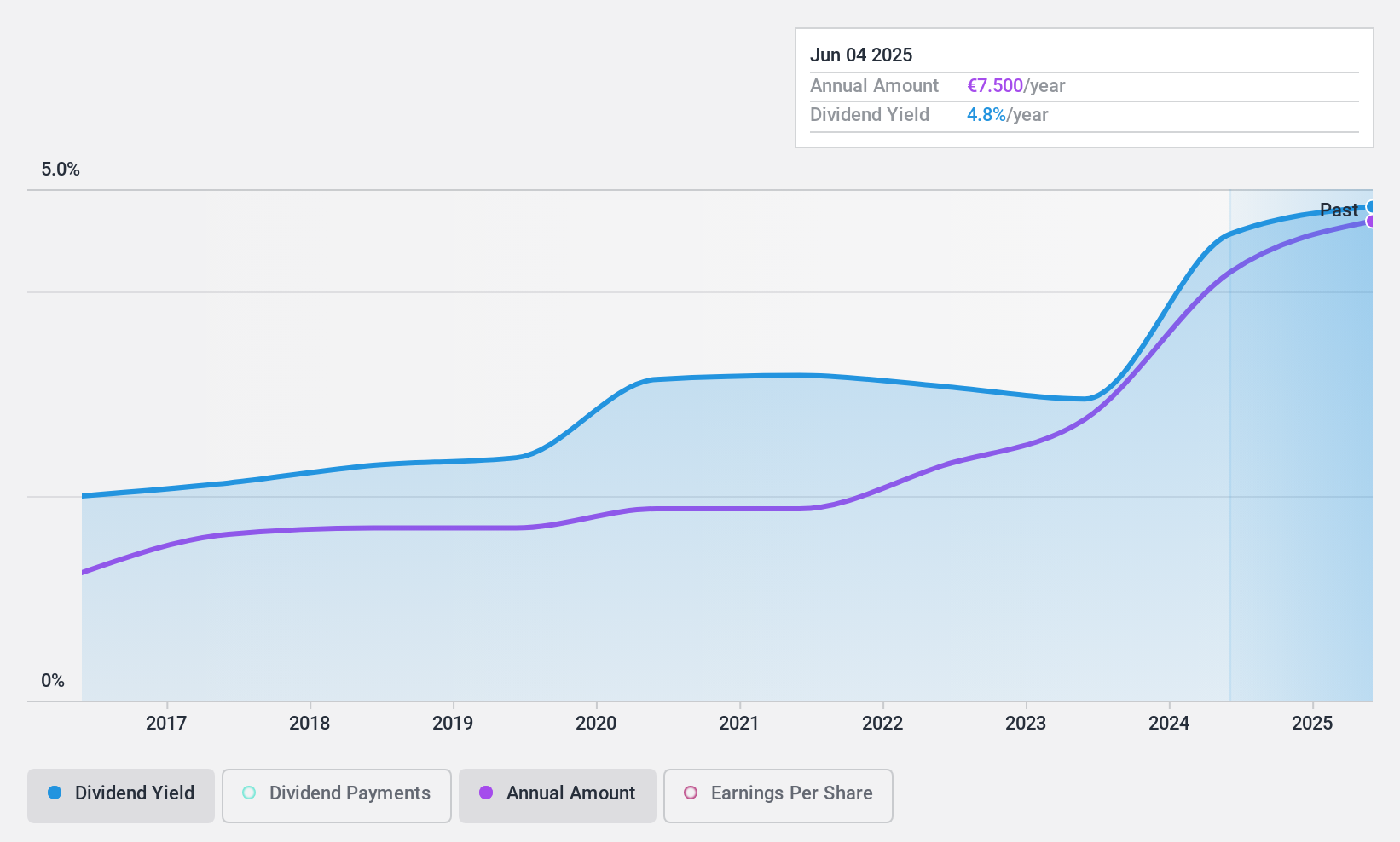

Dividend Yield: 4.8%

Exacompta Clairefontaine's dividend is well-covered, with a payout ratio of 35.4% and a cash payout ratio of 10.7%, indicating sustainability from both earnings and cash flows. Despite recent declines in sales (€408.42M) and net income (€16.5M), dividends have remained stable over the past decade, though the yield (4.79%) is below top-tier French payers (5.51%). Profit margins have decreased to 2.6% from 6.5% last year, impacting overall financial health.

- Click here to discover the nuances of Exacompta Clairefontaine with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Exacompta Clairefontaine shares in the market.

TotalEnergies (ENXTPA:TTE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TotalEnergies SE is a multi-energy company engaged in the production and marketing of oil, biofuels, natural gas, green gases, renewables, and electricity across France, Europe, North America, Africa, and globally with a market cap of €135.70 billion.

Operations: TotalEnergies SE generates revenue through several segments, including Integrated LNG ($21.46 billion), Integrated Power ($27.01 billion), Marketing & Services ($71.38 billion), Refining & Chemicals ($134.98 billion), and Exploration & Production ($47.20 billion).

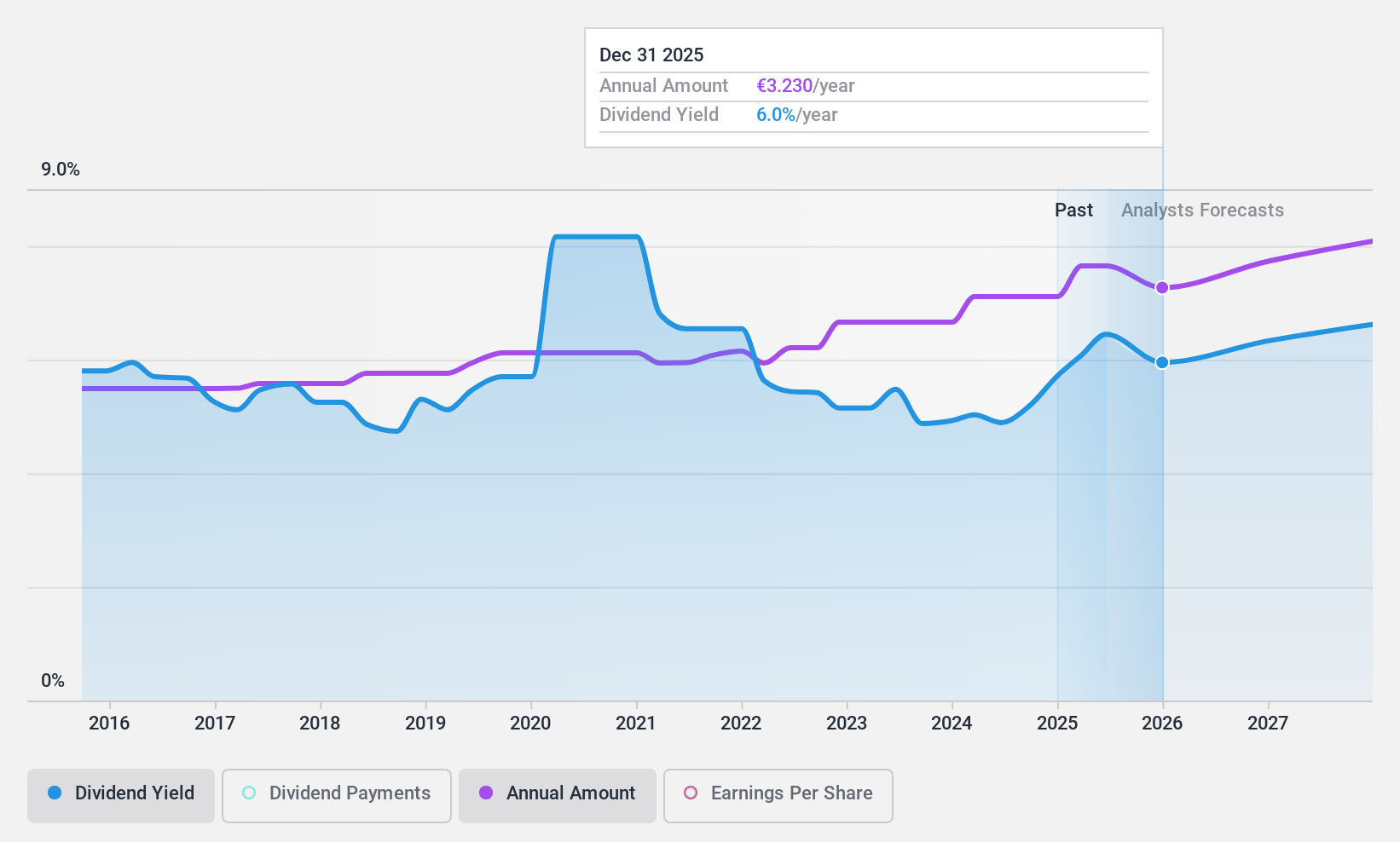

Dividend Yield: 5.3%

TotalEnergies' dividend is well-covered, with a payout ratio of 37.7% and cash payout ratio of 37.4%, indicating sustainability from both earnings and cash flows. However, its dividend yield (5.29%) is slightly below the top tier in France (5.59%). The company has a volatile dividend history over the past decade but has increased dividends recently. Recent expansions into renewable energy projects highlight TotalEnergies' strategic shift towards sustainable growth, potentially supporting future dividends despite historical volatility.

- Click here and access our complete dividend analysis report to understand the dynamics of TotalEnergies.

- In light of our recent valuation report, it seems possible that TotalEnergies is trading behind its estimated value.

Vicat (ENXTPA:VCT)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Vicat S.A., with a market cap of €1.54 billion, operates in the construction industry through its production and sale of cement, ready-mixed concrete, and aggregates.

Operations: Vicat S.A.'s revenue segments consist of €2.52 billion from Cement and €1.55 billion from Concrete & Aggregates.

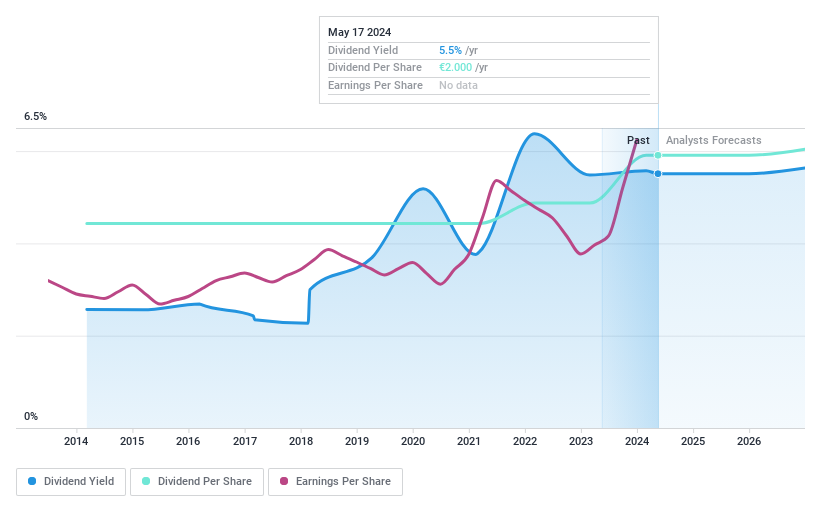

Dividend Yield: 5.8%

Vicat's dividend payments are well-supported by earnings, with a payout ratio of 33.4%, and cash flows, with a cash payout ratio of 45.7%. The company offers an attractive dividend yield of 5.78%, placing it in the top quartile among French dividend payers. Despite having substantial debt, Vicat's dividends have been stable over the past decade and have shown consistent growth. Recent earnings results indicate improved profitability, which may further support its reliable dividend strategy.

- Dive into the specifics of Vicat here with our thorough dividend report.

- Our valuation report unveils the possibility Vicat's shares may be trading at a discount.

Next Steps

- Gain an insight into the universe of 32 Top Euronext Paris Dividend Stocks by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VCT

Vicat

Engages in the production and sale of cement, ready-mixed concrete, and aggregates for construction industry.

Undervalued with solid track record and pays a dividend.