Stock Analysis

Exploring High Insider Ownership Growth Companies On Euronext Paris

Reviewed by Simply Wall St

Amidst a backdrop of cautious optimism in European markets, where France's CAC 40 Index saw a slight decline last week, investors continue to seek opportunities that align with both growth potential and stability. High insider ownership in growth companies on Euronext Paris can be an attractive feature for investors, signaling confidence from those who know the company best during uncertain times.

Top 10 Growth Companies With High Insider Ownership In France

| Name | Insider Ownership | Earnings Growth |

| VusionGroup (ENXTPA:VU) | 13.3% | 24.4% |

| Groupe OKwind Société anonyme (ENXTPA:ALOKW) | 24.8% | 37.7% |

| WALLIX GROUP (ENXTPA:ALLIX) | 19.9% | 101.4% |

| La Française de l'Energie (ENXTPA:FDE) | 20.1% | 37.6% |

| Adocia (ENXTPA:ADOC) | 12.8% | 104.5% |

| OSE Immunotherapeutics (ENXTPA:OSE) | 24.9% | 92.9% |

| Icape Holding (ENXTPA:ALICA) | 30.2% | 26.1% |

| Arcure (ENXTPA:ALCUR) | 21.4% | 41.7% |

| Munic (ENXTPA:ALMUN) | 29.2% | 150% |

| MedinCell (ENXTPA:MEDCL) | 16.4% | 68.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Lectra (ENXTPA:LSS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lectra SA offers industrial intelligence solutions tailored for the fashion, automotive, and furniture sectors, with a market capitalization of approximately €1.24 billion.

Operations: The company generates its revenue from the Americas and Asia-Pacific regions, totaling €170.33 million and €110.28 million respectively.

Insider Ownership: 19.6%

Revenue Growth Forecast: 11.3% p.a.

Lectra, a French company, reported a slight decline in net income and EPS in its latest quarter with sales rising to €129.56 million. Despite trading 20.4% below its estimated fair value, Lectra is poised for robust growth with earnings expected to increase by 28.6% annually, outpacing the French market's forecast of 10.9%. However, its projected return on equity of 13.3% could be considered modest. No significant insider transactions were reported recently, maintaining stable insider ownership levels.

- Unlock comprehensive insights into our analysis of Lectra stock in this growth report.

- In light of our recent valuation report, it seems possible that Lectra is trading behind its estimated value.

MedinCell (ENXTPA:MEDCL)

Simply Wall St Growth Rating: ★★★★★☆

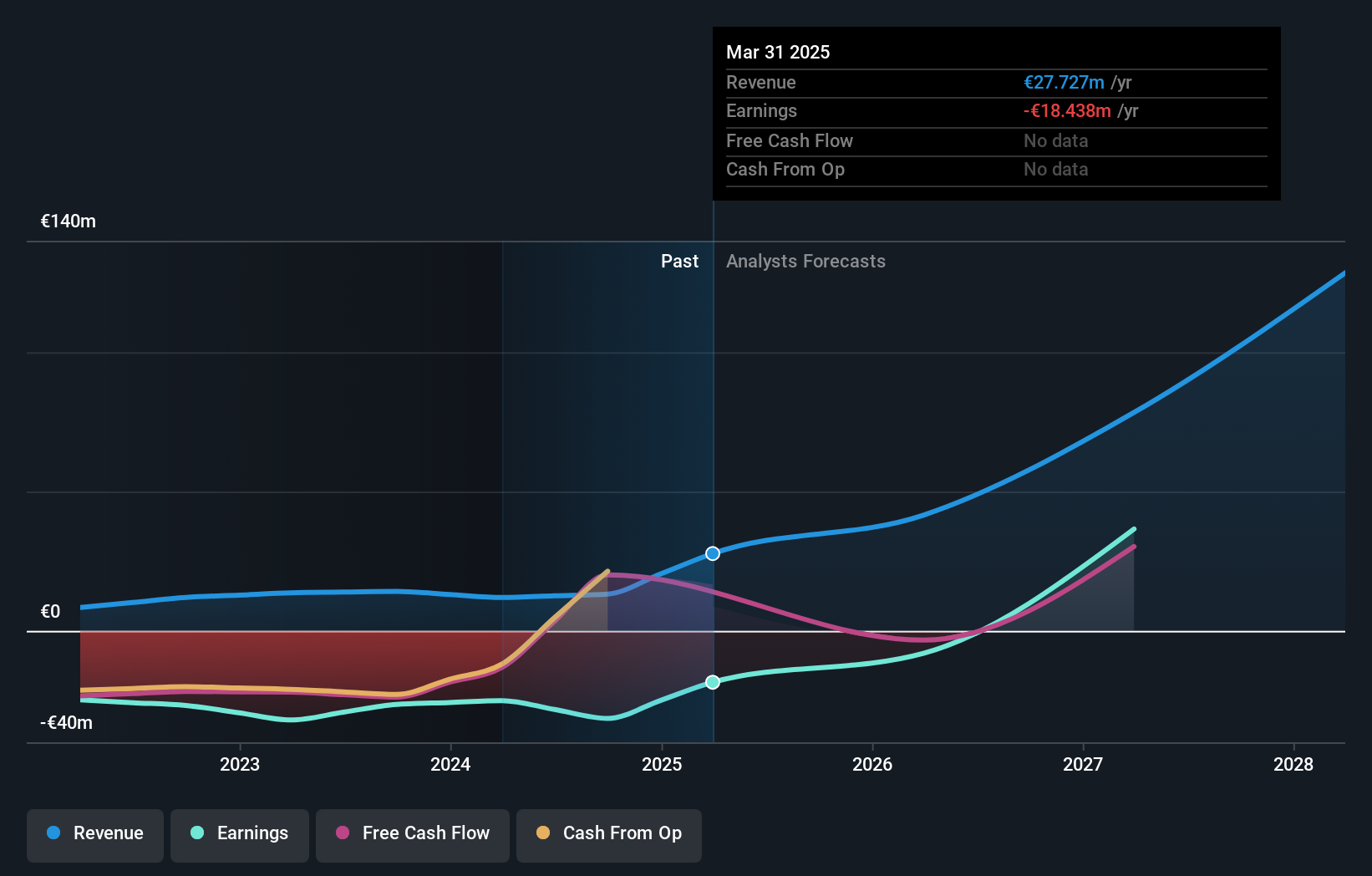

Overview: MedinCell S.A. is a French pharmaceutical company specializing in the development of long-acting injectable medications across multiple therapeutic areas, with a market capitalization of approximately €409.68 million.

Operations: The company generates its revenue primarily from the pharmaceuticals segment, totaling approximately €14.13 million.

Insider Ownership: 16.4%

Revenue Growth Forecast: 40.1% p.a.

MedinCell, a French biotech firm, has recently faced setbacks with its Phase 3 trial for F14 not meeting its primary endpoint in knee replacement recovery. However, the drug showed significant improvements in secondary measures such as knee range of motion and swelling reduction. MedinCell's collaboration with Teva on UZEDY™ for schizophrenia treatment has reached commercial stages, expecting substantial revenues. Despite recent share price volatility and shareholder dilution over the past year, MedinCell is forecasted to grow revenue by 40.1% annually and become profitable within three years.

- Click here and access our complete growth analysis report to understand the dynamics of MedinCell.

- Insights from our recent valuation report point to the potential overvaluation of MedinCell shares in the market.

OVH Groupe (ENXTPA:OVH)

Simply Wall St Growth Rating: ★★★★☆☆

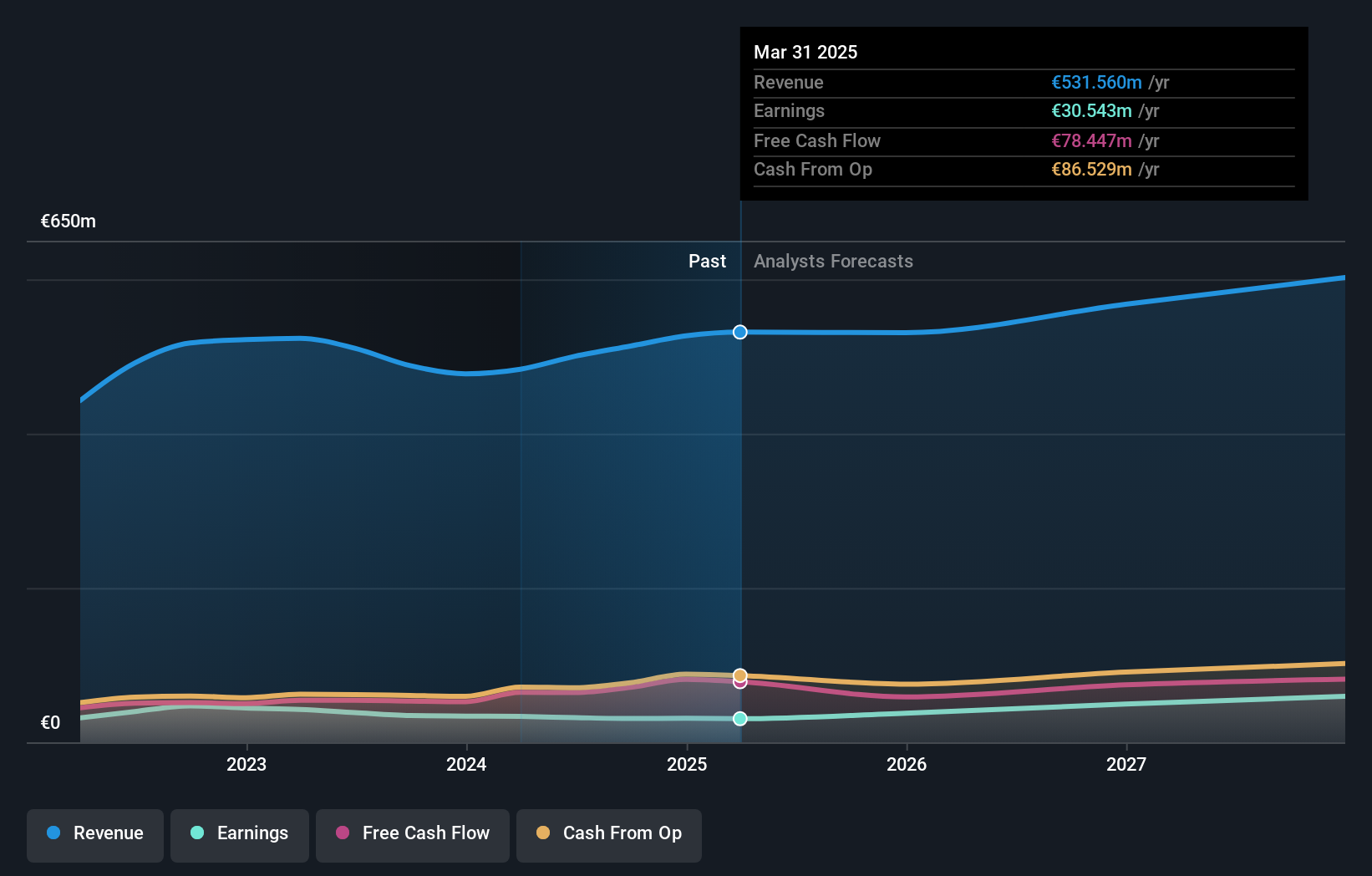

Overview: OVH Groupe S.A. operates globally, offering public and private cloud services, shared hosting, and dedicated server solutions with a market capitalization of approximately €1.19 billion.

Operations: The company generates revenue primarily through three segments: Public Cloud (€140.71 million), Private Cloud (€514.59 million), and Web Cloud (€179.45 million).

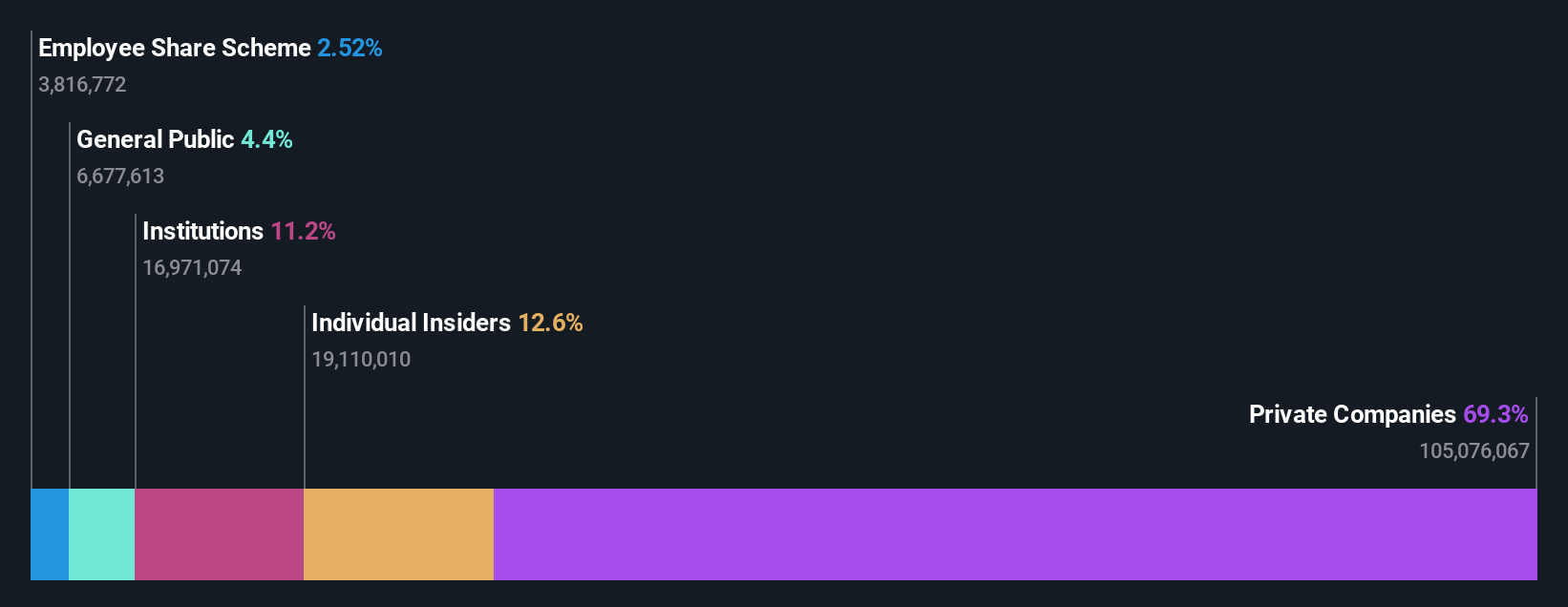

Insider Ownership: 10.5%

Revenue Growth Forecast: 11.3% p.a.

OVH Groupe S.A., a French cloud services provider, is navigating through a transformative phase with significant leadership changes and strategic expansions. Recently, the company reported improved half-year sales of €486.09 million and reduced net losses. With high insider ownership, OVH is expected to become profitable in three years amidst a volatile share price environment. Revenue growth forecasts at 11.3% per year outpace the French market's average, despite a forecasted low return on equity of 3.8%.

- Take a closer look at OVH Groupe's potential here in our earnings growth report.

- Our expertly prepared valuation report OVH Groupe implies its share price may be too high.

Make It Happen

- Gain an insight into the universe of 21 Fast Growing Euronext Paris Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're helping make it simple.

Find out whether OVH Groupe is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OVH

OVH Groupe

Provides public and private cloud, shared hosting, and dedicated server products and solutions worldwide.

Reasonable growth potential and slightly overvalued.