As European markets navigate a mixed landscape, with the pan-European STOXX Europe 600 Index ending slightly lower amid varied monetary policy decisions, investors are keenly evaluating opportunities for stable returns. In this environment, dividend stocks can offer a compelling proposition by providing consistent income streams and potential resilience against market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.48% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.49% | ★★★★★☆ |

| Sulzer (SWX:SUN) | 3.18% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.67% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.66% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.94% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.45% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.72% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.52% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.74% | ★★★★★☆ |

Click here to see the full list of 232 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative (ENXTPA:CRLO)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative offers a range of banking products and services to diverse clients in France, including individuals, businesses, and associations, with a market cap of €743.86 million.

Operations: Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative's revenue segments include Land (€1.13 billion), Leasing activity (€151.14 million), and Local Banking in France (€234.80 million).

Dividend Yield: 3.1%

Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative offers a reliable dividend yield of 3.08%, supported by a low payout ratio of 29.5%, ensuring coverage by earnings. Over the past decade, dividends have been stable and growing, though the yield is below top-tier French dividend payers. Despite a high level of bad loans at 3.2%, its price-to-earnings ratio of 9.6x suggests good value compared to the broader French market at 15.9x.

- Click here and access our complete dividend analysis report to understand the dynamics of Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative.

- In light of our recent valuation report, it seems possible that Caisse Régionale de Crédit Agricole Mutuel Loire Haute-Loire Société coopérative is trading beyond its estimated value.

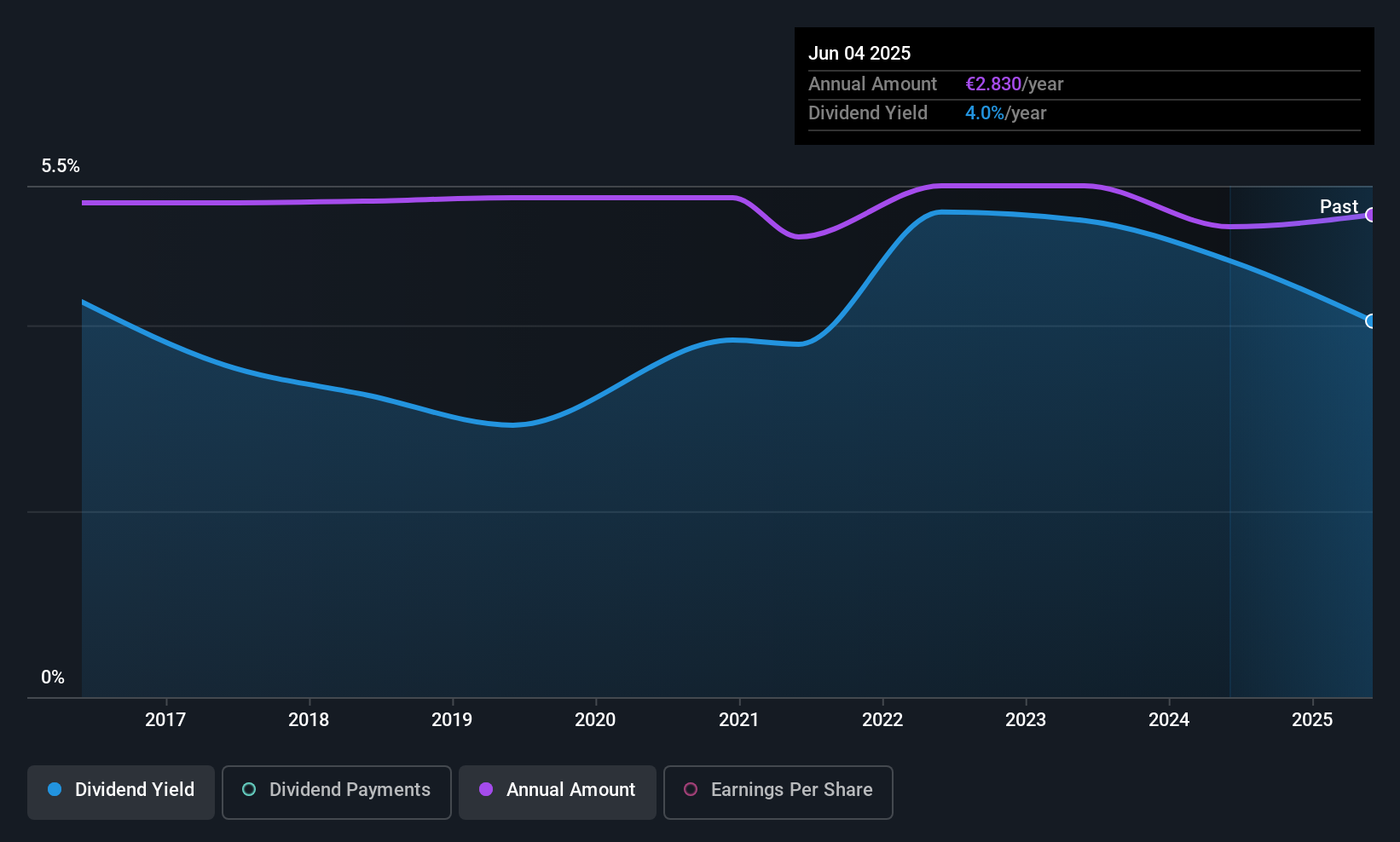

Linedata Services (ENXTPA:LIN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Linedata Services S.A. develops, publishes, and distributes financial software across Southern Europe, Northern Europe, North America, and Asia with a market cap of €286.81 million.

Operations: Linedata Services S.A. generates its revenue through the development, publication, and distribution of financial software across various regions including Southern Europe, Northern Europe, North America, and Asia.

Dividend Yield: 3%

Linedata Services, recently added to the CAC All-Tradable and Small Indexes, offers a dividend yield of 3.02%, below top-tier French payers. Despite its high debt level and volatile dividend history with annual drops over 20%, dividends are well-covered by earnings (payout ratio: 33.4%) and cash flows (cash payout ratio: 32.4%). The company reported a decline in half-year sales to €86.6 million from €89.7 million, with net income falling to €8 million from €10.6 million year-over-year.

- Click to explore a detailed breakdown of our findings in Linedata Services' dividend report.

- Upon reviewing our latest valuation report, Linedata Services' share price might be too pessimistic.

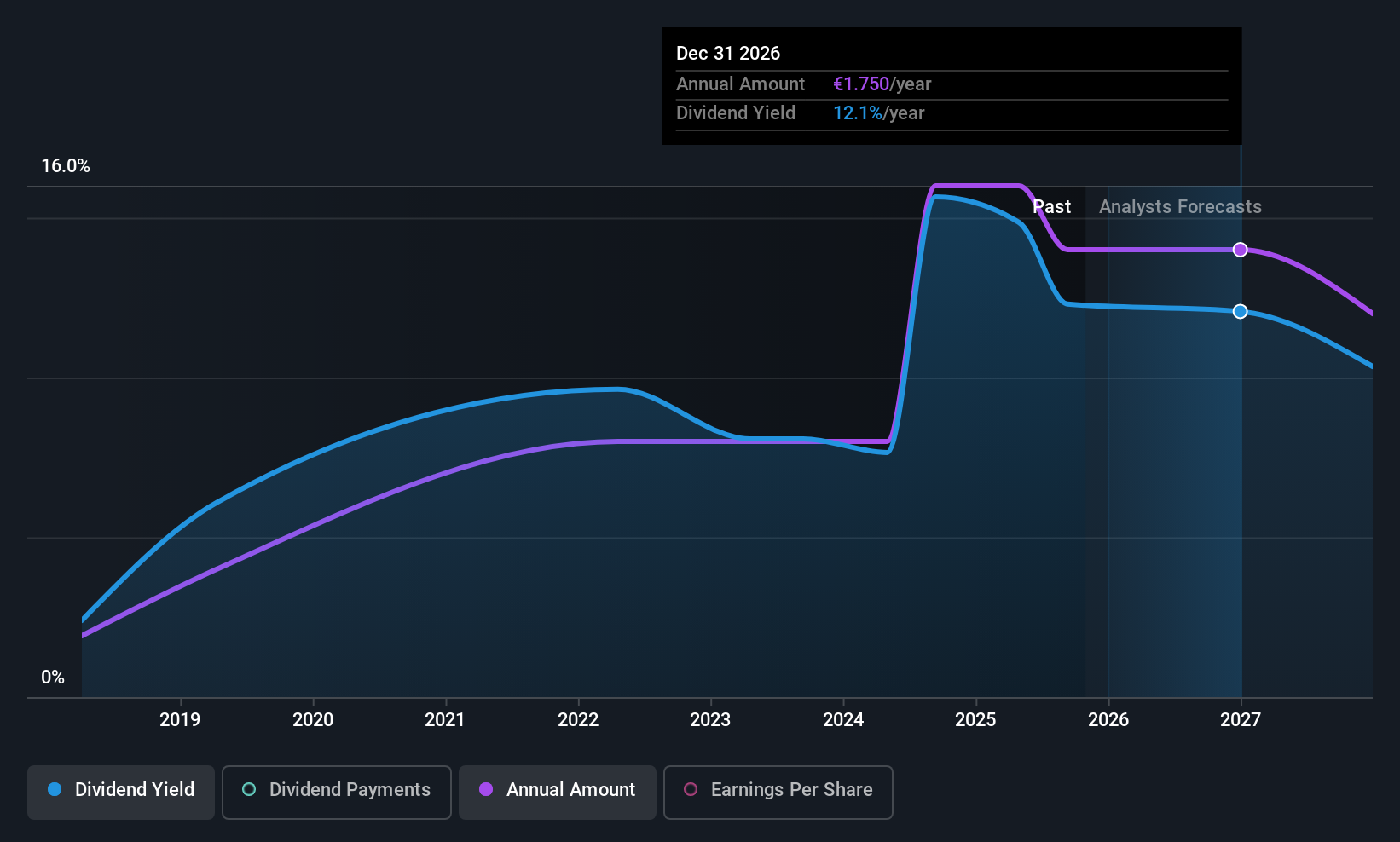

FBD Holdings (ISE:EG7)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: FBD Holdings plc, with a market cap of €510.73 million, operates through its subsidiaries to provide general insurance underwriting services to farmers, private individuals, and business owners in Ireland.

Operations: FBD Holdings generates revenue primarily from its general insurance segment, which accounts for €479.78 million.

Dividend Yield: 12.4%

FBD Holdings recently declared a special dividend of €0.75 per share, reflecting its strategy to return excess capital while maintaining ordinary dividend sustainability. Despite a decline in half-year net income from €28.05 million to €14.82 million, the company continues to prioritize shareholder returns, though earnings coverage for dividends appears strained with a high cash payout ratio of 135.1%. Recent board changes may influence future financial strategies and governance practices.

- Click here to discover the nuances of FBD Holdings with our detailed analytical dividend report.

- Our valuation report here indicates FBD Holdings may be undervalued.

Seize The Opportunity

- Dive into all 232 of the Top European Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:LIN

Linedata Services

Develops, publishes, and distributes financial software in Southern Europe, Northern Europe, North America, and Asia.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives