- Switzerland

- /

- Electrical

- /

- SWX:PMN

3 European Dividend Stocks To Consider With Up To 5% Yield

Reviewed by Simply Wall St

As the European market experiences a period of mixed returns, with indices like France’s CAC 40 and Italy’s FTSE MIB showing modest gains, investors are paying close attention to inflation trends and labor market stability across the region. In this environment, dividend stocks can offer a reliable income stream, making them an attractive option for those looking to balance potential risks with steady yields.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.47% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.32% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.59% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.76% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.87% | ★★★★★★ |

| Holcim (SWX:HOLN) | 5.22% | ★★★★★★ |

| ERG (BIT:ERG) | 5.27% | ★★★★★★ |

| Bredband2 i Skandinavien (OM:BRE2) | 3.95% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.51% | ★★★★★★ |

Click here to see the full list of 235 stocks from our Top European Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

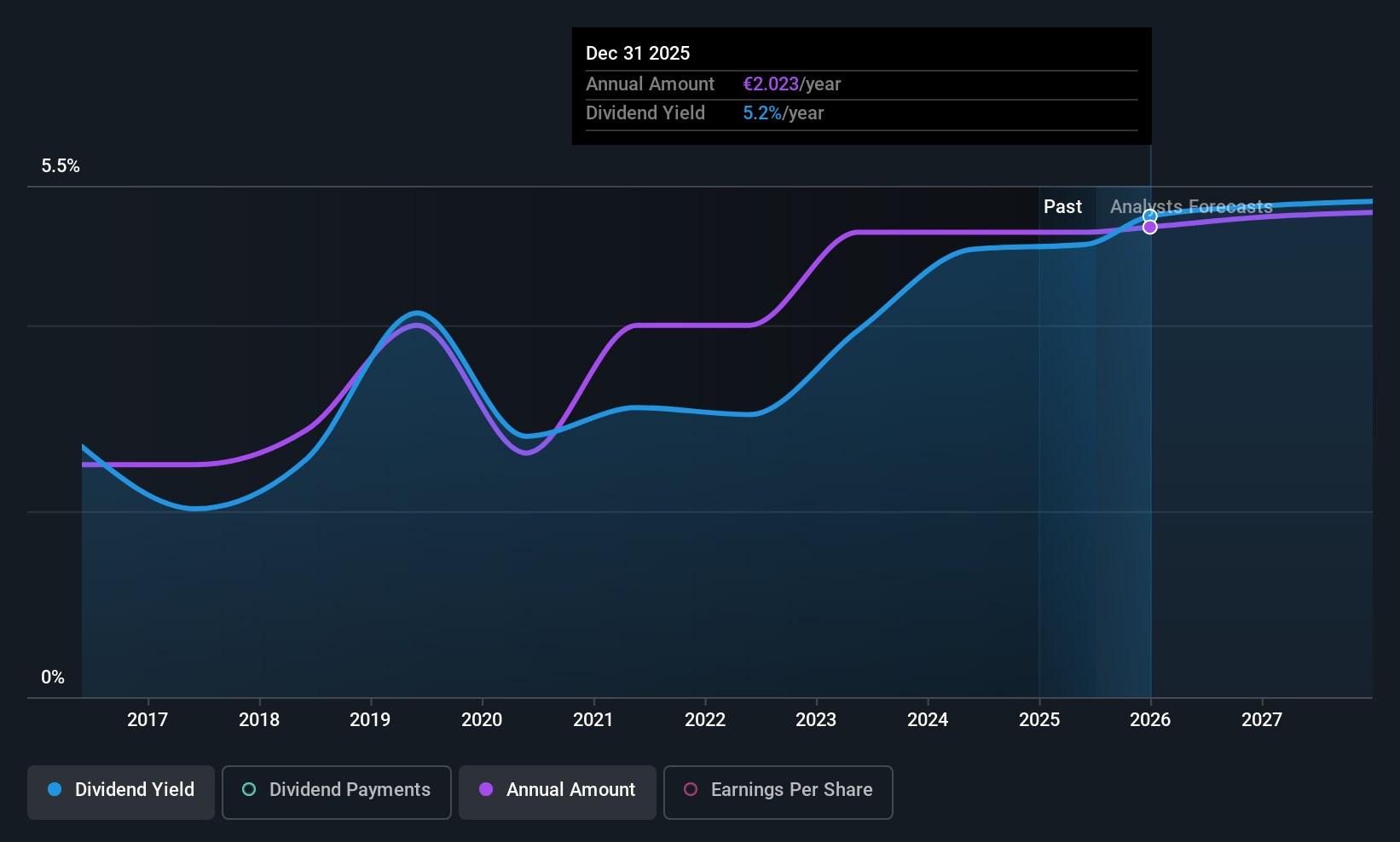

Infotel (ENXTPA:INF)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Infotel SA is a company that specializes in designing, developing, marketing, and maintaining software solutions focused on security, performance, and management on a global scale with a market cap of €277.63 million.

Operations: Infotel SA's revenue is generated from its Services segment, which accounts for €281.49 million, and its Software segment, contributing €13.33 million.

Dividend Yield: 5%

Infotel's dividend payments have been volatile over the past decade, although they have shown growth. The company's dividends are well-covered by earnings and cash flows, with a payout ratio of 74.9% and a cash payout ratio of 44.3%. Despite trading at good value compared to peers, its dividend yield is slightly below the top tier in France. Recent share buybacks aim to enhance market liquidity and potentially support future growth initiatives.

- Take a closer look at Infotel's potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Infotel is priced lower than what may be justified by its financials.

Marimekko Oyj (HLSE:MEKKO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marimekko Oyj is a lifestyle design company that designs, manufactures, and sells clothing, bags and accessories, and interior decoration products globally with a market cap of €524.99 million.

Operations: Marimekko Oyj generates revenue primarily from its Marimekko Business segment, which includes the design and sale of clothing, bags and accessories, and interior decoration products, amounting to €184.50 million.

Dividend Yield: 3.1%

Marimekko Oyj's dividend payments have been stable and growing over the past decade, supported by earnings and cash flows with a payout ratio of 68.3% and a cash payout ratio of 68%. Recently, Marimekko approved regular and extraordinary dividends totaling EUR 0.65 per share for FY2024. While trading below fair value estimates, its dividend yield of 3.09% is lower than Finland's top-tier payers. Earnings are projected to grow annually by 11.86%.

- Click to explore a detailed breakdown of our findings in Marimekko Oyj's dividend report.

- Our valuation report unveils the possibility Marimekko Oyj's shares may be trading at a premium.

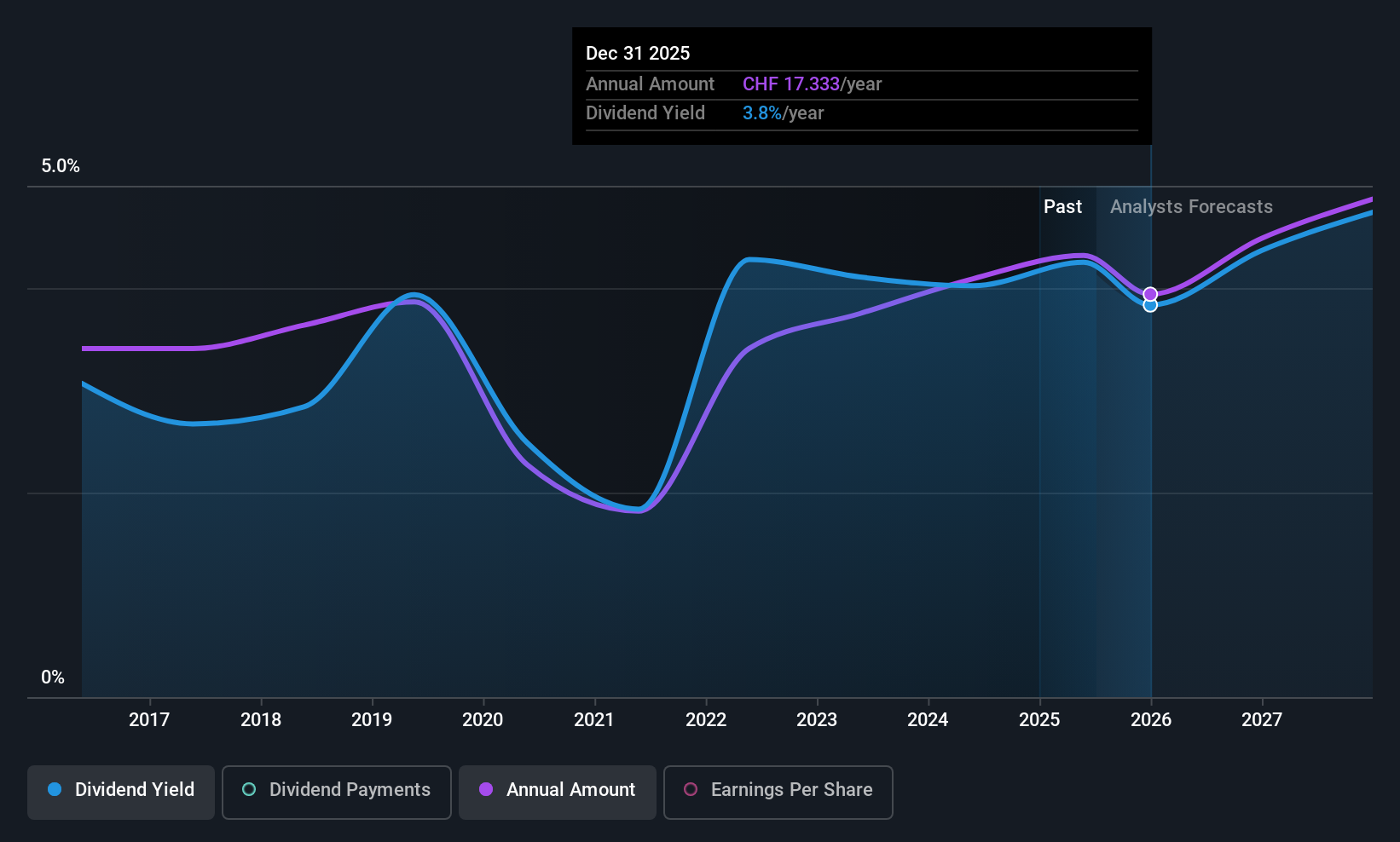

Phoenix Mecano (SWX:PMN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Phoenix Mecano AG, with a market cap of CHF424.89 million, manufactures and sells components for industrial customers globally through its subsidiaries.

Operations: Phoenix Mecano AG's revenue is primarily derived from its Dewertokin Technology Group (€376.73 million), Enclosure Systems (€216.73 million), and Industrial Components (€184.92 million) segments.

Dividend Yield: 4.2%

Phoenix Mecano's dividend yield of 4.16% ranks in the top 25% of Swiss payers, but its sustainability is questionable due to a high cash payout ratio of 97.7%. Although dividends have grown over the past decade, they remain volatile and not well covered by free cash flow. Recent earnings showed a decline with net income at €34.55 million for FY2024, down from €45.17 million previously, impacting dividend reliability despite an increase to CHF 19 per share announced for May 2025.

- Unlock comprehensive insights into our analysis of Phoenix Mecano stock in this dividend report.

- In light of our recent valuation report, it seems possible that Phoenix Mecano is trading behind its estimated value.

Turning Ideas Into Actions

- Delve into our full catalog of 235 Top European Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:PMN

Phoenix Mecano

Manufactures and sells components for industrial customers worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives