The Dassault Systèmes (EPA:DSY) Share Price Has Gained 200%, So Why Not Pay It Some Attention?

When you buy a stock there is always a possibility that it could drop 100%. But when you pick a company that is really flourishing, you can make more than 100%. For instance, the price of Dassault Systèmes SE (EPA:DSY) stock is up an impressive 200% over the last five years. Also pleasing for shareholders was the 13% gain in the last three months. But this could be related to the strong market, which is up 9.7% in the last three months.

View 1 warning sign we detected for Dassault Systèmes

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

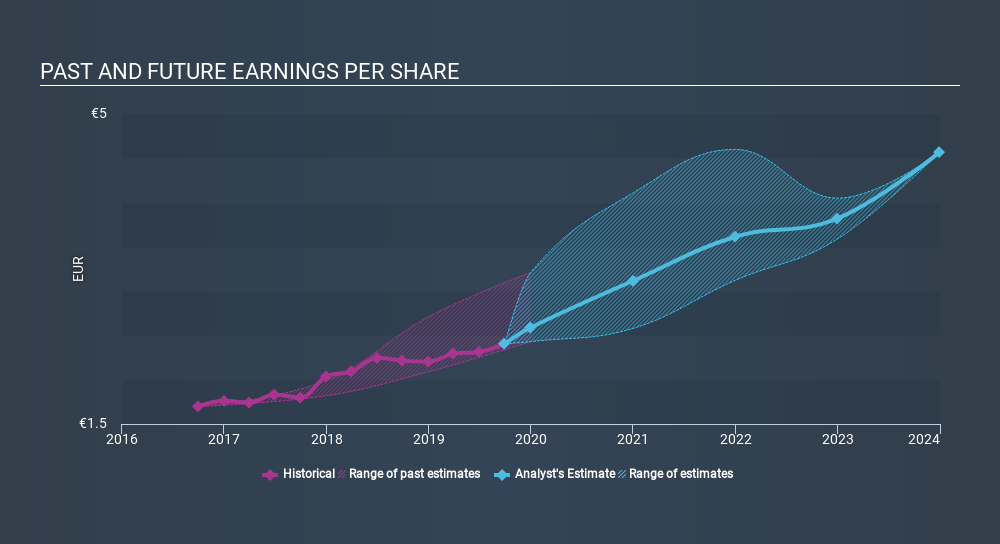

During five years of share price growth, Dassault Systèmes achieved compound earnings per share (EPS) growth of 15% per year. This EPS growth is lower than the 25% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth. This optimism is visible in its fairly high P/E ratio of 60.89.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

While share prices often depend primarily on earnings, they can be sensitive to an investment's risk level as well. For example, we've discovered 1 warning sign for Dassault Systèmes which any shareholder or potential investor should be aware of.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Dassault Systèmes, it has a TSR of 208% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that Dassault Systèmes shareholders have received a total shareholder return of 43% over the last year. And that does include the dividend. That gain is better than the annual TSR over five years, which is 25%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Before forming an opinion on Dassault Systèmes you might want to consider these 3 valuation metrics.

But note: Dassault Systèmes may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ENXTPA:DSY

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives