Claranova SE (EPA:CLA) Surges 26% Yet Its Low P/S Is No Reason For Excitement

Despite an already strong run, Claranova SE (EPA:CLA) shares have been powering on, with a gain of 26% in the last thirty days. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

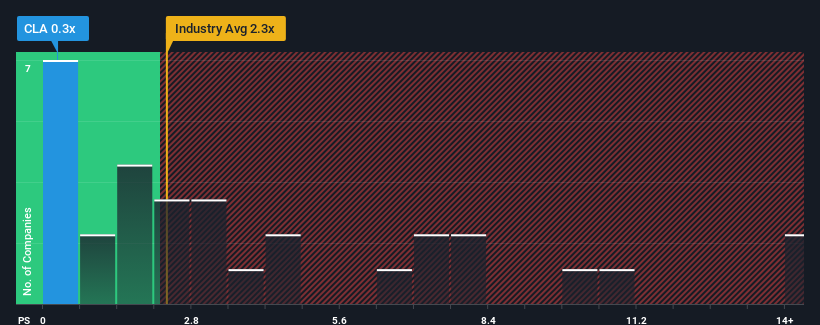

Although its price has surged higher, Claranova's price-to-sales (or "P/S") ratio of 0.3x might still make it look like a strong buy right now compared to the wider Software industry in France, where around half of the companies have P/S ratios above 2.3x and even P/S above 7x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Claranova

How Claranova Has Been Performing

With revenue growth that's inferior to most other companies of late, Claranova has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Claranova will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Claranova would need to produce anemic growth that's substantially trailing the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. That's essentially a continuation of what we've seen over the last three years, as its revenue growth has been virtually non-existent for that entire period. So it seems apparent to us that the company has struggled to grow revenue meaningfully over that time.

Looking ahead now, revenue is anticipated to climb by 4.1% during the coming year according to the two analysts following the company. That's shaping up to be materially lower than the 8.7% growth forecast for the broader industry.

With this in consideration, its clear as to why Claranova's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Claranova's P/S

Shares in Claranova have risen appreciably however, its P/S is still subdued. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Claranova maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Claranova that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CLA

Claranova

A technology company, engages in personalized e-commerce, software publishing, and Internet of Things (IoT) management in France, the United States, the United Kingdom, Germany, other European countries, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives