Axway Software And 2 Undiscovered Gems In France With Strong Fundamentals

Reviewed by Simply Wall St

As global markets grapple with rising geopolitical tensions and economic uncertainties, the French market has experienced notable declines, with the CAC 40 Index dropping by over 3% amid cautious investor sentiment. In this environment, identifying stocks with strong fundamentals becomes crucial for navigating volatility and uncovering potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Nord de France Société coopérative | 10.84% | 3.22% | 6.38% | ★★★★★★ |

| EssoF | 1.19% | 11.14% | 41.41% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| ADLPartner | 82.84% | 9.86% | 16.18% | ★★★★★☆ |

| VIEL & Cie société anonyme | 54.02% | 5.66% | 19.86% | ★★★★★☆ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Caisse Régionale de Crédit Agricole Mutuel Alpes Provence Société coopérative | 391.01% | 4.67% | 17.31% | ★★★★☆☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

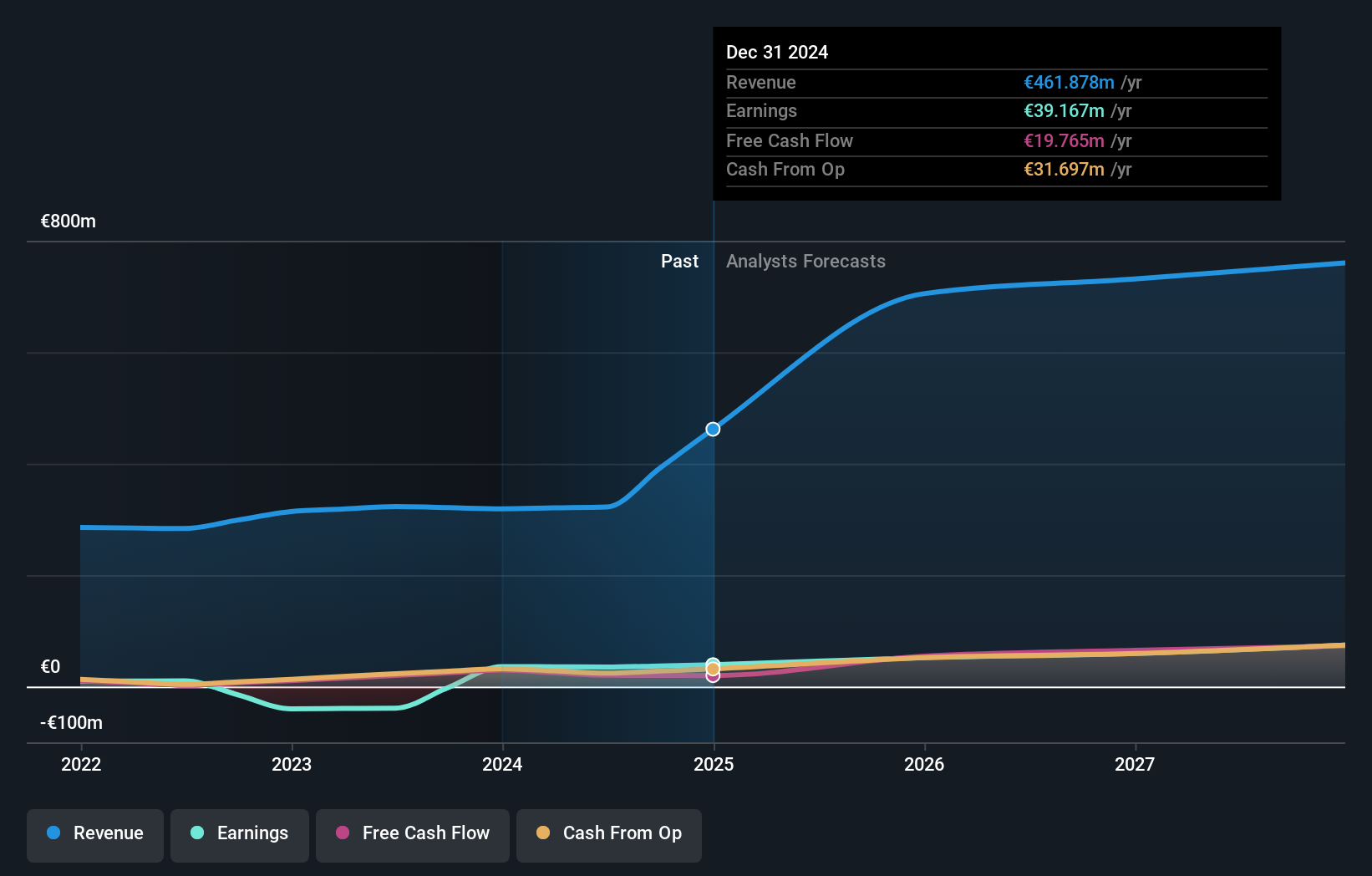

Axway Software (ENXTPA:AXW)

Simply Wall St Value Rating: ★★★★★☆

Overview: Axway Software SA is an infrastructure software publisher operating across France, the rest of Europe, the Americas, and the Asia Pacific with a market capitalization of approximately €714.54 million.

Operations: Axway Software generates revenue primarily through its Subscription segment (€201.19 million), followed by Maintenance (€77.04 million), Services excluding Subscription (€35.49 million), and License sales (€8.46 million).

Axway Software, a smaller player in the tech field, has shown resilience with its EBIT covering interest payments 10.1 times over. Despite a net debt to equity ratio of 19.9%, which remains satisfactory, shareholders faced dilution last year. The company's recent profitability and high-quality earnings are promising, though net income slipped slightly from €3.7 million to €2.8 million for the half-year ending June 2024. Axway's P/E ratio of 20.5x suggests it offers good value compared to industry peers at 28.3x.

- Click here and access our complete health analysis report to understand the dynamics of Axway Software.

Assess Axway Software's past performance with our detailed historical performance reports.

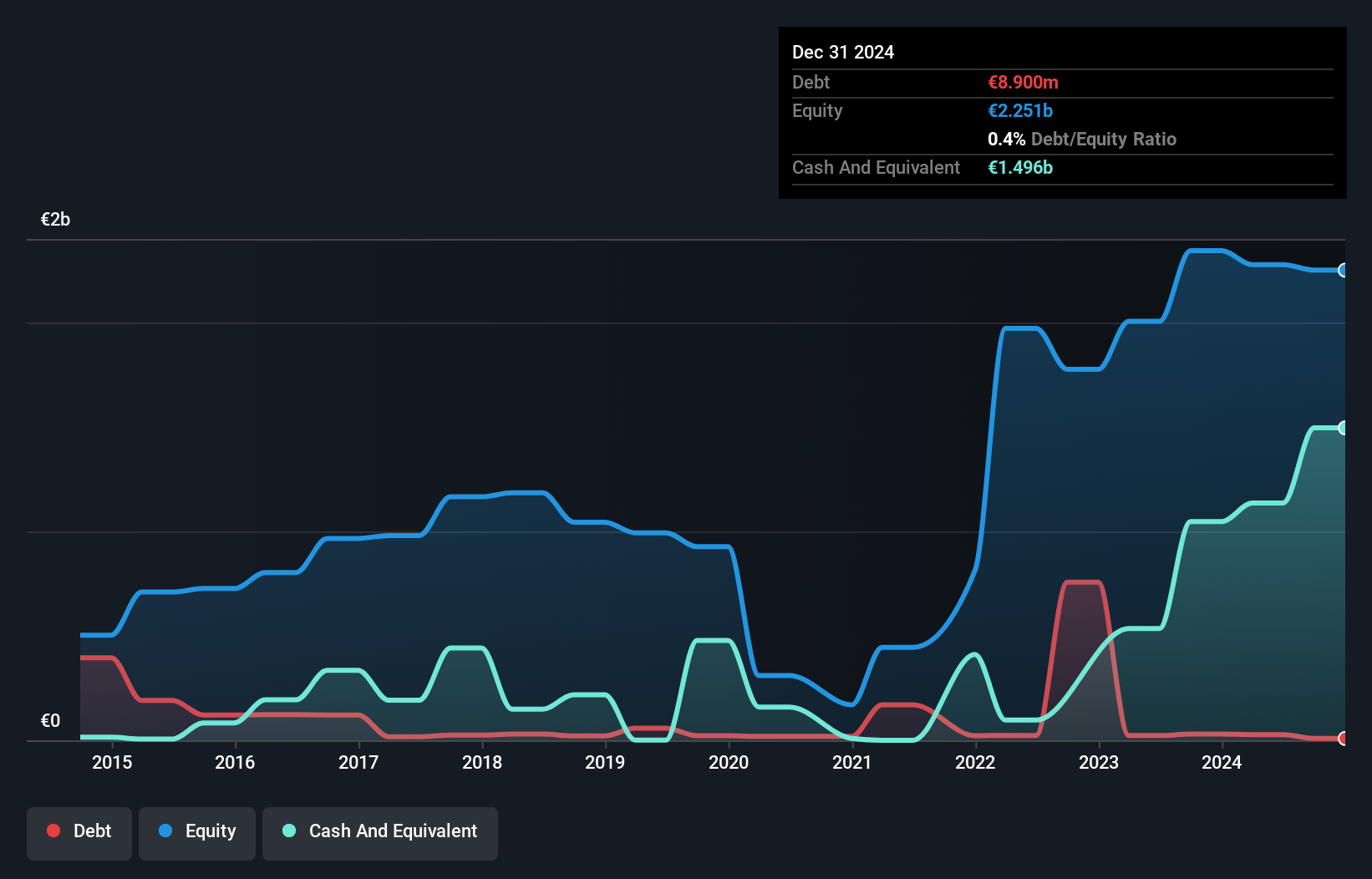

EssoF (ENXTPA:ES)

Simply Wall St Value Rating: ★★★★★★

Overview: Esso S.A.F. engages in refining, distributing, and marketing refined petroleum products across France and internationally, with a market capitalization of approximately €1.70 billion.

Operations: Esso S.A.F. generates revenue primarily from its refining and distribution segment, which accounted for €18.93 billion. The company focuses on these core activities to drive its financial performance.

EssoF, a smaller player in the oil and gas sector, showcases an intriguing profile with its debt to equity ratio improving from 5.8 to 1.2 over five years. The company has become profitable this year, outpacing the industry's growth rate of -0.5%. Despite recent earnings showing a dip in net income from €265.6M to €116M for half-year results, EssoF trades at 96.5% below estimated fair value, suggesting potential undervaluation opportunities for investors exploring niche markets within France's energy landscape.

- Click here to discover the nuances of EssoF with our detailed analytical health report.

Review our historical performance report to gain insights into EssoF's's past performance.

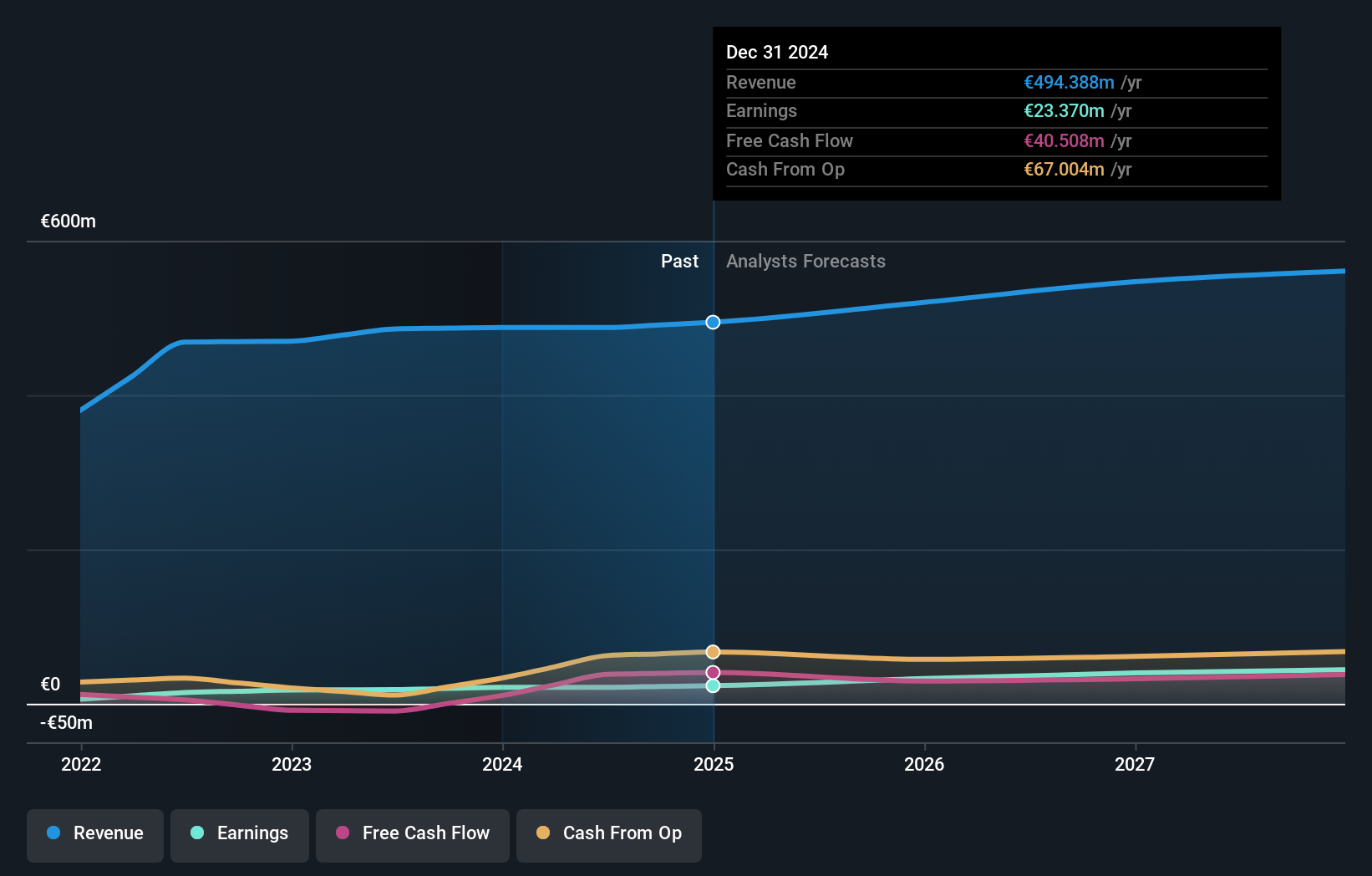

EPC Groupe (ENXTPA:EXPL)

Simply Wall St Value Rating: ★★★★☆☆

Overview: EPC Groupe is involved in the manufacture, storage, and distribution of explosives across Europe, Africa, Asia Pacific, and the Americas with a market capitalization of €378.61 million.

Operations: EPC Groupe generates revenue primarily from its Specialty Chemicals segment, amounting to €487.56 million. The company operates with a market capitalization of €378.61 million.

EPC Groupe, a smaller player in the industry, showcases high-quality earnings and a positive free cash flow of €38.12 million as of June 2024. Despite its volatile share price recently, it's trading at 55.6% below estimated fair value, suggesting potential undervaluation. The company’s net debt to equity ratio is high at 42.6%, with interest coverage by EBIT being less than ideal at 2.9x, indicating some financial pressure despite strong earnings growth of 17.4% over the past year.

Make It Happen

- Access the full spectrum of 36 Euronext Paris Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if EPC Groupe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EXPL

EPC Groupe

Engages in the manufacture, storage, and distribution of explosives in Europe, Africa, Asia Pacific, and the Americas.

Flawless balance sheet with proven track record.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion