Exploring Atos (ENXTPA:ATO) Valuation After Recent Modest Share Price Uptick

Reviewed by Simply Wall St

See our latest analysis for Atos.

Atos’s share price has shown a modest climb, rising 1.29% today and building on a strong 7-day run, despite a rocky month. However, even with some swift moves this year, the 1-year total shareholder return remains deep in the red. This indicates that while recent momentum has been positive, longer-term investors have experienced significant losses.

If today’s uptick has you weighing new opportunities, this could be the right moment to broaden your scope and discover fast growing stocks with high insider ownership.

Yet with recent gains and a challenging backdrop, the real question remains: is Atos’s current weakness a sign the market is missing its long-term value, or are future growth prospects already accounted for in the price?

Most Popular Narrative: 5.1% Overvalued

The narrative’s fair value for Atos is calculated at €43, compared to its last close of €45.2. This subtle gap is attracting attention because the fair value estimate has remained unchanged, but slight changes in risk factors and profit margin projections are affecting analyst perspectives.

Persistent high debt levels and a negative equity position limit strategic flexibility and raise the risk of higher future interest costs, credit downgrades, or forced asset sales. This constraint is likely to depress net earnings and could restrict investment needed to pursue growth in emerging segments.

What is really behind this value assessment? One critical financial pressure is influencing analyst projections, with the company’s outlook depending on how it manages the balance between debt and future earnings. Ready to see which bold assumptions drive the narrative’s price estimate?

Result: Fair Value of €43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stabilizing revenues and faster than expected progress on the Genesis restructuring could provide positive surprises that challenge the prevailing bearish outlook.

Find out about the key risks to this Atos narrative.

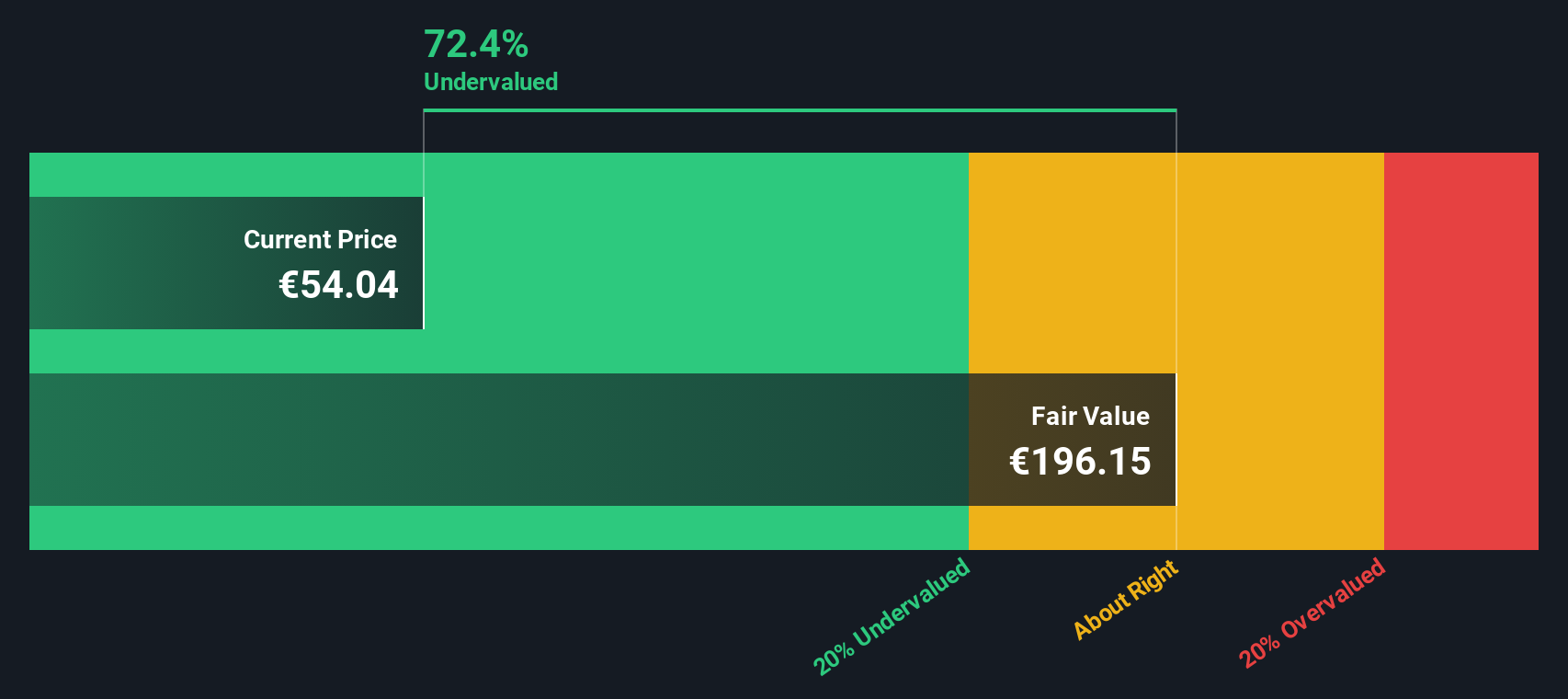

Another View: Our DCF Model Tells a Different Story

While the first method suggests Atos is overvalued, our SWS DCF model presents a much more optimistic perspective. According to this approach, Atos should be trading at €253.09, which is significantly higher than both its current and fair value estimates. This could indicate a potential long-term opportunity, or it may reflect the influence of assumptions inherent in DCF models.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Atos Narrative

If you have your own perspective or would rather form independent conclusions, you can easily build your own view of Atos in just a few minutes, and Do it your way.

A great starting point for your Atos research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

Looking for More Smart Investment Angles?

Set yourself up for your next smart move by checking out exceptional stock ideas on Simply Wall Street. You’ll find opportunities others may be missing, and you could be one step ahead with your next pick.

- Uncover fresh upside potential with these 928 undervalued stocks based on cash flows to target companies where the price may not reflect their true growth story.

- Tap into long-term income streams by researching these 15 dividend stocks with yields > 3% that offer consistent yields above 3%, helping boost your portfolio returns.

- Ride the wave of technology innovation with these 25 AI penny stocks to explore companies reshaping industries and unlocking powerful digital transformation megatrends.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success