Assessing Atos (ENXTPA:ATO) Valuation Following Recent Share Price Declines and Recovery

Reviewed by Simply Wall St

See our latest analysis for Atos.

Despite a sharp 13% drop in share price over the past month, Atos is still up 77% year-to-date. However, its 1-year total shareholder return sits deep in negative territory at -98%. This stark gap suggests that short-term momentum is fading and market confidence remains fragile after a string of difficult years for long-term investors.

If you’re watching for a better momentum story or seeking more resilient profiles, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With shares still down drastically over the past year but up sharply since January, the key question is whether Atos remains undervalued or if the recent recovery reflects all of its future growth potential.

Most Popular Narrative: 2.8% Overvalued

Atos's last closing price of €44.23 is just above the most-followed narrative's fair value estimate of €43. This suggests the share price may be factoring in slightly more optimism than analysts’ collective outlook. With short-term momentum fading, the market seems to be weighing whether this modest premium is justified by future profit potential or resilience through restructuring.

Ongoing restructuring, significant country exits, and pending divestitures are required to restore profitability but also create business disruption and uncertainty. This operational upheaval could impact customer retention, slow pipeline conversion, and further pressure short-to-medium term earnings.

Curious which turnaround milestones and contract wins could tip the balance for Atos’s future profits? The narrative hinges on bold projections for margins and a finely-balanced risk versus reward calculation. Find out what assumptions analysts are really betting on before the price swings again.

Result: Fair Value of €43 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stronger customer retention or a faster than expected restructuring could stabilize revenues and potentially improve Atos’s outlook far sooner than analysts anticipate.

Find out about the key risks to this Atos narrative.

Another View: A Numbers-Driven Bargain?

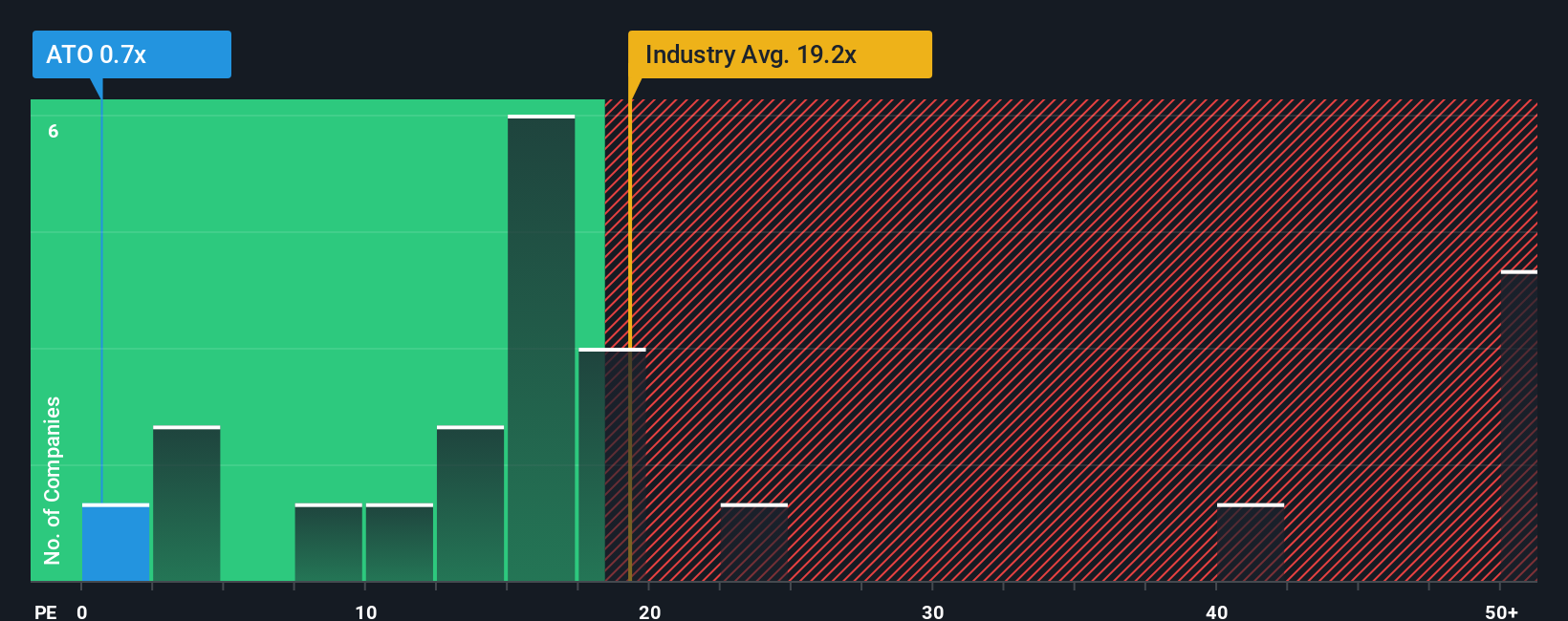

While the fair value estimate suggests Atos is overvalued, looking at its price-to-earnings ratio tells a very different story. Atos currently trades at just 0.6x, which is far below the European IT industry’s 19.2x average and its own fair ratio of 7x. This steep discount points to either market doubt or a rare opportunity. Could such a wide gap eventually close as underlying risks subside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Atos Narrative

If you’d rather follow your own research instincts, you can dig into the numbers and assemble a fresh perspective in just a few minutes. Do it your way

A great starting point for your Atos research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Maximize your edge and stay ahead of the market by checking out carefully selected stock ideas with the Simply Wall Street Screener. Don't miss out on these unique chances before others catch on.

- Capture promising long-term growth by evaluating these 878 undervalued stocks based on cash flows with proven cash flows and already attracting smart capital.

- Tap into the future of healthcare by browsing these 31 healthcare AI stocks, which is propelling innovation with AI-driven breakthroughs and next-generation patient care solutions.

- Boost your portfolio’s income by scoping out these 16 dividend stocks with yields > 3% that delivers solid yields above 3% and strong payout reliability.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Community Narratives