- France

- /

- Semiconductors

- /

- ENXTPA:XFAB

The Market Doesn't Like What It Sees From X-FAB Silicon Foundries SE's (EPA:XFAB) Earnings Yet

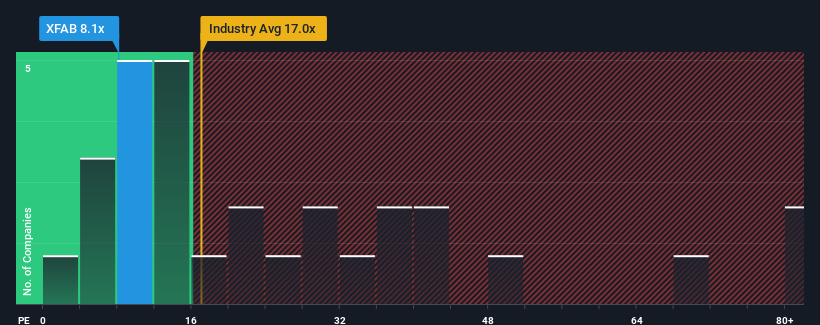

When close to half the companies in France have price-to-earnings ratios (or "P/E's") above 16x, you may consider X-FAB Silicon Foundries SE (EPA:XFAB) as an attractive investment with its 8.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

Recent times have been advantageous for X-FAB Silicon Foundries as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for X-FAB Silicon Foundries

Is There Any Growth For X-FAB Silicon Foundries?

There's an inherent assumption that a company should underperform the market for P/E ratios like X-FAB Silicon Foundries' to be considered reasonable.

If we review the last year of earnings growth, the company posted a terrific increase of 390%. Still, EPS has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing earnings over that time.

Turning to the outlook, the next year should bring diminished returns, with earnings decreasing 5.4% as estimated by the seven analysts watching the company. Meanwhile, the broader market is forecast to expand by 11%, which paints a poor picture.

In light of this, it's understandable that X-FAB Silicon Foundries' P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that X-FAB Silicon Foundries maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for X-FAB Silicon Foundries with six simple checks.

If you're unsure about the strength of X-FAB Silicon Foundries' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:XFAB

X-FAB Silicon Foundries

Develops, produces, and sells analog/mixed-signal IC, micro-electro-mechanical systems, and silicon carbide products for automotive, medical, industrial, communication, and consumer sectors in the Europe, the United States, Asia, and internationally.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives