- France

- /

- Semiconductors

- /

- ENXTPA:STMPA

STMicroelectronics FY 2025 Margin Compression Challenges Bullish Earnings Growth Narrative

How STMicroelectronics (ENXTPA:STMPA) Just Shaped Its FY 2025 Story

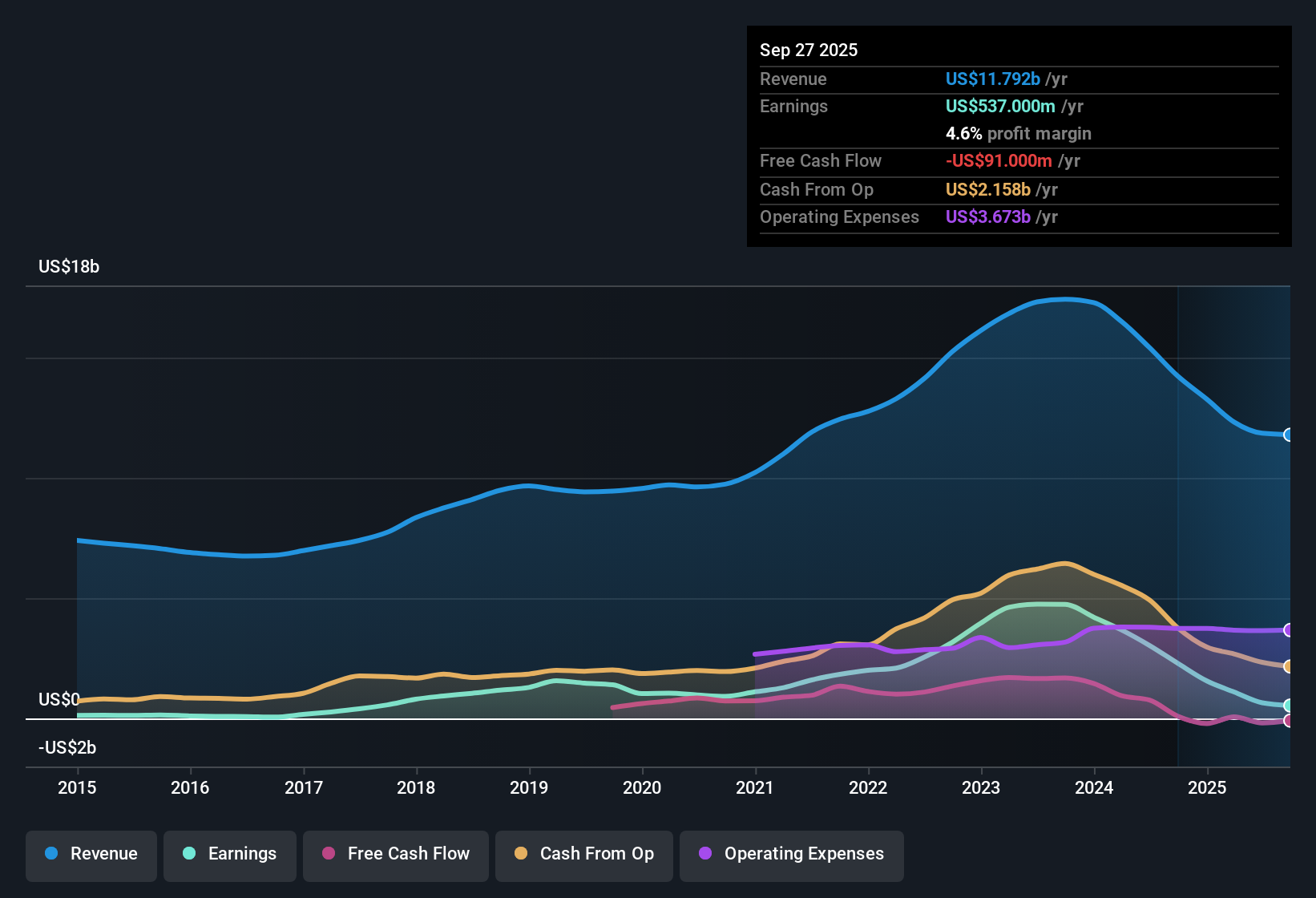

STMicroelectronics (ENXTPA:STMPA) closed FY 2025 with fourth quarter revenue of US$3.3b and a basic EPS loss of US$0.03, setting a mixed headline for investors digesting the latest print. Over the past six quarters, the company has seen quarterly revenue range from US$2.5b to US$3.3b, while basic EPS has swung between a profit of about US$0.39 and a loss of roughly US$0.11. This underscores how sensitive earnings have been to changes in profitability. With trailing 12 month net margins running at 1.4% after a sizeable one off loss, this set of results keeps the spotlight firmly on how durable the company’s margins really are.

See our full analysis for STMicroelectronics.With the latest numbers on the table, the next step is to see how this earnings profile lines up with the widely followed growth and risk narratives around STMicroelectronics and where those stories may need updating.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Hit By 1.4% Net Profit Level

- Over the last 12 months, STMicroelectronics generated about US$11.8b of revenue and US$166 million of net income, which works out to a 1.4% net profit margin compared with 11.7% in the prior year period mentioned in the risk summary.

- Bears point to the margin compression as a key concern, and the numbers give them material support:

- Net income for FY 2025 swung between a profit of US$237 million in Q3 and a loss of US$97 million in Q2, which sits uncomfortably next to the earlier trailing 12 month net income of US$1.6b reported for 2024 Q4.

- The risk summary also flags that earnings over the past five years declined about 6.4% per year, so the current 1.4% margin and recent losses in two of the last four quarters strengthen the bearish argument about earnings quality and consistency.

US$376m One Off Loss Distorts Profit Picture

- The analysis highlights a one off loss of US$376 million in the last 12 months, which had a large impact on reported profitability relative to the US$166 million of trailing net income.

- What is interesting for a more bullish angle is how this single item shapes the story:

- Without separating that US$376 million charge, the trailing figures fold it into the 1.4% margin, making the recent profitability look much weaker alongside the US$11.8b revenue base.

- Supporters arguing a bullish case could say that a one off of this size relative to trailing net income is masking the underlying run rate, but the mixed quarterly pattern, including losses in Q2 and Q4 2025, means the data does not give a clean read in their favor.

Revenue Stability Versus EPS Swings

- Quarterly revenue over FY 2025 stayed in a fairly tight band between US$2.5b and US$3.3b, while basic EPS moved from a profit of US$0.27 in Q3 2025 to a loss of US$0.11 in Q2 2025 and a small loss of US$0.03 in Q4 2025.

- Putting this alongside the AI generated growth oriented narrative creates a clear tension:

- The analysis references forecasts for earnings growth of about 37.2% a year and revenue growth of roughly 8.6% a year, yet the trailing 12 month basic EPS slipped from US$2.54 at 2024 Q3 to US$0.19 at 2025 Q4.

- That contrast between steady revenue in the US$11.8b range and much lower trailing EPS means any bullish view built around strong growth expectations has to square those forecasts with the recent pattern of earnings volatility and compressed profitability.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on STMicroelectronics's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

STMicroelectronics is facing thin 1.4% net margins, a sizeable US$376 million one off loss and uneven EPS, which all raise questions about earnings reliability.

If that kind of choppy profit profile makes you cautious, check out stable growth stocks screener (2166 results) to focus on companies with steadier revenue and earnings patterns that can help balance your ideas.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:STMPA

STMicroelectronics

Designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Palantir: Redefining Enterprise Software for the AI Era

Microsoft - A Fundamental and Historical Valuation

The Oncology Anchor: Why Merck’s 46% Discount Defies the Keytruda Cliff

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion

<b>Reported:</b> Revenue growth: 2024 → 2025 sharp increase of approx. 165%. Assuming moderate annual growth of 40%, a fair value in three years would be approx. $170. Given the customer base and the story, this should be possible. I find the most valuable “property” particularly interesting, as it solves the electricity problem.