- France

- /

- Semiconductors

- /

- ENXTPA:STMPA

STMicroelectronics (ENXTPA:STMPA): Revisiting Valuation After a Recent Share Price Rebound

Reviewed by Simply Wall St

Recent Performance and Context

STMicroelectronics (ENXTPA:STMPA) has been drifting in a tight range, with the stock roughly flat over the past week but up about 14% this month, even as its past 3 months remain negative.

See our latest analysis for STMicroelectronics.

Zooming out, STMicroelectronics has had a choppy ride, with the recent 13.68% 1 month share price return offering a partial rebound against a weaker year to date share price trend and negative multi year total shareholder returns. As a result, current momentum looks more like a cautious reset than a full turnaround.

If this kind of selective rebound has you rethinking your tech exposure, it could be a good moment to explore high growth tech and AI stocks for other semiconductor and AI driven opportunities.

With earnings still growing and the share price lagging its past highs, STMicroelectronics trades at a modest discount to analyst targets. The key question is whether that represents a genuine value opportunity or simply the market cautiously pricing in future growth.

Most Popular Narrative Narrative: 11% Undervalued

Compared with the last close around €21.92, the most followed narrative points to a higher fair value near €24.62, framing upside built on medium term recovery.

The normalization of distribution channel inventories, with genuine end market demand driving industrial segment growth rather than just inventory replenishment, points to a healthy demand environment that should reduce unused capacity charges and structurally improve gross margins in coming quarters.

Curious how this story turns margin pain into potential upside, with earnings, revenues, and multiples all pulling in different directions? Want the full playbook behind that projected fair value?

Result: Fair Value of $24.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying Chinese competition and lingering inventory imbalances could still pressure margins and delay the earnings recovery embedded in this valuation story.

Find out about the key risks to this STMicroelectronics narrative.

Another Lens on Valuation

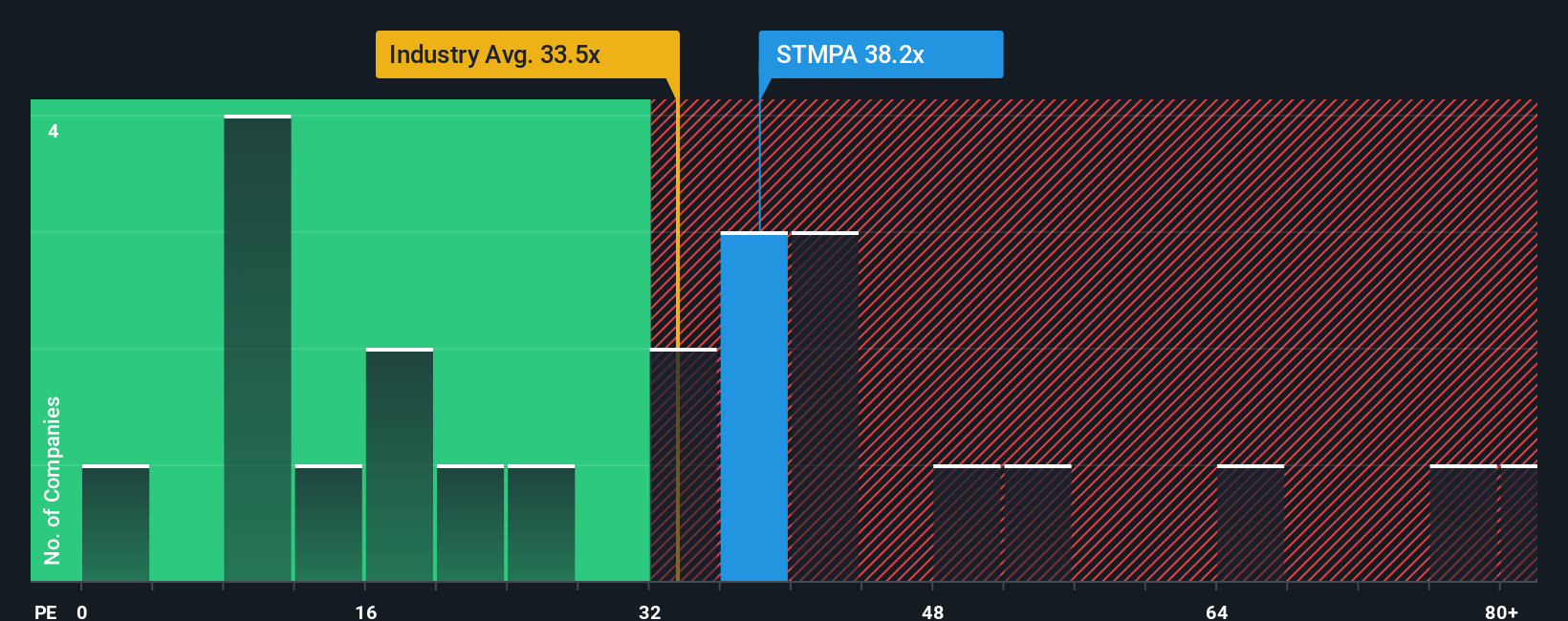

On earnings, the picture is less generous. STMicroelectronics trades on a P or E of 42.5x, richer than the European semiconductor average at 36.6x, yet close to its fair ratio of 45x and well below peers at 56.3x, hinting at both rerating risk and catch up potential.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own STMicroelectronics Narrative

If this perspective does not fully resonate and you would rather review the numbers yourself, you can craft a personalized view in under three minutes using Do it your way.

A great starting point for your STMicroelectronics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in an edge by lining up your next opportunities with focused stock ideas that match your return goals and risk comfort.

- Capture potential multi baggers early by targeting these 3614 penny stocks with strong financials that already boast healthy balance sheets and credible fundamentals.

- Position yourself in tomorrow’s infrastructure by scanning these 80 cryptocurrency and blockchain stocks tied to real world adoption of blockchain and digital asset technologies.

- Turn steady income into a core strategy by zeroing in on these 13 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:STMPA

STMicroelectronics

Designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion