- France

- /

- Semiconductors

- /

- ENXTPA:STMPA

STMicroelectronics (ENXTPA:STMPA) Margin Drop to 5.5% Challenges Recent Bullish Narratives on Growth

Reviewed by Simply Wall St

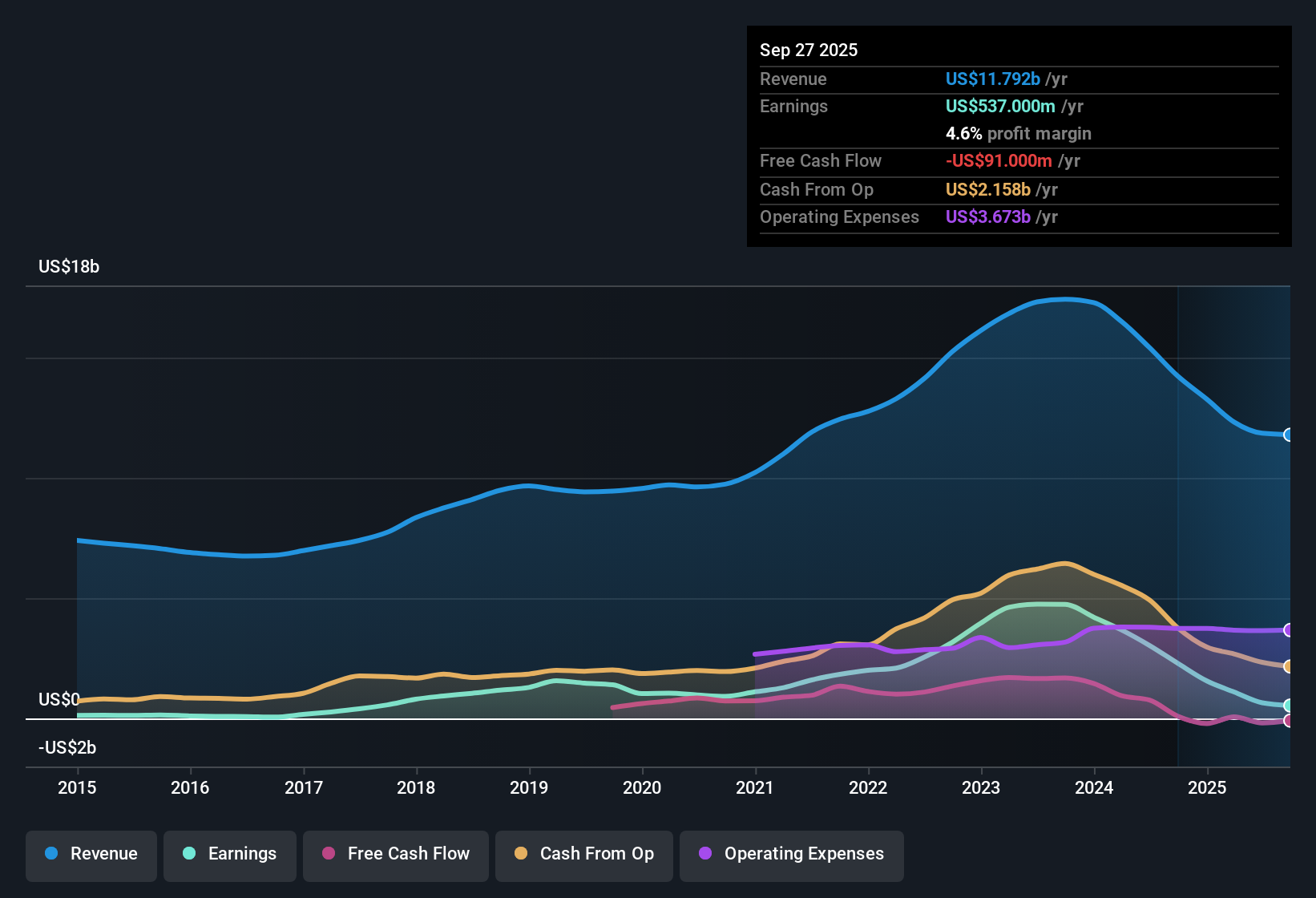

STMicroelectronics (ENXTPA:STMPA) reported net profit margins of 5.5%, marking a sharp decline from last year’s 19.7%. While earnings growth was negative over the past year, the company has averaged an 8% annual growth rate over the last five years. Looking ahead, expectations remain high, with earnings forecast to climb 36.1% per year and revenue projected to rise 10.3% annually. Both figures are expected to outpace the French market average.

See our full analysis for STMicroelectronics.Now, it's time to see how these results stack up against the market’s expectations and the community narratives that drive sentiment about STMicroelectronics.

See what the community is saying about STMicroelectronics

Profit Margins Projected to Nearly Triple

- Analysts expect profit margins to rise from 5.5% now to 14.1% in three years, a dramatic improvement despite recent margin pressures.

- According to the analysts' consensus view, this margin expansion is anchored in several tangible drivers:

- Strategic investments in advanced materials and cost-saving initiatives are expected to lower manufacturing expenses, helping margins recover from last year’s compression.

- Design wins in high-growth markets such as EVs, industrial automation, and AI power solutions reflect broad-based demand that supports the outlook for both higher volumes and improved operating leverage.

Surging profit margins could be transformative if cost savings and demand truly play out. See where analysts diverge in the consensus narrative. 📊 Read the full STMicroelectronics Consensus Narrative.

PE Ratio Discount Versus Industry

- STMicroelectronics is trading on a PE ratio well below the European semiconductor industry’s 33.4x, signaling undervaluation despite a growth profile above sector averages.

- Analysts' consensus narrative points out that:

- Achieving the forecasted $2.2 billion in earnings by 2028 would drive the company to a PE of 15.5x, even lower than today’s industry benchmark.

- This valuation gap persists even as the company posts stronger expected revenue and margin trends, suggesting additional upside if operational goals are met.

Restructuring and Chinese Competition Remain Risks

- Profit margins have sharply dropped this year and 13 to 14 percent of overall revenue is exposed to China, where intensifying competition and domestic chip policies threaten further downside.

- Analysts' consensus narrative cautions that:

- The current manufacturing and cost-base restructuring program brings high execution risk, including ongoing impairment charges and potential margin drag if initiatives stall.

- Uncertain demand in the automotive segment and currency headwinds are compounding risks to short-term earnings stability, especially if Chinese competitors capture market share.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for STMicroelectronics on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something unique in the trends? Shape your perspective and share your take in just a few minutes. Do it your way

A great starting point for your STMicroelectronics research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

Despite promising forecasts, STMicroelectronics faces ongoing execution risks from restructuring and heavy exposure to volatile Chinese competition. These factors could weigh on stability.

Prefer steadier opportunities? Use stable growth stocks screener (2090 results) to focus on companies that consistently deliver reliable revenue and earnings growth, helping you sidestep sudden surprises.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:STMPA

STMicroelectronics

Designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives