- France

- /

- Semiconductors

- /

- ENXTPA:ALTRO

Tronic's Microsystems SA (EPA:ALTRO) Stocks Pounded By 27% But Not Lagging Industry On Growth Or Pricing

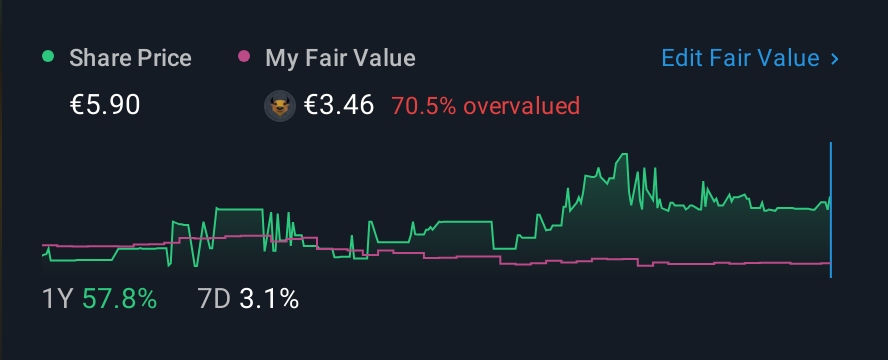

Tronic's Microsystems SA (EPA:ALTRO) shares have retraced a considerable 27% in the last month, reversing a fair amount of their solid recent performance. Still, a bad month hasn't completely ruined the past year with the stock gaining 31%, which is great even in a bull market.

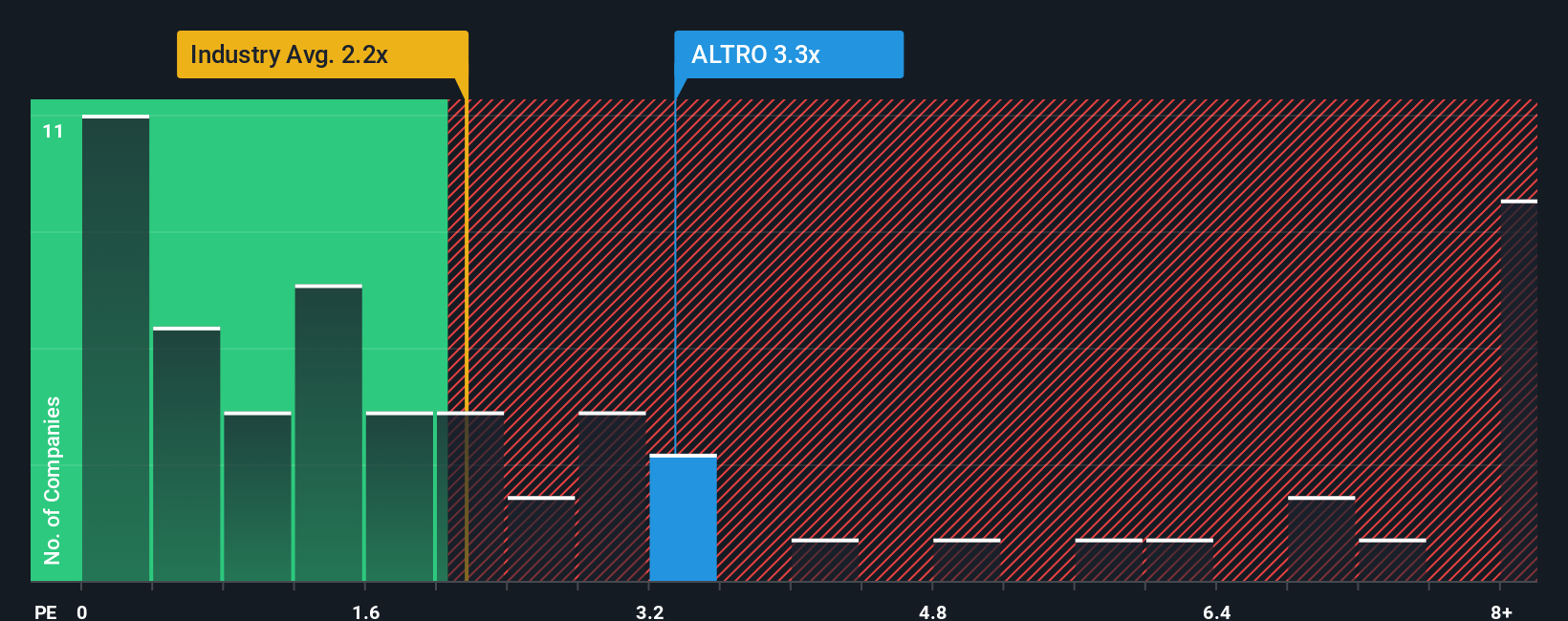

In spite of the heavy fall in price, when almost half of the companies in France's Semiconductor industry have price-to-sales ratios (or "P/S") below 1.6x, you may still consider Tronic's Microsystems as a stock probably not worth researching with its 3.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's as high as it is.

Check out our latest analysis for Tronic's Microsystems

What Does Tronic's Microsystems' P/S Mean For Shareholders?

Tronic's Microsystems has been doing a good job lately as it's been growing revenue at a solid pace. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Tronic's Microsystems will help you shine a light on its historical performance.How Is Tronic's Microsystems' Revenue Growth Trending?

In order to justify its P/S ratio, Tronic's Microsystems would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.2% last year. Pleasingly, revenue has also lifted 36% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.2% shows it's noticeably more attractive.

With this information, we can see why Tronic's Microsystems is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Tronic's Microsystems' P/S remain high even after its stock plunged. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It's no surprise that Tronic's Microsystems can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

Plus, you should also learn about these 5 warning signs we've spotted with Tronic's Microsystems (including 1 which can't be ignored).

If you're unsure about the strength of Tronic's Microsystems' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tronic's Microsystems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALTRO

Tronic's Microsystems

Manufactures and sells inertial micro-electro-mechanical-system (MEMS) sensor solutions for motion sensing, positioning, and navigation and condition monitoring of assets in France and internationally.

Slight risk with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026