- France

- /

- General Merchandise and Department Stores

- /

- ENXTPA:PSAT

How Much is Passat Société Anonyme's (EPA:PSAT) CEO Getting Paid?

The CEO of Passat Société Anonyme (EPA:PSAT) is Borries Broszio. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. After that, we will consider the growth in the business. And finally - as a second measure of performance - we will look at the returns shareholders have received over the last few years. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Passat Société Anonyme

How Does Borries Broszio's Compensation Compare With Similar Sized Companies?

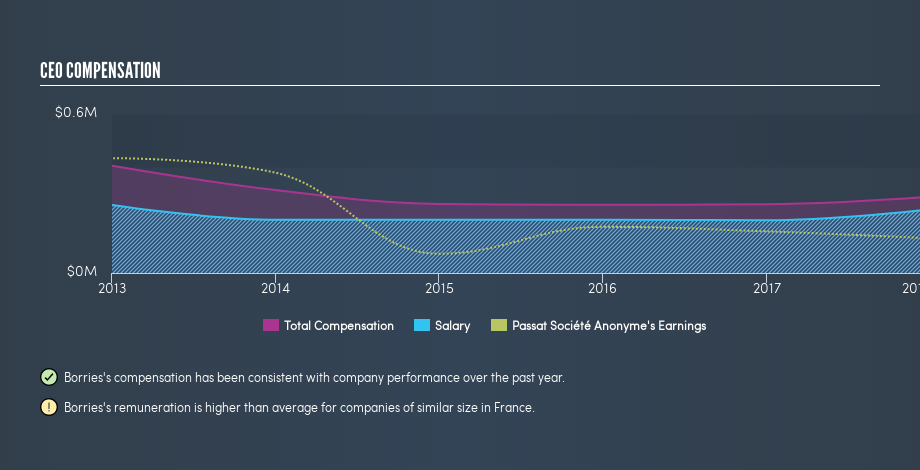

Our data indicates that Passat Société Anonyme is worth €15m, and total annual CEO compensation is €287k. (This figure is for the year to December 2017). While we always look at total compensation first, we note that the salary component is less, at €239k. We took a group of companies with market capitalizations below €177m, and calculated the median CEO total compensation to be €147k.

As you can see, Borries Broszio is paid more than the median CEO pay at companies of a similar size, in the same market. However, this does not necessarily mean Passat Société Anonyme is paying too much. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

You can see a visual representation of the CEO compensation at Passat Société Anonyme, below.

Is Passat Société Anonyme Growing?

Passat Société Anonyme has reduced its earnings per share by an average of 7.9% a year, over the last three years (measured with a line of best fit). It saw its revenue drop -14% over the last year.

Unfortunately, earnings per share have trended lower over the last three years. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Passat Société Anonyme Been A Good Investment?

Passat Société Anonyme has generated a total shareholder return of 17% over three years, so most shareholders would be reasonably content. But they probably wouldn't be so happy as to think the CEO should be paid more than is normal, for companies around this size.

In Summary...

We compared the total CEO remuneration paid by Passat Société Anonyme, and compared it to remuneration at a group of similar sized companies. We found that it pays well over the median amount paid in the benchmark group.

Earnings per share have not grown in three years, and the revenue growth fails to impress us.And while shareholder returns have been respectable, they have hardly been superb. So you may want to delve deeper, because we don't think the CEO pay is too low. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Passat Société Anonyme (free visualization of insider trades).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:PSAT

Passat Société Anonyme

Engages in the image-assisted sale of consumer products in France.

Excellent balance sheet low.

Market Insights

Community Narratives