- Netherlands

- /

- Hospitality

- /

- ENXTAM:TKWY

3 European Stocks Estimated To Be Trading At Discounts Of Up To 45.2%

Reviewed by Simply Wall St

As European markets navigate cautious optimism amid geopolitical developments and mixed economic indicators, investors are keenly observing undervalued opportunities in the region. Identifying stocks trading at significant discounts can offer potential value, especially when market conditions present a blend of challenges and prospects for growth.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Vimi Fasteners (BIT:VIM) | €0.995 | €1.95 | 48.9% |

| Wienerberger (WBAG:WIE) | €33.62 | €67.13 | 49.9% |

| CD Projekt (WSE:CDR) | PLN222.90 | PLN441.95 | 49.6% |

| Vestas Wind Systems (CPSE:VWS) | DKK104.05 | DKK205.07 | 49.3% |

| Nyab (OM:NYAB) | SEK5.27 | SEK10.42 | 49.4% |

| Cint Group (OM:CINT) | SEK6.67 | SEK13.22 | 49.5% |

| Surgical Science Sweden (OM:SUS) | SEK159.00 | SEK310.42 | 48.8% |

| Groupe Airwell Société anonyme (ENXTPA:ALAIR) | €1.24 | €2.42 | 48.7% |

| Bactiguard Holding (OM:BACTI B) | SEK34.80 | SEK68.97 | 49.5% |

| Facephi Biometria (BME:FACE) | €2.07 | €4.04 | 48.7% |

Underneath we present a selection of stocks filtered out by our screen.

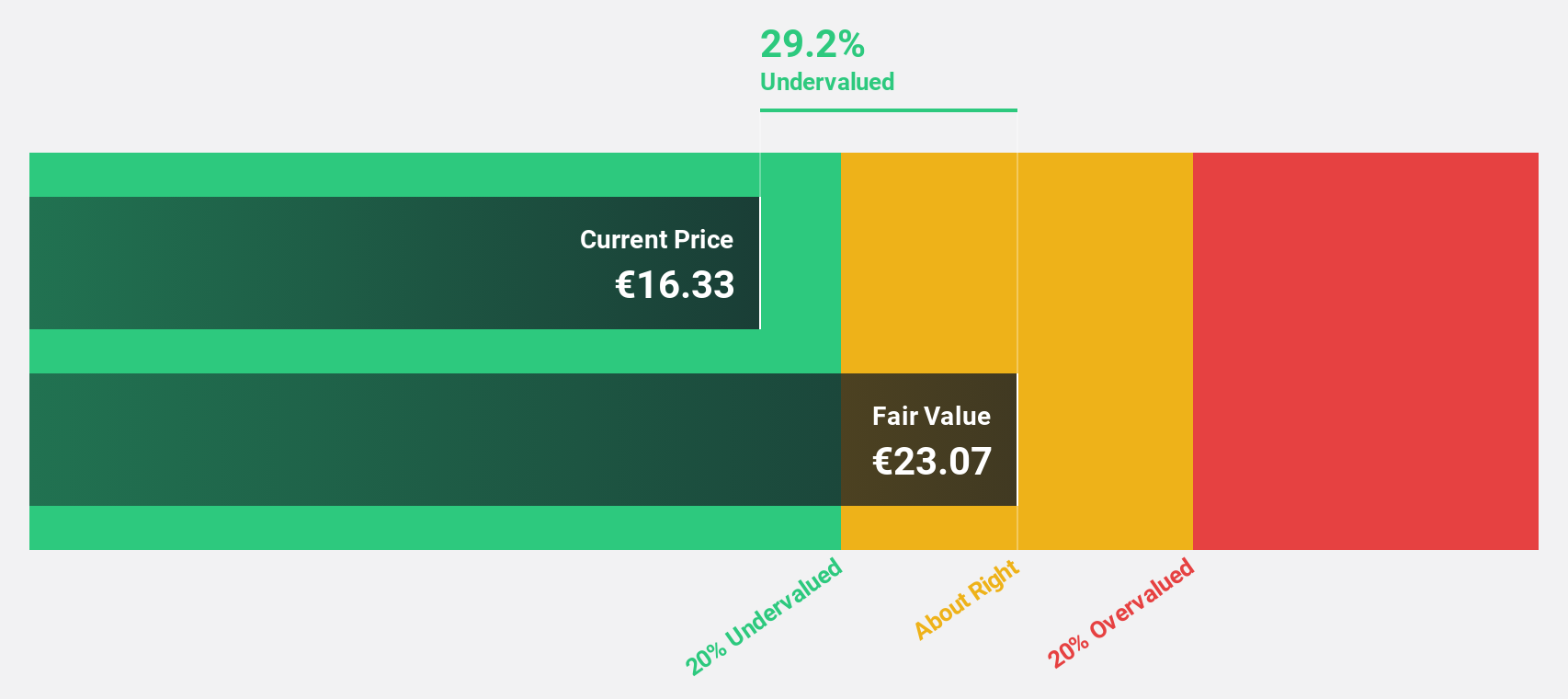

CVC Capital Partners (ENXTAM:CVC)

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure, credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts with a market cap of €24.61 billion.

Operations: CVC Capital Partners plc generates revenue through its focus on middle market secondaries, infrastructure and credit investments, management and leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts.

Estimated Discount To Fair Value: 11.6%

CVC Capital Partners is trading at €23.15, slightly below its estimated fair value of €26.2, representing an 11.6% discount. Despite carrying a high level of debt, CVC's earnings are forecast to grow significantly at 27.4% annually over the next three years, outpacing the Dutch market's growth rate of 12.6%. Recent M&A activity includes interest in Akzo Nobel’s South Asia portfolio and divesting a stake in HealthCare Global Enterprises to KKR & Co., potentially impacting future cash flows positively.

- The analysis detailed in our CVC Capital Partners growth report hints at robust future financial performance.

- Click to explore a detailed breakdown of our findings in CVC Capital Partners' balance sheet health report.

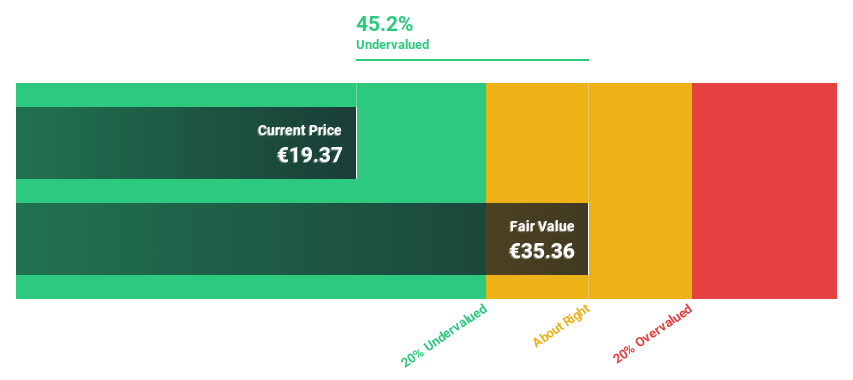

Just Eat Takeaway.com (ENXTAM:TKWY)

Overview: Just Eat Takeaway.com N.V. operates as a global online food delivery company with a market cap of approximately €3.92 billion.

Operations: The company's revenue segments include North America (€1.97 billion), UK and Ireland (€1.39 billion), Northern Europe (€1.37 billion), and Southern Europe & Australia (€372 million).

Estimated Discount To Fair Value: 45.2%

Just Eat Takeaway.com is trading at €19.37, significantly below its estimated fair value of €35.36, indicating it is undervalued based on cash flows. Despite a net loss of €1.64 billion in 2024, the company is expected to become profitable within three years with earnings growth forecasted at over 105% annually. The recent acquisition proposal by Prosus for approximately €4.1 billion underscores potential long-term value under private ownership and strategic realignment post-delistings.

- Our earnings growth report unveils the potential for significant increases in Just Eat Takeaway.com's future results.

- Click here and access our complete balance sheet health report to understand the dynamics of Just Eat Takeaway.com.

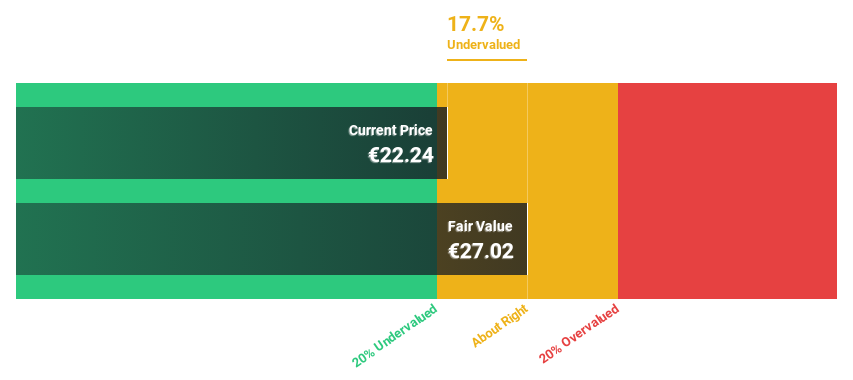

Icade (ENXTPA:ICAD)

Overview: Icade is a full-service real estate company operating throughout France, specializing in commercial property investment with a portfolio worth €6.8 billion and property development generating €1.3 billion in economic revenue for 2023, with a market capitalization of approximately €1.69 billion.

Operations: The company's revenue segments include €1.21 billion from the Property Development Business and €375.60 million from Commercial Property Investment for 2023.

Estimated Discount To Fair Value: 17.7%

Icade is trading at €22.24, below its estimated fair value of €27.02, suggesting undervaluation based on cash flows. Despite a net loss of €275.9 million in 2024, the company is expected to achieve profitability within three years with earnings growth forecasted at 83% annually. Revenue growth is anticipated to outpace the French market, yet its high dividend yield remains unsustainable due to insufficient coverage by earnings or free cash flows.

- Our comprehensive growth report raises the possibility that Icade is poised for substantial financial growth.

- Take a closer look at Icade's balance sheet health here in our report.

Summing It All Up

- Unlock our comprehensive list of 201 Undervalued European Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:TKWY

Just Eat Takeaway.com

Operates as an online food delivery company worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives