- France

- /

- Office REITs

- /

- ENXTPA:EIFF

The Société de la Tour Eiffel (EPA:EIFF) Share Price Is Down 30% So Some Shareholders Are Getting Worried

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But in any portfolio, there are likely to be some stocks that fall short of that benchmark. We regret to report that long term Société de la Tour Eiffel (EPA:EIFF) shareholders have had that experience, with the share price dropping 30% in three years, versus a market return of about 42%. The good news is that the stock is up 3.8% in the last week.

See our latest analysis for Société de la Tour Eiffel

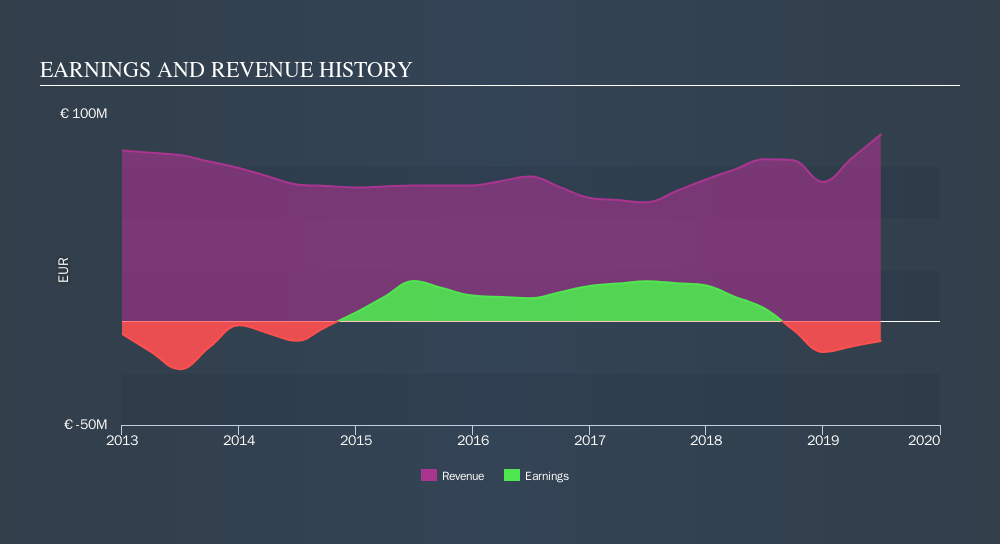

Because Société de la Tour Eiffel is loss-making, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over three years, Société de la Tour Eiffel grew revenue at 10% per year. That's a pretty good rate of top-line growth. Shareholders have seen the share price fall at 11% per year, for three years. So the market has definitely lost some love for the stock. However, that's in the past now, and it's the future is more important - and the future looks brighter (based on revenue, anyway).

The company's revenue and earnings (over time) are depicted in the image below.

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, Société de la Tour Eiffel's TSR for the last 3 years was -16%, which exceeds the share price return mentioned earlier. This is largely a result of its dividend payments!

A Different Perspective

While the broader market gained around 13% in the last year, Société de la Tour Eiffel shareholders lost 4.8% (even including dividends) . However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 2.9% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Keeping this in mind, a solid next step might be to take a look at Société de la Tour Eiffel's dividend track record. This free interactive graph is a great place to start.

Of course Société de la Tour Eiffel may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:EIFF

Société de la Tour Eiffel

Société de la Tour Eiffel with a property portfolio amounting to 1.6bn Euro, Societe de la Tour Eiffel is an integrated property company with a strong culture of services.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives