- France

- /

- Real Estate

- /

- ENXTPA:BASS

How Is BASSAC Société anonyme's (EPA:BASS) CEO Paid Relative To Peers?

Moïse Mitterrand is the CEO of BASSAC Société anonyme (EPA:BASS), and in this article, we analyze the executive's compensation package with respect to the overall performance of the company. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

View our latest analysis for BASSAC Société anonyme

How Does Total Compensation For Moïse Mitterrand Compare With Other Companies In The Industry?

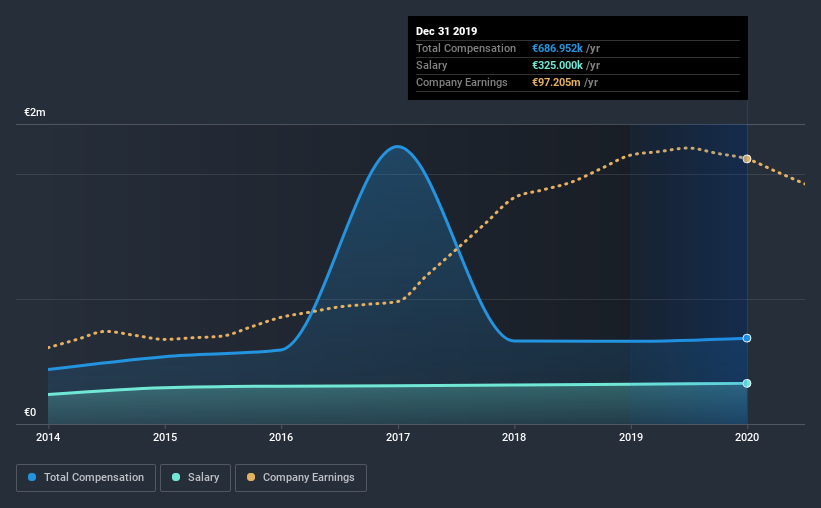

Our data indicates that BASSAC Société anonyme has a market capitalization of €707m, and total annual CEO compensation was reported as €687k for the year to December 2019. That's a modest increase of 3.8% on the prior year. While this analysis focuses on total compensation, it's worth acknowledging that the salary portion is lower, valued at €325k.

On examining similar-sized companies in the industry with market capitalizations between €328m and €1.3b, we discovered that the median CEO total compensation of that group was €808k. This suggests that BASSAC Société anonyme remunerates its CEO largely in line with the industry average.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | €325k | €319k | 47% |

| Other | €362k | €344k | 53% |

| Total Compensation | €687k | €662k | 100% |

On an industry level, around 90% of total compensation represents salary and 10% is other remuneration. BASSAC Société anonyme pays a modest slice of remuneration through salary, as compared to the broader industry. If non-salary compensation dominates total pay, it's an indicator that the executive's salary is tied to company performance.

BASSAC Société anonyme's Growth

BASSAC Société anonyme has seen its earnings per share (EPS) increase by 11% a year over the past three years. It achieved revenue growth of 2.3% over the last year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has BASSAC Société anonyme Been A Good Investment?

With a total shareholder return of 2.7% over three years, BASSAC Société anonyme has done okay by shareholders. But they probably don't want to see the CEO paid more than is normal for companies around the same size.

To Conclude...

As we touched on above, BASSAC Société anonyme is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. But EPS growth for the company has been strong over the last three years, though shareholder returns in comparison haven't been as impressive. Considering overall performance, we'd say the compensation is fair, although stockholders will want to see higher returns moving forward.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We did our research and identified 2 warning signs (and 1 which is significant) in BASSAC Société anonyme we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade BASSAC Société anonyme, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if BASSAC Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:BASS

BASSAC Société anonyme

Operates as a real estate development company primarily in France, Belgium, Germany, and Spain.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives