- France

- /

- Residential REITs

- /

- ENXTPA:ALTA

Is Now the Moment to Reassess Altarea After Recent Share Price Dip?

Reviewed by Simply Wall St

Wondering whether now is the moment to buy, hold or sell Altarea stock? You are not alone. Investors have been keeping a close eye on Altarea as it navigates the recent ups and downs of the European market. While the stock dipped 3.4% in the past week and 2.6% over the past month, it remains up 9.6% year-to-date and has delivered a solid 30.4% gain over five years. These moves hint at shifting investor sentiment, reflecting both new growth hopes and changes in perceived risk for the company, especially as economic optimism continues to ebb and flow across real estate markets.

In the process, Altarea’s value score currently sits at 3 out of 6, based on our six-check system for undervaluation. This means the company appears undervalued in half the key ways analysts typically measure. What does this really mean for investors trying to find an edge in the market? And just how reliable are these common valuation techniques when it comes to capturing the bigger picture?

Let us take a closer look at those valuation approaches, and later in the article, we will consider an even more effective way to judge whether Altarea is truly a bargain right now.

Altarea delivered 6.1% returns over the last year. See how this stacks up to the rest of the Residential REITs industry.Approach 1: Altarea Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model tries to estimate what a business is truly worth by projecting its future cash flows, then discounting those figures back to today using a suitable rate. For Altarea, analysts use adjusted funds from operations, looking at both near-term and long-term trends, to map out this trajectory.

Currently, Altarea generates €127.2 million in free cash flow. Analyst projections estimate a decline in free cash flow over the coming years, with 2026 expected to be about €100.8 million. By 2035, Simply Wall St's extrapolations suggest annual free cash flow could be around €70.7 million. This method leverages cash flows anticipated by analysts for the next five years and extends beyond that using trend analysis. It is worth noting those longer-term figures are increasingly speculative.

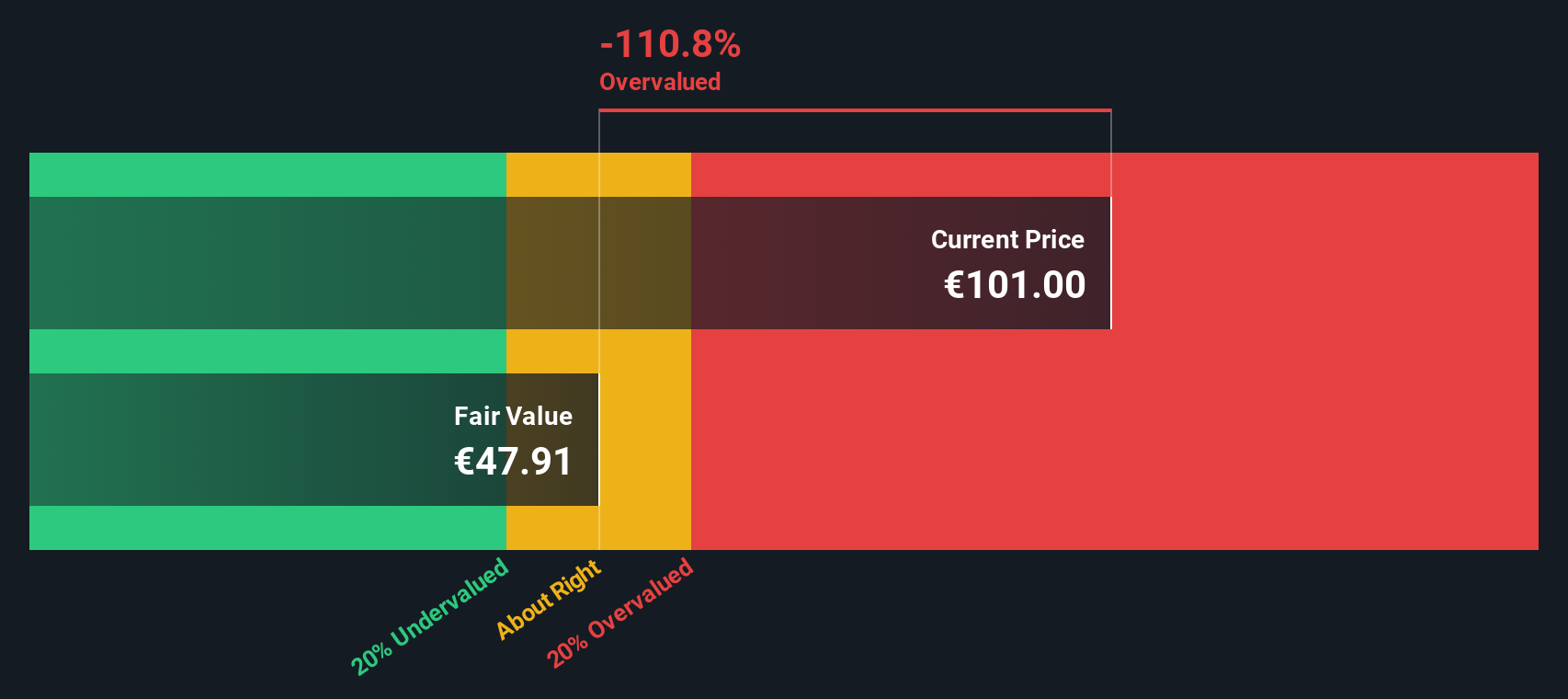

Based on these projections, the DCF valuation model calculates an intrinsic value of €47.75 per share. Comparing this to the current market price, Altarea appears to be trading at a 123.3% premium to its intrinsic value. This indicates the stock is significantly overvalued on this measure.

Result: OVERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Altarea.

Approach 2: Altarea Price vs Sales (P/S)

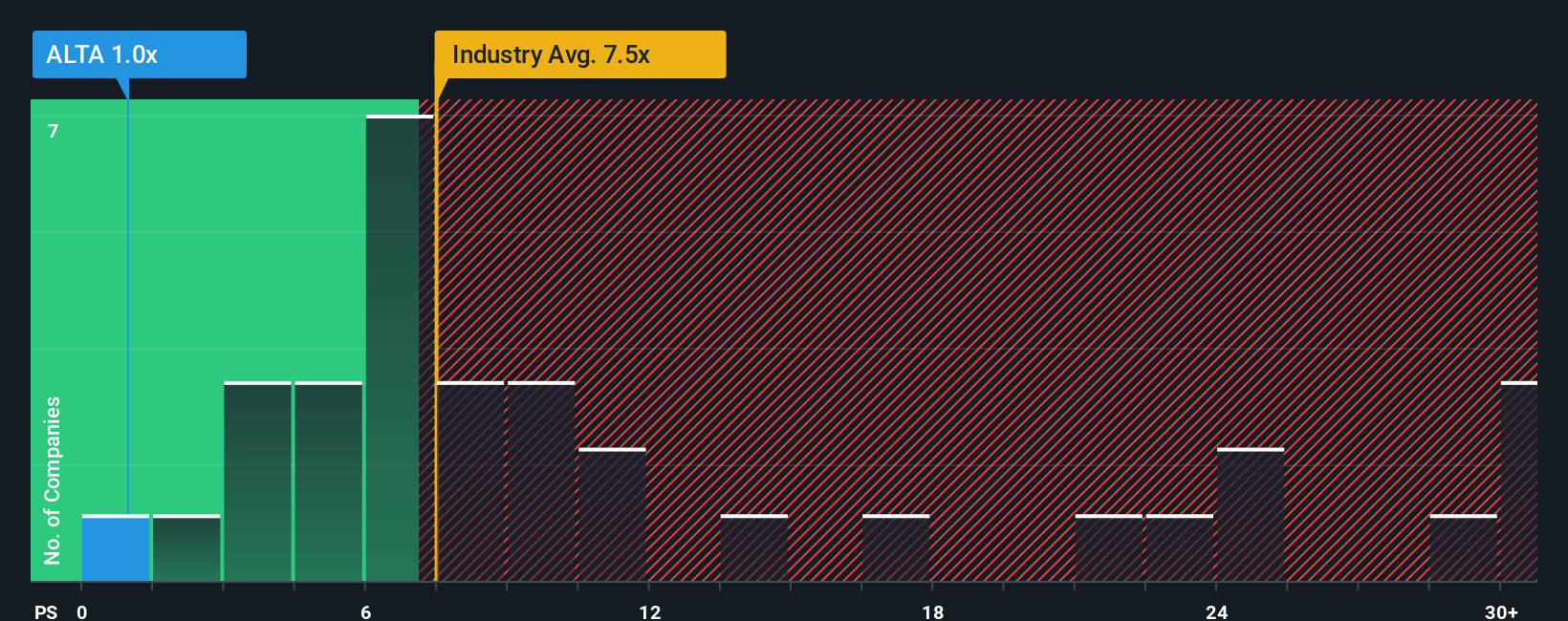

For companies like Altarea, the Price-to-Sales (P/S) ratio is a particularly relevant valuation tool, especially in real estate, where reported earnings can be volatile or affected by non-cash charges. Revenue generally remains a stable indicator of business strength. The P/S ratio shows how much investors are paying for every euro of sales and helps gauge whether the stock’s price fairly reflects its underlying business activity.

Growth prospects and risk profile have a big influence on what is considered a "normal" or “fair” P/S ratio. Companies with higher expected growth or lower risk usually justify a higher multiple, while those facing uncertainty or slowdowns generally trade at a discount.

Currently, Altarea trades at a 1.0x P/S ratio. That is well below the Residential REITs sector average of 7.0x and also under its peer average of 11.6x, suggesting it appears cheap at first glance. However, to dig deeper, Simply Wall St uses a proprietary “Fair Ratio” model that reflects not just industry averages or recent peer trends but also factors like Altarea’s specific growth outlook, risk, margins, and market cap. For Altarea, the Fair Ratio comes out to 1.6x, indicating the valuation investors might expect given these variables.

The Fair Ratio is more robust than direct comparisons to industry benchmarks because it adjusts for business quality, trajectory, and risk, offering a more customized sense of fair value. This means that even though Altarea looks very cheap compared to the sector, it is valued at just below what would be considered fair for a business with its characteristics.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Altarea Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is a simple, powerful way to connect your perspective on a company to the numbers. It is your story about Altarea, backed up by your own estimates of future revenue, margins, and fair value. Instead of only relying on traditional models, Narratives let you anchor the numbers in your own outlook, linking Altarea’s business story directly to a financial forecast and a calculated fair value.

Narratives are available as an easy tool inside Simply Wall St’s Community page, trusted and used by millions of investors worldwide. They allow you to compare your fair value to the latest market price and see, in real time, whether Altarea looks like a buy or a sell based on your unique assumptions.

Even more, Narratives are dynamic, so they update automatically as new news and earnings roll in, keeping your analysis relevant and timely. For example, some investors may see Altarea’s fair value as much higher due to strong growth expectations, while others may set a lower value because they anticipate risks in future earnings. Narratives help you make smarter investment choices by blending your judgment and the latest numbers together.

Do you think there's more to the story for Altarea? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALTA

Altarea

Altarea is the French leader in low-carbon urban transformation, with the most comprehensive real estate offering to serve the city and its users.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives