Exploring Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative And Two Other Undiscovered French Gems

Reviewed by Simply Wall St

Amid a backdrop of fluctuating global markets, the French stock market has shown resilience with the CAC 40 Index experiencing modest gains. Recent data indicates an environment where smaller-cap stocks, such as those listed in France, might find favorable conditions due to broader economic trends and investor sentiment shifting towards value-oriented assets. In this context, exploring lesser-known companies like Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative could uncover potential opportunities for investors seeking growth in niche sectors influenced by current market dynamics.

Top 10 Undiscovered Gems With Strong Fundamentals In France

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 34.89% | 3.23% | 3.61% | ★★★★★★ |

| Gévelot | 0.25% | 10.64% | 20.33% | ★★★★★★ |

| Société des Chemins de Fer et Tramways du Var et du Gard | NA | nan | -2.95% | ★★★★★★ |

| VIEL & Cie société anonyme | 63.16% | 5.00% | 16.26% | ★★★★★☆ |

| ADLPartner | 86.83% | 9.59% | 11.00% | ★★★★★☆ |

| Exacompta Clairefontaine | 30.44% | 6.92% | 31.73% | ★★★★★☆ |

| CFM Indosuez Wealth Management | 239.60% | 10.01% | 13.52% | ★★★★★☆ |

| La Forestière Equatoriale | 0.00% | -50.76% | 49.41% | ★★★★★☆ |

| Société Fermière du Casino Municipal de Cannes | 11.60% | 6.69% | 10.30% | ★★★★☆☆ |

| Société Industrielle et Financière de l'Artois Société anonyme | 2.93% | -1.09% | 8.31% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative operates as a cooperative bank offering diversified banking services to various customer segments in France, with a market capitalization of approximately €0.97 billion.

Operations: The company operates in the retail banking sector, generating a consistent gross profit margin of 100% across several reporting periods. It has seen a net income margin ranging from approximately 22.24% to 36.50%, indicating variability in profitability relative to its total revenue, which has fluctuated between €504.60 million and €682.55 million during different quarters.

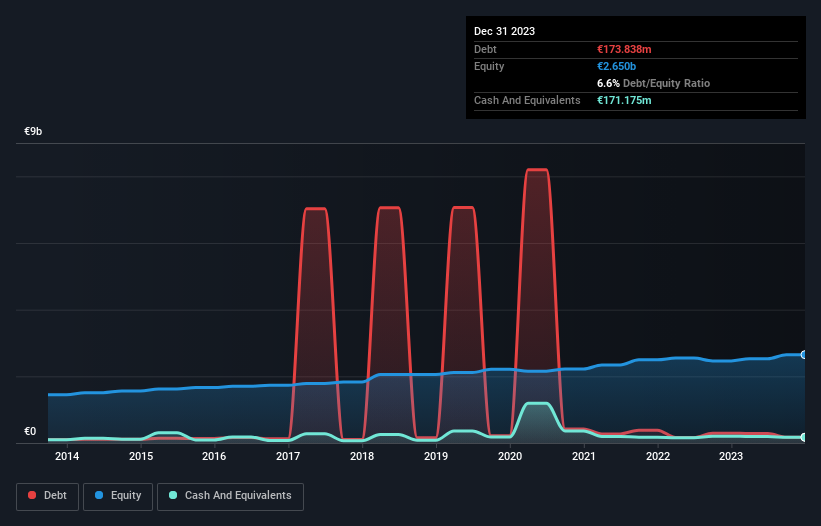

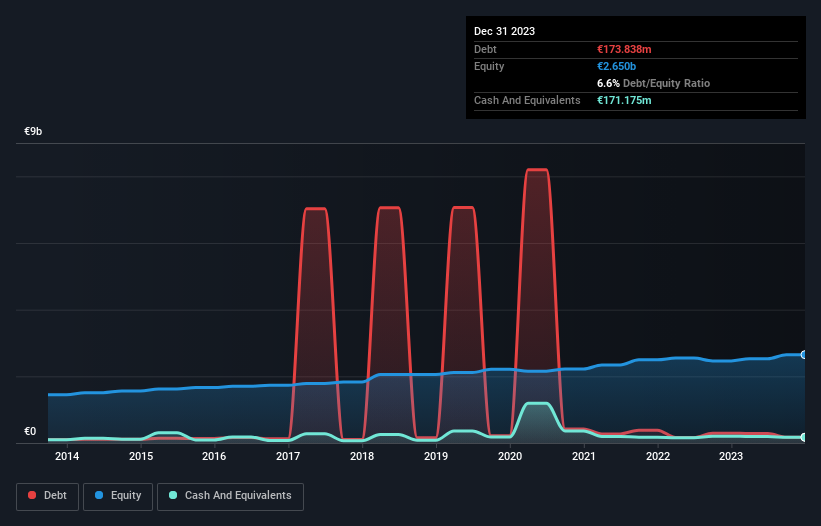

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie, with a robust balance sheet boasting €42.2B in assets and €5.0B in equity, stands out for its financial health. The bank prides itself on a low-risk funding model, with 91% of liabilities backed by customer deposits. Notably, it maintains an appropriate bad loans ratio at 1.2% and a sufficient allowance for these loans at 115%. Additionally, its earnings have grown by 6.2% over the past year, outpacing the industry's -17.9%.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative operates as a cooperative bank offering diversified banking services to various customer segments in France, with a market capitalization of approximately €0.97 billion.

Operations: The company operates in the retail banking sector, generating a consistent gross profit margin of 100% across several reporting periods. It has seen a net income margin ranging from approximately 22.24% to 36.50%, indicating variability in profitability relative to its total revenue, which has fluctuated between €504.60 million and €682.55 million during different quarters.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie, with a robust balance sheet boasting €42.2B in assets and €5.0B in equity, stands out for its financial health. The bank prides itself on a low-risk funding model, with 91% of liabilities backed by customer deposits. Notably, it maintains an appropriate bad loans ratio at 1.2% and a sufficient allowance for these loans at 115%. Additionally, its earnings have grown by 6.2% over the past year, outpacing the industry's -17.9%.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services within France, with a market capitalization of €428.37 million.

Operations: The company operates primarily through two segments: Proximity Banking, which generated €253.67 million, and Management for Own Account and Miscellaneous activities, contributing €92.57 million in revenue. It consistently achieves a gross profit margin of 100%, indicating that it incurs no cost of goods sold across its operations.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou, with a robust €16.9B in assets and €2.7B in equity, stands out due to its prudent financial management. The bank's total loans of €14.1B are well-covered by deposits amounting to €13.5B, reflecting a stable funding base primarily sourced from customer deposits—considered low-risk financing at 95%. Notably, the company's earnings surged by 19.5% last year, significantly outpacing the industry's decline of 17.9%. Moreover, it maintains an impressive allowance for bad loans at 134%, ensuring resilience against potential credit losses.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative (ENXTPA:CRTO)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative offers a range of banking products and services within France, with a market capitalization of €428.37 million.

Operations: The company operates primarily through two segments: Proximity Banking, which generated €253.67 million, and Management for Own Account and Miscellaneous activities, contributing €92.57 million in revenue. It consistently achieves a gross profit margin of 100%, indicating that it incurs no cost of goods sold across its operations.

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou, with a robust €16.9B in assets and €2.7B in equity, stands out due to its prudent financial management. The bank's total loans of €14.1B are well-covered by deposits amounting to €13.5B, reflecting a stable funding base primarily sourced from customer deposits—considered low-risk financing at 95%. Notably, the company's earnings surged by 19.5% last year, significantly outpacing the industry's decline of 17.9%. Moreover, it maintains an impressive allowance for bad loans at 134%, ensuring resilience against potential credit losses.

Fiducial Real Estate (ENXTPA:ORIA)

Simply Wall St Value Rating: ★★★★☆☆

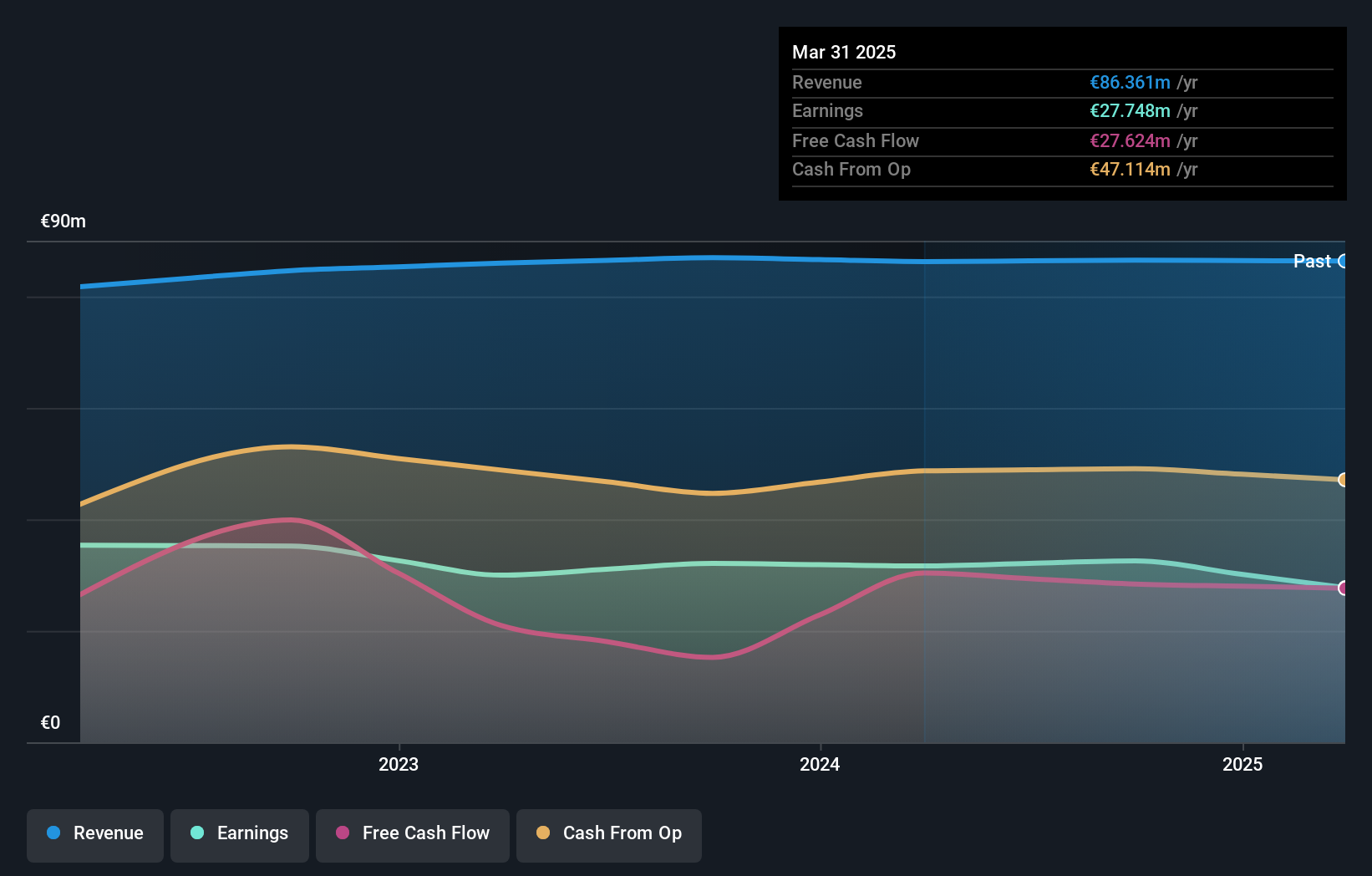

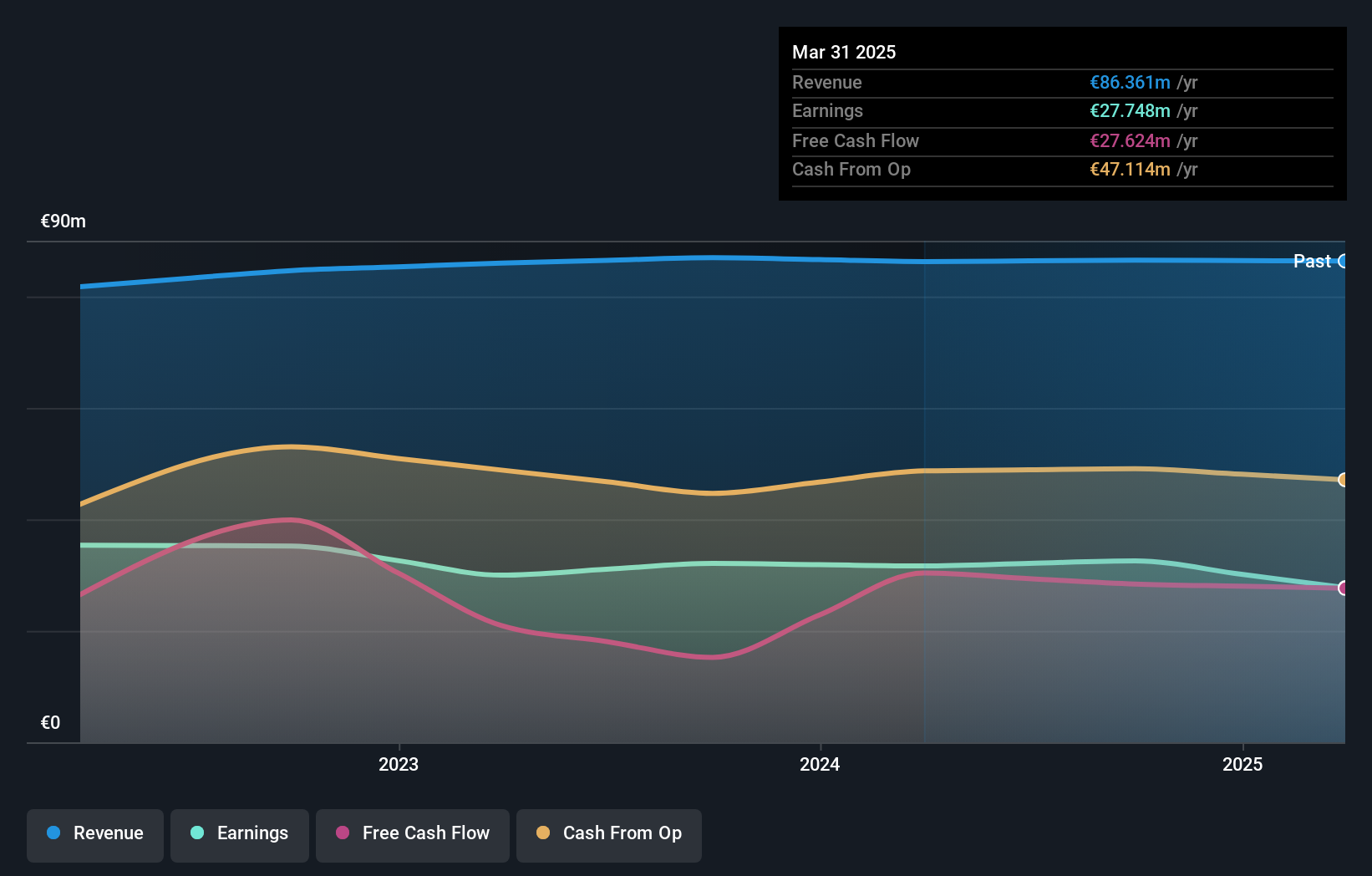

Overview: Fiducial Real Estate SA is engaged in the operation and management of real estate properties across France, with a market capitalization of €424.86 million.

Operations: Fiducial Real Estate generates revenue primarily through land activities and service provider activities, contributing €71.21 million and €23.01 million respectively. The company has demonstrated a consistently high gross profit margin, averaging approximately 98% over recent periods, indicating efficient cost management relative to its revenue generation.

Fiducial Real Estate, a lesser-known yet promising entity in the French market, has demonstrated robust financial health. With a price-to-earnings ratio of 13.4, it sits attractively below the French market average of 15.6. Recent earnings reveal a slight dip with sales at €42.86 million and net income at €14.99 million, reflecting subtle shifts in performance metrics. Notably, its debt to equity ratio improved significantly over five years from 81% to 34%, underscoring prudent financial management and enhanced stability.

Fiducial Real Estate (ENXTPA:ORIA)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fiducial Real Estate SA is engaged in the operation and management of real estate properties across France, with a market capitalization of €424.86 million.

Operations: Fiducial Real Estate generates revenue primarily through land activities and service provider activities, contributing €71.21 million and €23.01 million respectively. The company has demonstrated a consistently high gross profit margin, averaging approximately 98% over recent periods, indicating efficient cost management relative to its revenue generation.

Fiducial Real Estate, a lesser-known yet promising entity in the French market, has demonstrated robust financial health. With a price-to-earnings ratio of 13.4, it sits attractively below the French market average of 15.6. Recent earnings reveal a slight dip with sales at €42.86 million and net income at €14.99 million, reflecting subtle shifts in performance metrics. Notably, its debt to equity ratio improved significantly over five years from 81% to 34%, underscoring prudent financial management and enhanced stability.

Key Takeaways

- Explore the 32 names from our Euronext Paris Undiscovered Gems With Strong Fundamentals screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRTO

Caisse Régionale de Crédit Agricole Mutuel de la Touraine et du Poitou Société Coopérative

Caisse Régionale de Crédit Agricole Mutuel de La Touraine et du Poitou Société Coopérative provides various banking products and services in France.

Flawless balance sheet, good value and pays a dividend.