- France

- /

- Real Estate

- /

- ENXTPA:BASS

Undiscovered Gems In Europe To Explore This April 2025

Reviewed by Simply Wall St

As European markets show signs of recovery, with the STOXX Europe 600 Index climbing by nearly 4% and major indexes like Italy's FTSE MIB and Germany's DAX also posting gains, investors are cautiously optimistic amid the European Central Bank's rate cuts aimed at stimulating growth. In this dynamic environment, identifying promising small-cap stocks can offer unique opportunities for those looking to explore under-the-radar investments that may benefit from these broader economic trends.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 3.81% | 3.66% | ★★★★★★ |

| Mirbud | 16.01% | 27.19% | 26.48% | ★★★★★★ |

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

BASSAC Société anonyme (ENXTPA:BASS)

Simply Wall St Value Rating: ★★★★☆☆

Overview: BASSAC Société anonyme is a real estate development company with operations in France, Belgium, Germany, and Spain, and has a market cap of approximately €1.02 billion.

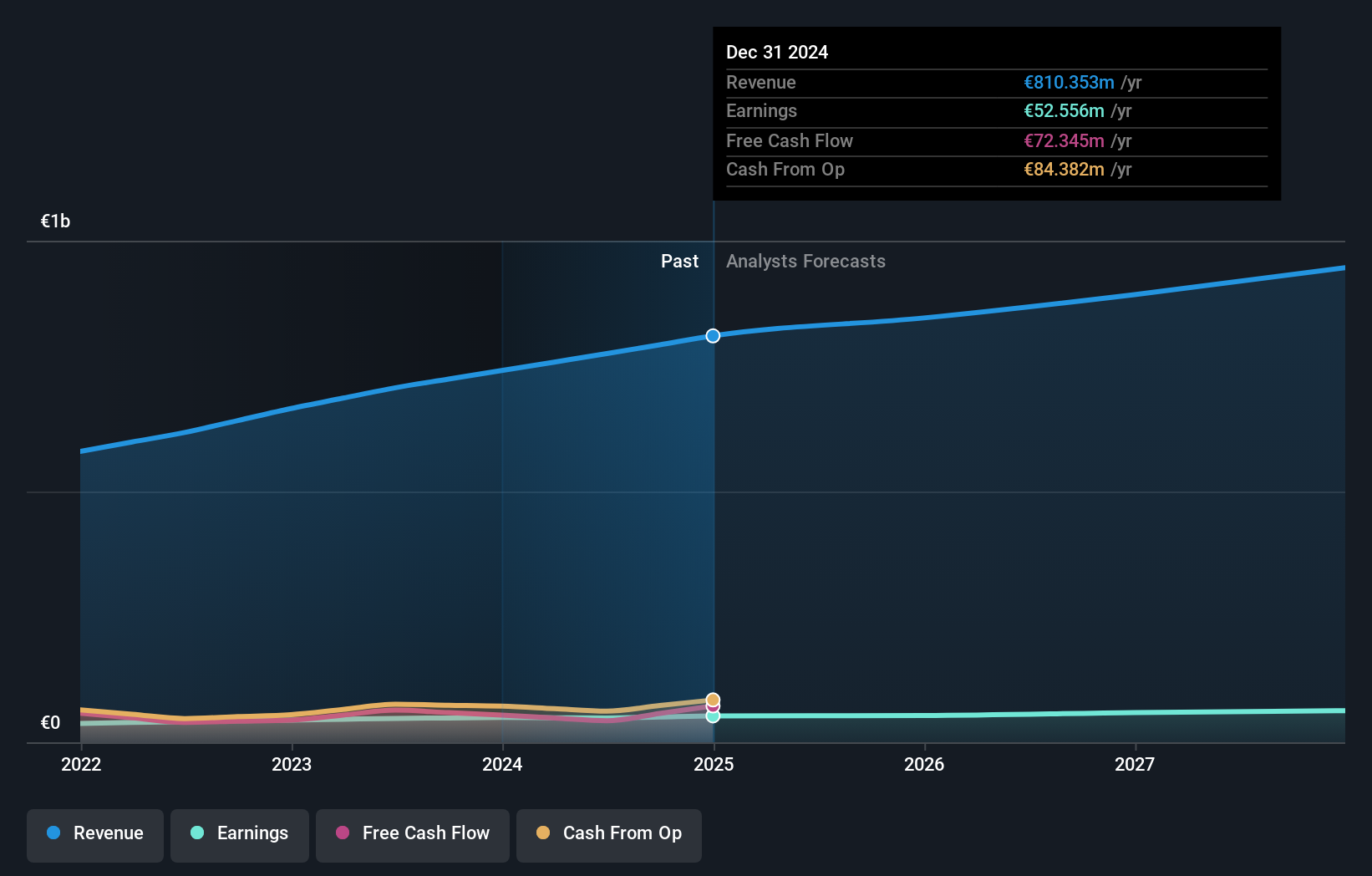

Operations: The company generates revenue primarily from real estate development in France (€1.05 billion) and foreign markets (€274 million).

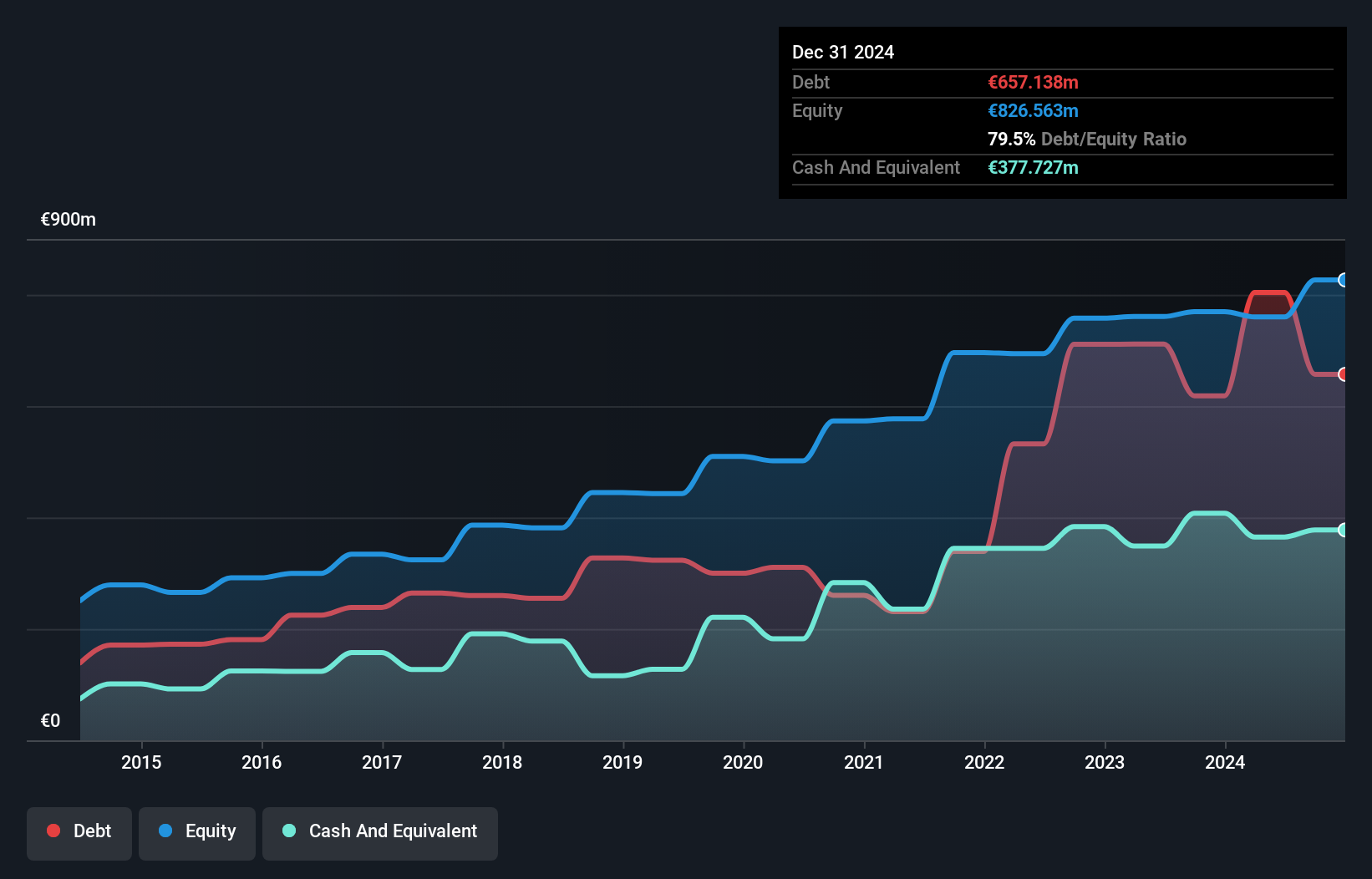

BASSAC, a nimble player in the real estate sector, reported impressive earnings growth of 26.7% over the past year, outpacing the industry average of 15.1%. The company boasts a favorable price-to-earnings ratio of 12.4x compared to the French market's 14.2x, suggesting potential value for investors. Despite an increase in its debt to equity ratio from 58.9% to 83.5% over five years, its net debt remains satisfactory at 23.7%. With high-quality earnings and well-covered interest payments at an EBIT coverage of 4.8x, BASSAC appears robust amidst recent dividend adjustments and steady sales growth reaching €1.40 billion last year.

- Click to explore a detailed breakdown of our findings in BASSAC Société anonyme's health report.

Understand BASSAC Société anonyme's track record by examining our Past report.

Neurones (ENXTPA:NRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Neurones S.A. is an IT services company offering infrastructure, application, and consulting services both in France and internationally, with a market cap of €1.11 billion.

Operations: Neurones generates revenue through its IT services, which include infrastructure, application, and consulting offerings. The company operates primarily in France but also serves international markets.

Neurones, a nimble player in the IT sector, has shown robust earnings growth of 6.3% over the past year, outpacing the industry average of 5.3%. Despite an increase in its debt to equity ratio from 0.05% to 11.7% over five years, it holds more cash than total debt, indicating sound financial health. Neurones' high-quality earnings and strong interest coverage further bolster its profile as a solid contender among European stocks with potential upside. Recently, it proposed a dividend increase to €1.3 per share for 2024 from €1.2 last year, reflecting confidence in sustained profitability and shareholder value enhancement.

- Navigate through the intricacies of Neurones with our comprehensive health report here.

Assess Neurones' past performance with our detailed historical performance reports.

Apotea (OM:APOTEA)

Simply Wall St Value Rating: ★★★★★☆

Overview: Apotea AB (publ) is a Swedish company that operates an online pharmacy, with a market capitalization of approximately SEK7.57 billion.

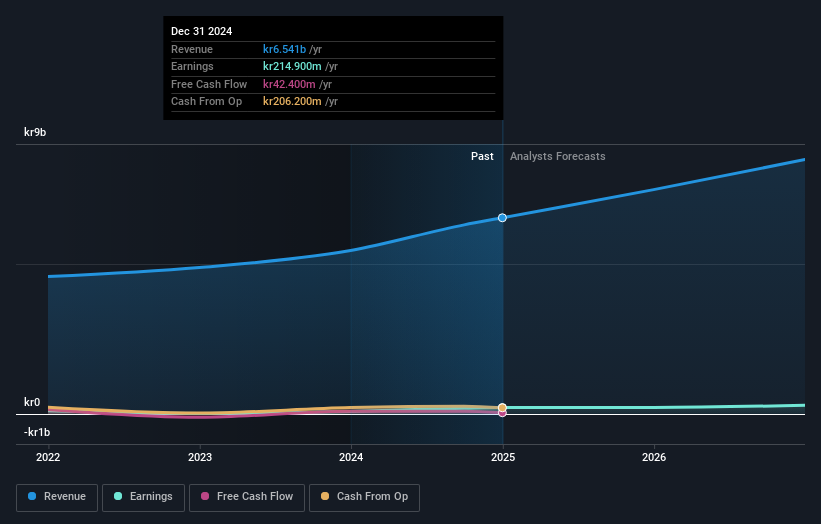

Operations: Apotea AB generates revenue primarily through its online retail segment, which accounted for SEK6.54 billion. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

Apotea's recent performance highlights its robust position within the consumer retailing sector, with a remarkable 147% earnings growth over the past year, outpacing the industry's -4.9%. The company's net debt to equity ratio stands at a satisfactory 8.2%, reflecting prudent financial management. Its interest payments are comfortably covered by EBIT at an impressive 241.6 times, underscoring strong operational efficiency. Despite fluctuations in levered free cash flow from US$146 million in 2021 to US$42 million recently, Apotea remains profitable and well-positioned for future growth with forecasted annual earnings growth of 15.24%.

- Click here and access our complete health analysis report to understand the dynamics of Apotea.

Review our historical performance report to gain insights into Apotea's's past performance.

Next Steps

- Gain an insight into the universe of 358 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BASSAC Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BASS

BASSAC Société anonyme

Operates as a real estate development company primarily in France, Belgium, Germany, and Spain.

Good value with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives