Vetoquinol (ENXTPA:VETO): Assessing Valuation After Mixed Q3 2025 Sales and US Market Recovery

Reviewed by Simply Wall St

Vetoquinol (ENXTPA:VETO) released its third-quarter and nine-month 2025 sales figures, revealing an overall decline compared to last year. However, sales of essential products in particular, as well as the US market, posted modest gains.

See our latest analysis for Vetoquinol.

Vetoquinol’s share price has drifted moderately lower over the last year, with a 1-year total shareholder return of -5.8%, as mixed sales momentum and a soft recent update appear to have tempered investor enthusiasm. While the group is showing pockets of growth in essential products and a US rebound, overall sentiment remains cautious for now.

If you’re weighing what could outperform in a shifting market, this is an opportunity to broaden your outlook and discover fast growing stocks with high insider ownership

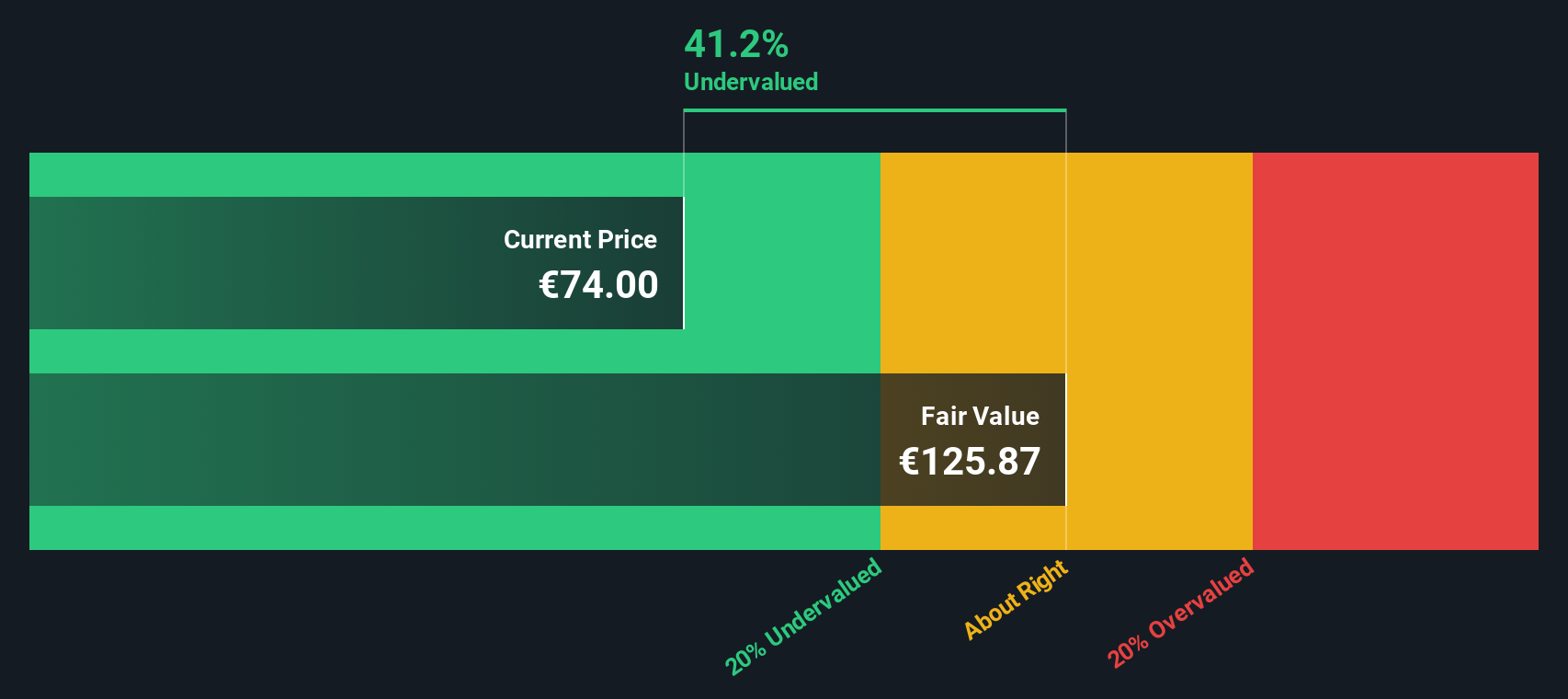

Given this backdrop of overall declines but underlying pockets of growth, is Vetoquinol currently trading at a discount, or do recent results suggest the market has already factored in expectations for its future performance?

Price-to-Earnings of 14.8x: Is it justified?

Vetoquinol’s shares are trading at a price-to-earnings (P/E) ratio of 14.8x, which is significantly lower than both its peer group and the broader industry. This compares to the last close of €75 and hints at potential undervaluation compared to similar companies in the market.

The price-to-earnings ratio measures how much investors are willing to pay for each euro of Vetoquinol’s earnings. For pharmaceutical and biotech companies, this multiple is a key metric that can reflect growth potential, market confidence, or skepticism about future profits if it diverges from the norm.

In Vetoquinol’s case, the current 14.8x P/E is well below the peer average of 21.7x and the European Pharmaceuticals industry average of 22.5x. This sharp discount could indicate that investors are underestimating the company’s prospects or that they expect slower growth ahead. For reference, the estimated fair P/E ratio is 11.5x, which suggests the market could trend closer to this benchmark if outlooks soften further.

Explore the SWS fair ratio for Vetoquinol

Result: Price-to-Earnings of 14.8x (UNDERVALUED)

However, persistent sector headwinds or further evidence of muted growth could prompt investors to reassess Vetoquinol’s valuation.

Find out about the key risks to this Vetoquinol narrative.

Another Angle: Is the DCF Model Telling a Different Story?

While Vetoquinol’s low price-to-earnings ratio points to potential undervaluation, our SWS DCF model paints an even stronger picture, suggesting the current share price is trading a substantial 53.7% below its estimated fair value. Are the company’s fundamentals being overlooked, or is the market cautious for a reason?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Vetoquinol for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Vetoquinol Narrative

If our analysis sparks different conclusions or you like to chart your own course, it's easy to investigate the numbers for yourself and create a story in minutes, so why not Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Vetoquinol.

Looking for More Investment Ideas?

Uncover your next big opportunity with Simply Wall Street’s powerful screener tools. Seasoned investors know fresh ideas are just a click away.

- Amplify your portfolio’s income potential and check out these 21 dividend stocks with yields > 3% with attractive yields above 3%.

- Catalyze your growth strategy by tapping into these 848 undervalued stocks based on cash flows backed by strong cash flows that others might overlook.

- Be ahead of the next tech wave by investigating these 28 quantum computing stocks propelling advances in quantum computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:VETO

Vetoquinol

A veterinary pharmaceutical company, designs, develops, and sells veterinary drugs and non-medicinal products for cattle, pigs, dogs, and cats in Europe, the Americas, and the Asia Pacific region.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives