Is Now the Moment to Revisit Sanofi Shares After a Recent 11% Jump?

Reviewed by Bailey Pemberton

If you’re on the fence about Sanofi, you’re definitely not alone. There has been a lot of back-and-forth among investors lately about whether this is a great time to hold or even add to a position, or if it is better to stay on the sidelines until the dust settles. Sanofi’s stock has shown real signs of life over the last month, climbing 11.4% as optimism returns to the broader pharmaceutical sector and confidence grows around its product pipeline. However, the year-to-date return is still down 7.5%, and looking back over the past year, the stock has slipped by 8.9%. Despite these declines, longer-term investors will note the 13.3% return over three years and 30.2% over five years, hinting at underlying resilience and growth potential.

Recently, the mood around Sanofi has shifted thanks to encouraging headlines about the company’s strategic realignments and positive regulatory developments for new therapies. Investors seem to be reassessing risk and reward in this case, causing some volatility but introducing renewed optimism in the market. Against this backdrop, what really makes Sanofi intriguing right now is how it stacks up on a valuation basis. On our valuation scorecard, where a point is awarded for each check the company passes for being undervalued, Sanofi gets a perfect 6 out of 6. That is a rare stamp of approval that deserves a closer look.

So, how does Sanofi measure up using widely used valuation approaches? And is there an even better way to think about what the company is truly worth? Let us dig into the numbers and see what the fundamentals reveal.

Why Sanofi is lagging behind its peers

Approach 1: Sanofi Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation approach that estimates the present value of a company by forecasting its future cash flows and discounting them back to today's terms. Essentially, it asks what Sanofi's future ability to generate cash is worth right now.

For Sanofi, analysts estimate current Free Cash Flow at approximately €8.1 billion, with projections showing steady growth in the years ahead. The five-year analyst outlooks suggest cash flows could exceed €9.3 billion by 2029. Beyond that, further growth rates are extrapolated to forecast as far as 2035, guided by modest growth percentages. All projections are provided in Euros, Sanofi's reporting currency.

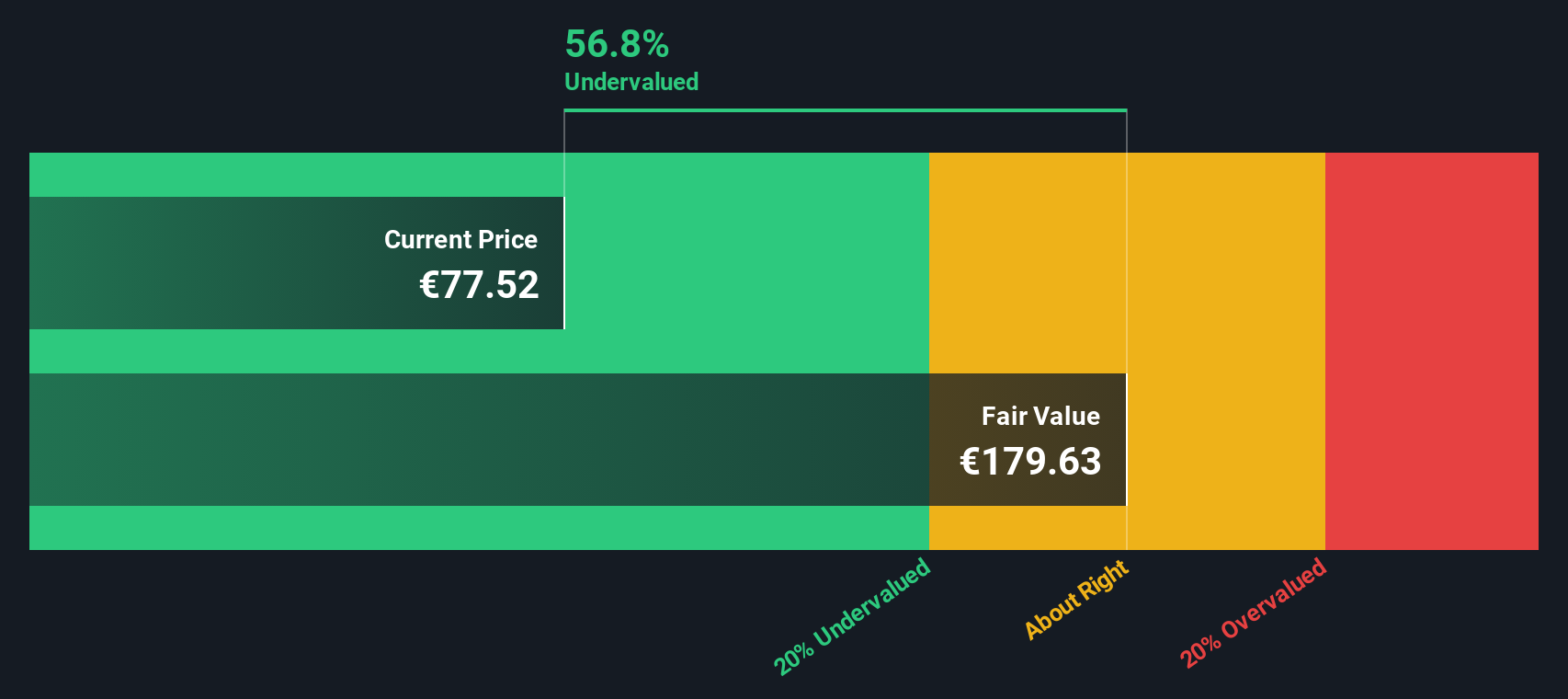

Based on these detailed cash flow forecasts and using the 2 Stage Free Cash Flow to Equity model, Sanofi's intrinsic value per share is calculated at €176.38. This figure is meaningfully higher than the company's current market valuation, implying the stock trades at a 50.5% discount to its DCF fair value.

All in, Sanofi appears significantly undervalued when analyzed strictly through the DCF lens. For long-term investors focused on fundamentals, that is a compelling signal in Sanofi’s favor.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sanofi is undervalued by 50.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sanofi Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies like Sanofi. It helps investors understand how much they are paying for each euro of a company's earnings, making it especially useful when comparing established businesses generating consistent profits.

However, a “normal” or “fair” PE ratio is not set in stone. It is shaped by several factors, including expectations for future growth and the risks unique to the company or its sector. Fast-growing, lower-risk firms tend to justify higher PE ratios. In contrast, slower growth or higher risks should drag the ratio lower.

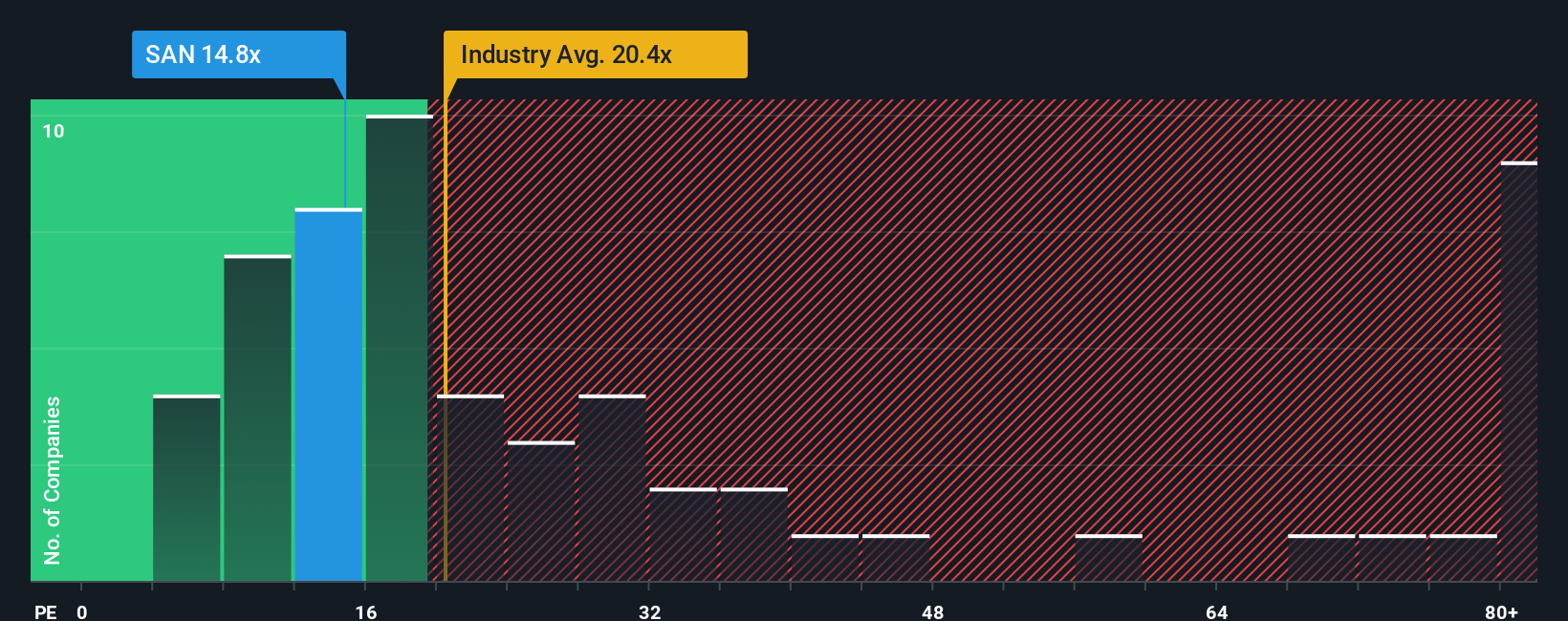

Sanofi currently trades at a PE ratio of 16.5x. By comparison, its pharmaceutical industry peers average a PE ratio of 21.1x, and the overall sector trades even higher at 24.6x. At first glance, this suggests Sanofi is valued more conservatively than many of its competitors.

Instead of defaulting to basic peer or industry averages, Simply Wall St uses a proprietary “Fair Ratio” to dig deeper. This Fair Ratio considers not just the company’s growth, but also factors like profit margins, its size, industry dynamics, and associated risks to determine a more tailored benchmark. For Sanofi, this Fair Ratio is calculated at 22.9x. This means that, relative to all the company’s individual factors, Sanofi is trading below its Fair Ratio, pointing to potential undervaluation by the market today.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sanofi Narrative

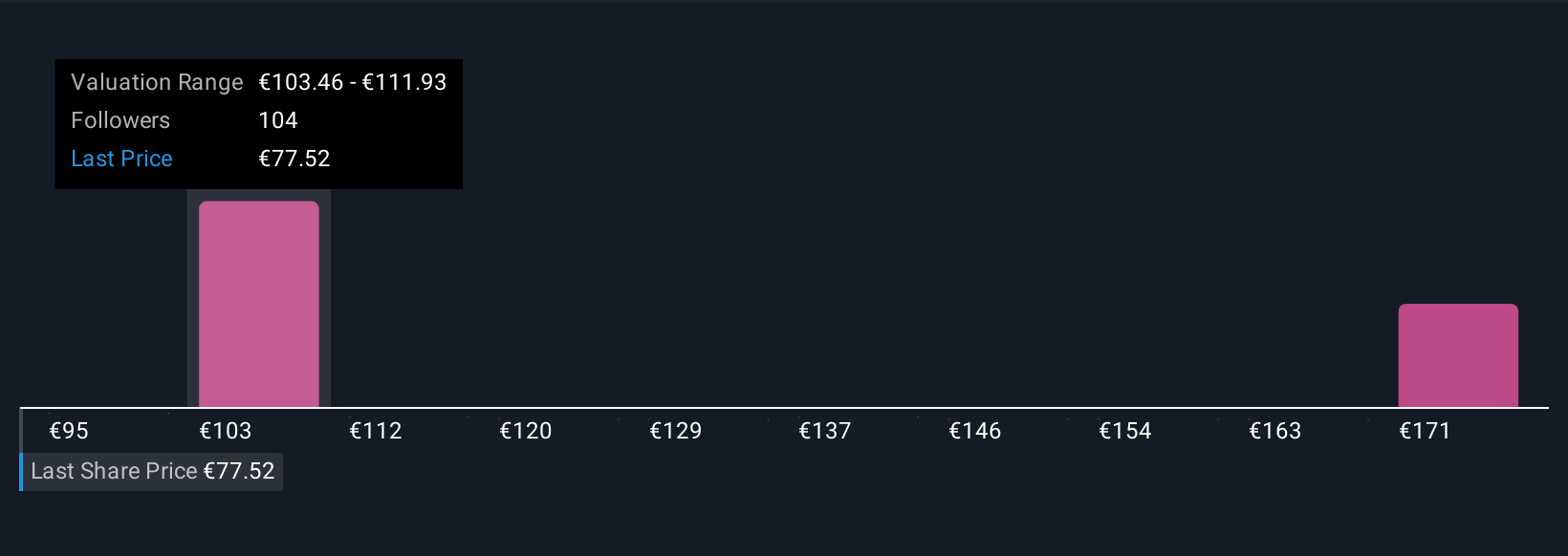

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, combining your view of Sanofi’s long-term prospects, financial forecasts, and what you believe the business is worth. Rather than relying on just one model or average, Narratives help you connect the dots between Sanofi’s latest developments, your assumptions for future revenue, earnings, and margins, and the resulting fair value.

Narratives are easy to use and available to everyone on Simply Wall St’s Community page, used by millions of investors. This tool makes investing more personal, letting you see whether your Narrative justifies buying (if fair value is above the share price) or waiting (if below). Best of all, Narratives automatically update to reflect the latest news, earnings, or other events, so you can stay aligned as conditions change.

For example, one Sanofi Narrative might use bullish estimates, believing rapid growth in biologics and product launches will drive the fair value well above the current price. A more cautious Narrative could focus on competition and margin pressures, resulting in a more conservative outlook. Each Narrative gives you context for your decisions by bringing together Sanofi’s story, numbers, and potential upside, all in one place.

Do you think there's more to the story for Sanofi? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAN

Sanofi

Engages in the research, development, manufacture, and marketing of therapeutic solutions.

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives