Are Sanofi Shares Offering Hidden Value After Pipeline Expansion News in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Sanofi stock is genuinely undervalued or just flying under the radar? Let’s break down what’s really happening beneath the surface so you can decide with confidence.

- Sanofi’s share price has slipped by 2.5% over the past week, but it has seen a mild rebound of 1.0% over the last month, amidst a longer-term dip of 9.4% year-to-date.

- Recent headlines have centered on Sanofi’s steps to advance its drug pipeline, as well as strategic moves in partnerships and market expansion. These factors have contributed to short-term volatility and have kept investors alert to potential catalysts and risks.

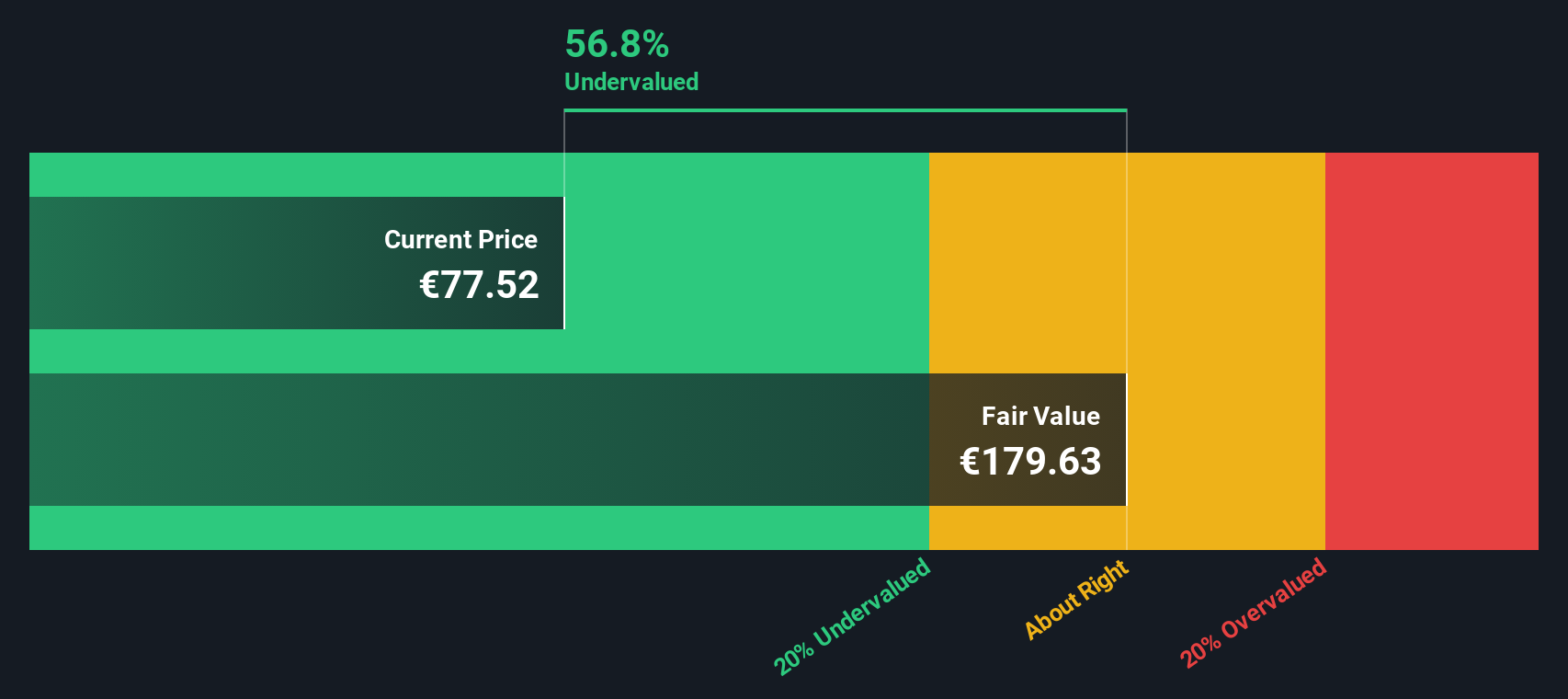

- On our valuation scale, Sanofi scores a 6 out of 6 for being undervalued according to key metrics. However, the real question is whether traditional valuation methods tell the full story. We will compare those, plus share a perspective that might change how you see the stock’s value entirely.

Find out why Sanofi's -6.8% return over the last year is lagging behind its peers.

Approach 1: Sanofi Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s value. This gives investors a sense of what the business is fundamentally worth, independent of day-to-day market fluctuations.

For Sanofi, the model uses the current Free Cash Flow of approximately €8.1 billion, with analysts forecasting steady growth in the coming years. By 2029, projections suggest Free Cash Flow could reach about €9.3 billion. Estimates extend out another five years through a combination of analyst input and systematic extrapolation. All figures are presented in Euros, reflecting Sanofi’s reporting currency.

These projections have yielded an estimated intrinsic value of €171.74 per share. This value is 50.2% higher than the company’s current share price, indicating a substantial discount according to the DCF model. Such a significant gap between price and calculated value suggests that Sanofi’s shares are considerably undervalued based on long-term cash flow expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sanofi is undervalued by 50.2%. Track this in your watchlist or portfolio, or discover 860 more undervalued stocks based on cash flows.

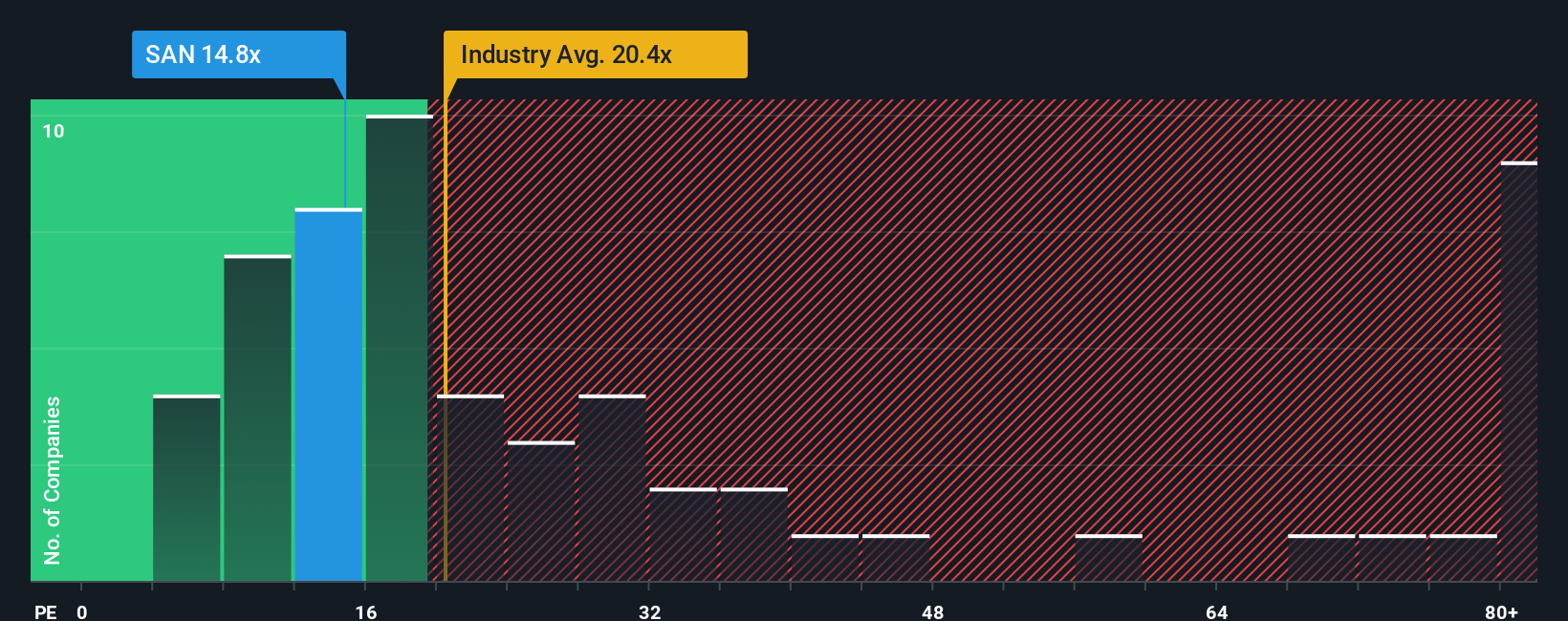

Approach 2: Sanofi Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies like Sanofi because it shows how much investors are paying for each euro of current earnings. This makes it especially useful for established firms with steady profit streams, rather than early-stage or unprofitable companies.

What counts as a “normal” or “fair” PE ratio depends on expected growth prospects and business risk. Companies with stronger earnings growth often deserve a higher PE, while those facing more risk or slower growth typically warrant a lower multiple. Market sentiment and industry trends can also shape what investors see as reasonable levels.

Sanofi is trading at a PE ratio of 16.2x, which is noticeably below both the pharmaceuticals industry average of 23.4x and the peer group average of 20.7x. This suggests that, compared to broad benchmarks, Sanofi looks undervalued on earnings. However, benchmarks can miss important context, such as company-specific growth rates or risks.

That is where the Simply Wall St “Fair Ratio” comes in. This proprietary metric combines factors like earnings growth forecasts, profit margins, industry outlook, company size, and risk profile. By considering all of these, the Fair Ratio of 23.2x paints a more nuanced picture than simply comparing to industry averages.

Since Sanofi’s current PE of 16.2x is well below its Fair Ratio of 23.2x, the stock appears undervalued relative to its true potential when accounting for all the relevant fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1404 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sanofi Narrative

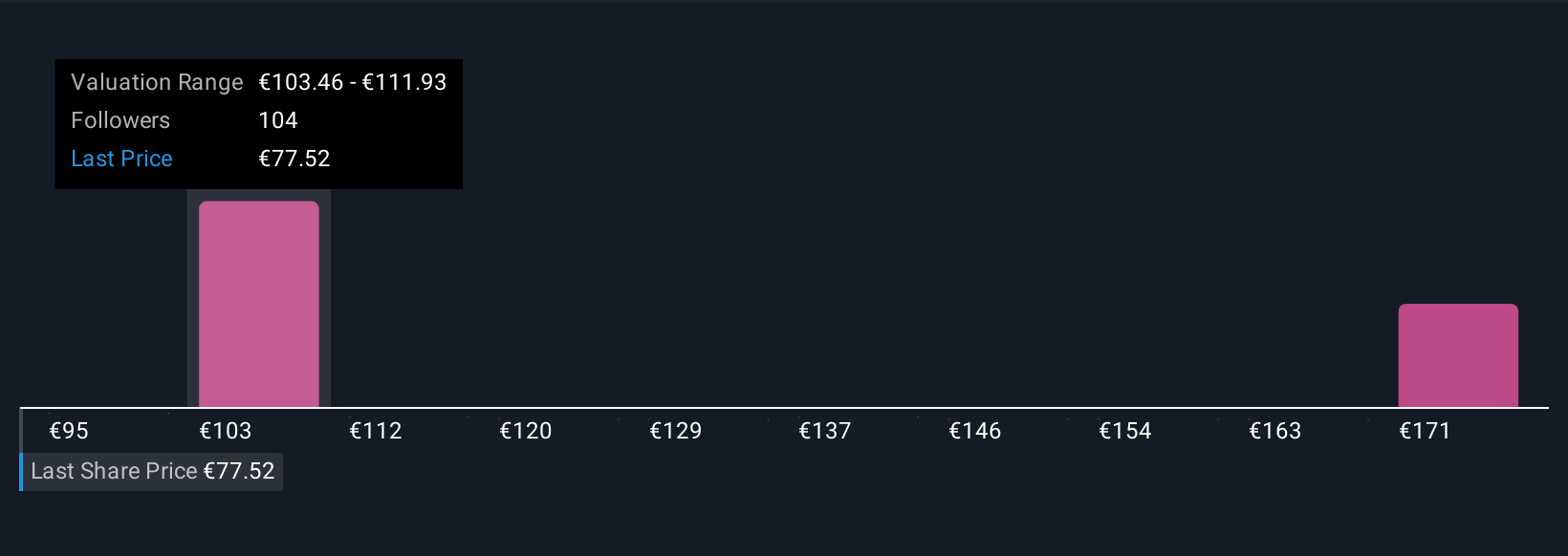

Earlier, we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a smarter, user-friendly tool that allow you to build and follow a story about a company by connecting your assumptions about Sanofi’s future revenue, earnings, and margins to a fair value estimate that reflects your view of its prospects.

With Narratives, you don’t just look at numbers in isolation; you link Sanofi’s real-world business story, growth drivers, and risks to financial forecasts, then see how this translates into a live fair value. Available right within Simply Wall St’s Community page (used by millions of investors), Narratives are easy to access and update with just a few clicks.

This tool helps you make more confident buy or sell decisions by showing how your fair value compares to the current price. Best of all, Narratives stay current, as market news and earnings updates are automatically reflected in the underlying analysis.

For example, some investors may build a bullish Sanofi Narrative by predicting strong revenue and margin growth, resulting in a fair value as high as €124.8. Others may see ongoing risks and choose a more cautious story, yielding a fair value closer to €92.0. Your personal perspective shapes your Narrative and empowers you to invest on your own terms.

Do you think there's more to the story for Sanofi? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:SAN

Sanofi

Engages in the research, development, manufacture, and marketing of therapeutic solutions.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives