Investing in OSE Immunotherapeutics (EPA:OSE) a year ago would have delivered you a 106% gain

When you buy shares in a company, there is always a risk that the price drops to zero. On the other hand, if you find a high quality business to buy (at the right price) you can more than double your money! For example, the OSE Immunotherapeutics SA (EPA:OSE) share price had more than doubled in just one year - up 106%. Also pleasing for shareholders was the 56% gain in the last three months. Zooming out, the stock is actually down 27% in the last three years.

Let's take a look at the underlying fundamentals over the longer term, and see if they've been consistent with shareholders returns.

Check out our latest analysis for OSE Immunotherapeutics

We don't think OSE Immunotherapeutics' revenue of €2,227,000 is enough to establish significant demand. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that OSE Immunotherapeutics comes up with a great new product, before it runs out of money.

As a general rule, if a company doesn't have much revenue, and it loses money, then it is a high risk investment. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some such companies do very well over the long term, others become hyped up by promoters before eventually falling back down to earth, and going bankrupt (or being recapitalized). Of course, if you time it right, high risk investments like this can really pay off, as OSE Immunotherapeutics investors might know.

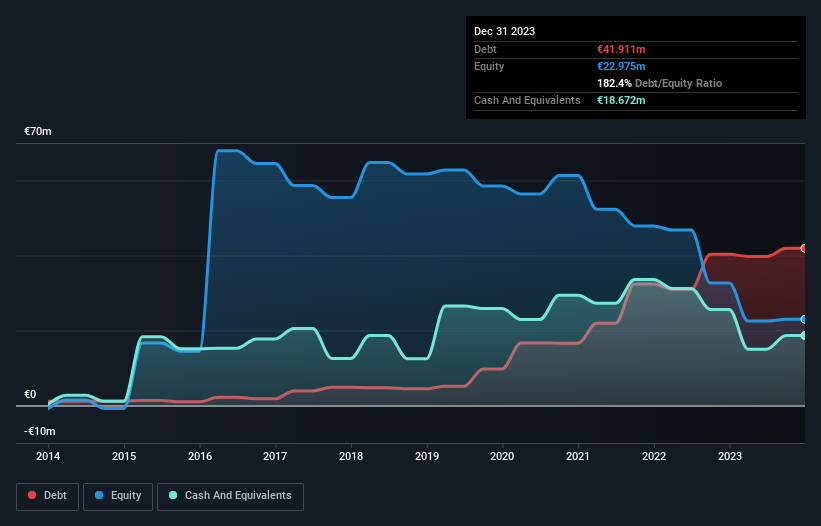

OSE Immunotherapeutics had liabilities exceeding cash by €40m when it last reported in December 2023, according to our data. That puts it in the highest risk category, according to our analysis. So we're surprised to see the stock up 98% in the last year , but we're happy for holders. Investors must really like its potential. The image below shows how OSE Immunotherapeutics' balance sheet has changed over time; if you want to see the precise values, simply click on the image.

In reality it's hard to have much certainty when valuing a business that has neither revenue or profit. Given that situation, many of the best investors like to check if insiders have been buying shares. If they are buying a significant amount of shares, that's certainly a good thing. You can click here to see if there are insiders buying.

A Different Perspective

It's good to see that OSE Immunotherapeutics has rewarded shareholders with a total shareholder return of 106% in the last twelve months. Since the one-year TSR is better than the five-year TSR (the latter coming in at 14% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For instance, we've identified 4 warning signs for OSE Immunotherapeutics (1 is significant) that you should be aware of.

But note: OSE Immunotherapeutics may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:OSE

OSE Immunotherapeutics

A clinical-stage biotechnology company, develops immunotherapies in the areas of immune-oncology and immune-inflammation in France and internationally.

Excellent balance sheet with proven track record.