Nanobiotix (ENXTPA:NANO) Secures $71 Million Royalty Financing Will Non-Dilutive Capital Reshape Its R&D Ambitions?

Reviewed by Sasha Jovanovic

- On October 31, Nanobiotix announced it had entered a royalty-based financing agreement with HealthCare Royalty to secure up to US$71 million in non-dilutive capital, supporting its operations and the advancement of nanotherapeutic platforms.

- This agreement signals a reinforced financial position for Nanobiotix, potentially underpinning its ability to sustain research and development initiatives over the long term.

- We’ll explore how this infusion of non-dilutive capital from the royalty-based financing agreement influences Nanobiotix's investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Nanobiotix's Investment Narrative?

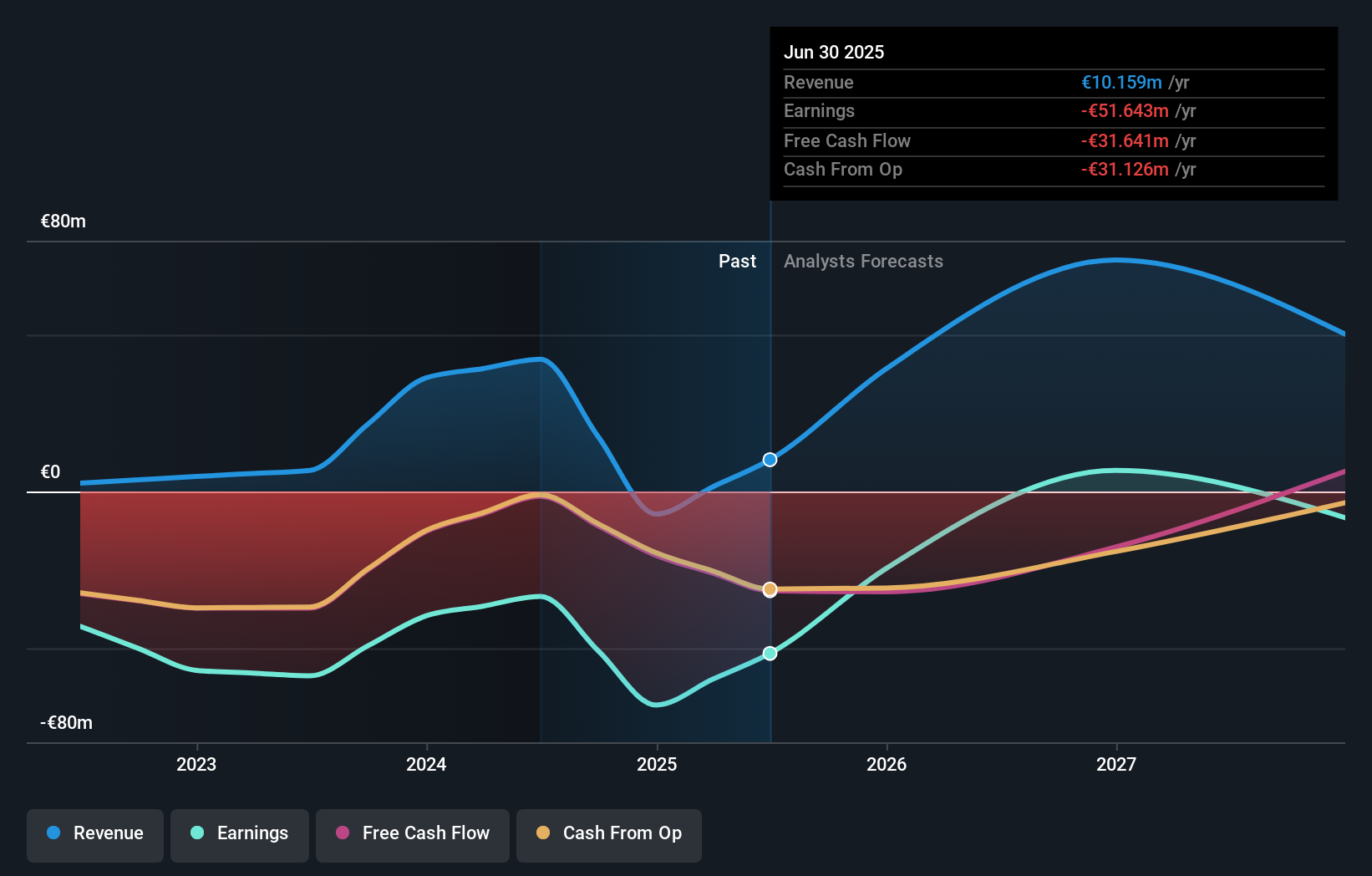

For those watching Nanobiotix, the belief centers on whether its nanotherapeutic platforms, particularly JNJ-1900 (NBTXR3), can transition from clinical promise to commercial success, especially as partnerships with established players like Johnson & Johnson evolve. The newly announced royalty-based financing with HealthCare Royalty offers up to US$71 million in non-dilutive capital, immediately improving Nanobiotix’s near-term cash position and providing a longer runway for research, development, and operations. This funding directly addresses one of the biggest short-term risks, the company’s previously tight cash runway, by bridging the gap until critical milestones, such as Phase 3 trial data, arrive. With global cancer studies ongoing and the product pipeline advancing, investor focus shifts to trial results, regulatory progress, and commercial deal execution. The risk profile is now tilted less towards immediate liquidity, but longer-term profitability and clinical outcomes remain central uncertainties. But be aware: cash concerns are only part of the whole risk story for Nanobiotix.

Upon reviewing our latest valuation report, Nanobiotix's share price might be too optimistic.Exploring Other Perspectives

Explore 3 other fair value estimates on Nanobiotix - why the stock might be worth as much as €18.80!

Build Your Own Nanobiotix Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nanobiotix research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Nanobiotix research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nanobiotix's overall financial health at a glance.

Searching For A Fresh Perspective?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanobiotix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:NANO

Nanobiotix

Operates as a clinical-stage biotechnology that focuses on developing product candidates for the treatment of cancer and other unmet medical needs.

Slight risk with limited growth.

Market Insights

Community Narratives