Ipsen (ENXTPA:IPN) Gains Canadian Approval For Bylvay In Treating Alagille Syndrome

Reviewed by Simply Wall St

Ipsen (ENXTPA:IPN) recently celebrated a significant milestone with Health Canada's approval of Bylvay™ (odevixibat) for treating cholestatic pruritus in Alagille Syndrome patients. This product-related development is a noteworthy achievement for the company and occurred amidst a robust quarterly performance where Ipsen’s share price rose 15.1%. The surge aligns with broader market trends, as the S&P 500 and Nasdaq achieved all-time highs. Ipsen's financial growth, revised earnings guidance, and regulatory successes likely added momentum, supporting investor optimism and potentially contributing to the stock's positive movement in the context of a generally rising market.

You should learn about the 2 possible red flags we've spotted with Ipsen.

The recent approval of Bylvay by Health Canada for treating cholestatic pruritus in Alagille Syndrome patients has the potential to enhance Ipsen's prospects in expanding its global footprint in the specialty drug market. This development supports the company’s strategic aim of geographic diversification and highlights its strengthening pipeline. Ipsen's focus on rare diseases could drive future revenue growth, aligning with the anticipated regulatory catalysts mentioned in their narrative.

Over the past five years, Ipsen's total return, including share price and dividends, was 35.45%. This contrasts with its one-year performance where it outperformed the French Market, which returned 3.3%, and the French Pharmaceuticals industry, which experienced a 22.7% decline. This suggests stronger recent recovery or resilience compared to its broader industry peers.

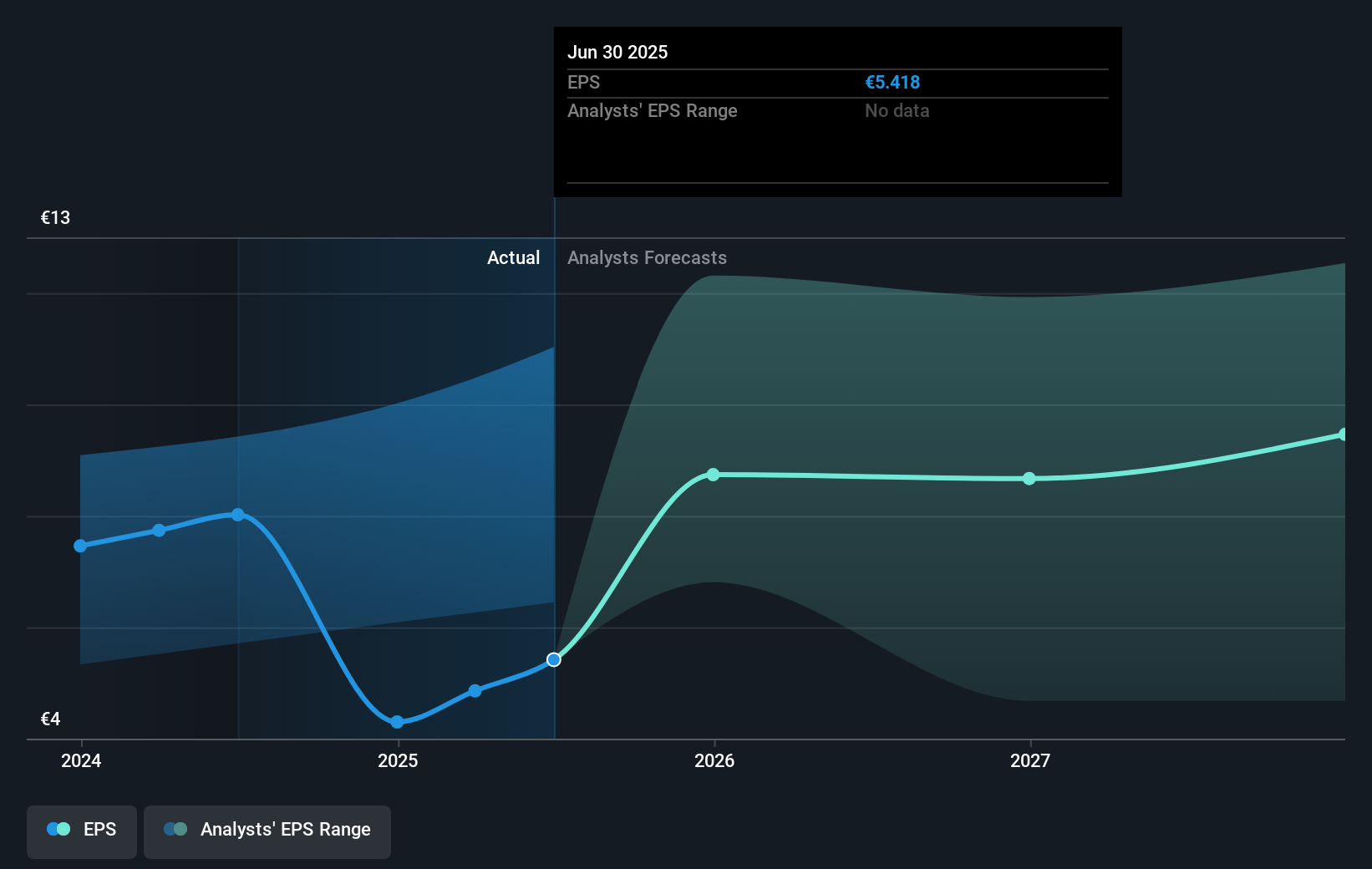

Looking to revenue and earnings forecasts, the approval of Bylvay is expected to aid sustained revenue growth and support upcoming earnings targets. Analysts forecast earnings to reach €801.2 million by 2028, implying substantial growth from current levels. Yet, the stock's current trading price of €118.90, alongside a consensus price target of €127.0, suggests a narrower margin for appreciation, with only a 7.6% higher expectation built into the analysts' consensus. This relatively modest price target differential may indicate a view that Ipsen's current valuation already reflects much of its future growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:IPN

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives