Discover 3 European Stocks Believed To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As European markets navigate the complexities of interest rate policies and trade uncertainties, indices like the STOXX Europe 600 have remained relatively stable, while major stock indexes in countries such as Italy and Germany have seen modest gains. In this environment, identifying stocks that are potentially trading below their intrinsic value can offer investors opportunities to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Millenium Hospitality Real Estate SOCIMI (BME:YMHRE) | €2.08 | €4.06 | 48.8% |

| Midsummer (OM:MIDS) | SEK2.76 | SEK5.45 | 49.3% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.15 | NOK59.61 | 49.4% |

| Industrie Chimiche Forestali (BIT:ICF) | €6.46 | €12.64 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.377 | €0.73 | 48.6% |

| Endomines Finland Oyj (HLSE:PAMPALO) | €25.70 | €50.50 | 49.1% |

| E-Globe (BIT:EGB) | €0.665 | €1.31 | 49.4% |

| Echo Investment (WSE:ECH) | PLN5.48 | PLN10.71 | 48.8% |

| Atea (OB:ATEA) | NOK145.40 | NOK282.88 | 48.6% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.915 | €3.77 | 49.2% |

Let's uncover some gems from our specialized screener.

Sartorius Stedim Biotech (ENXTPA:DIM)

Overview: Sartorius Stedim Biotech S.A. produces and sells instruments and consumables for the biopharmaceutical industry globally, with a market cap of €18.09 billion.

Operations: The company's revenue is primarily derived from its Biopharm segment, which generated €2.90 billion.

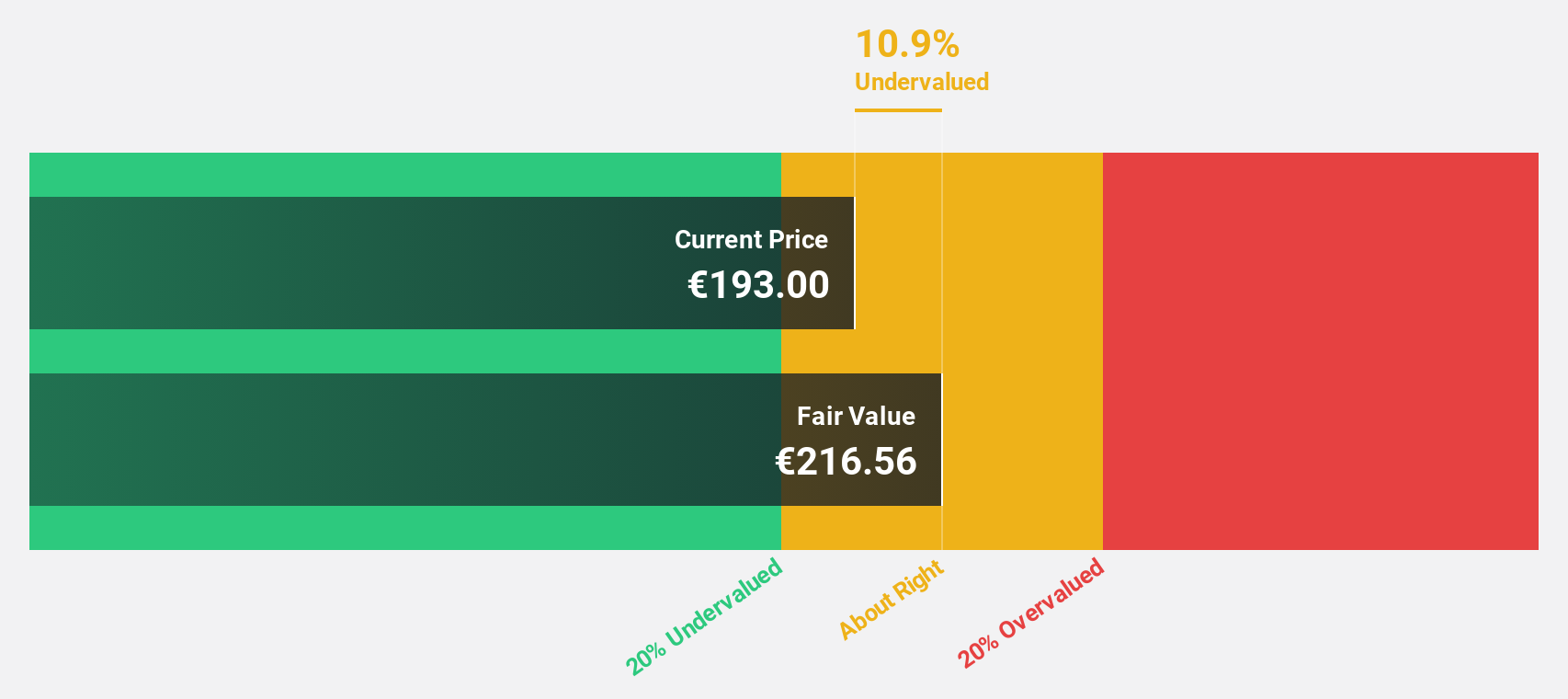

Estimated Discount To Fair Value: 15.1%

Sartorius Stedim Biotech is trading at €185.9, approximately 15.1% below its estimated fair value of €219.02, suggesting it may be undervalued based on cash flows. Despite high debt levels, the company reported strong earnings growth of 32.4% over the past year and forecasts a robust annual profit growth rate of 25.8%, outpacing the French market average of 12.3%. Recent strategic partnerships further bolster its long-term prospects in biopharmaceuticals and mRNA production expansion.

- The growth report we've compiled suggests that Sartorius Stedim Biotech's future prospects could be on the up.

- Dive into the specifics of Sartorius Stedim Biotech here with our thorough financial health report.

Eurofins Scientific (ENXTPA:ERF)

Overview: Eurofins Scientific SE, with a market cap of €11.19 billion, offers a wide range of analytical testing and laboratory services globally through its subsidiaries.

Operations: The company generates revenue of €7.14 billion from its analytical testing services worldwide.

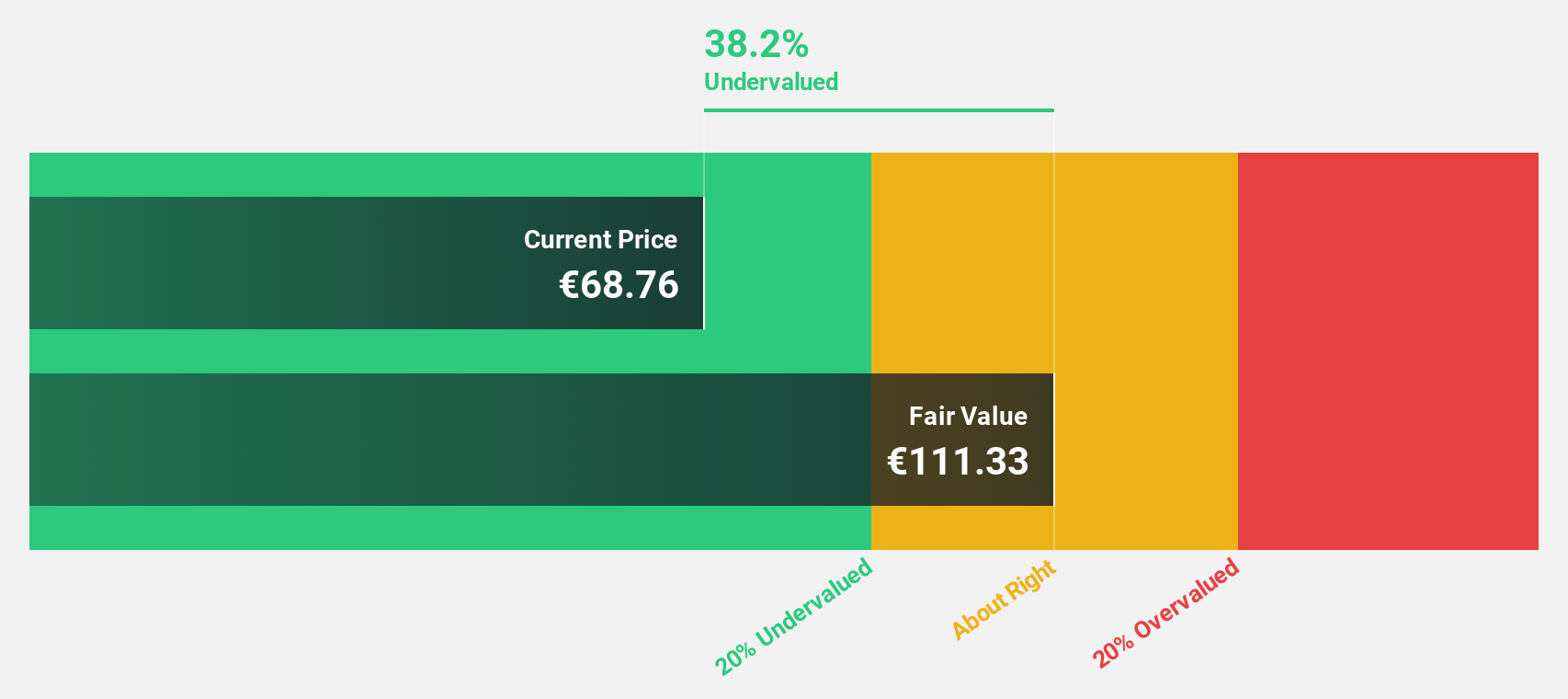

Estimated Discount To Fair Value: 46.2%

Eurofins Scientific, trading at €63.06, is significantly undervalued with a fair value estimate of €117.24. Despite high debt levels, the company has demonstrated solid earnings growth with net income rising to €246.6 million for H1 2025 and earnings per share increasing to €1.2 from €1.01 year-over-year. Recent bond issuance of €500 million supports strategic acquisitions and corporate purposes, while projected revenue growth of 6.5% annually surpasses the French market average of 5.4%.

- Our expertly prepared growth report on Eurofins Scientific implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Eurofins Scientific with our detailed financial health report.

Knorr-Bremse (XTRA:KBX)

Overview: Knorr-Bremse AG, along with its subsidiaries, specializes in developing, producing, and marketing brake systems for rail and commercial vehicles as well as other safety-critical systems globally, with a market cap of €12.92 billion.

Operations: The company's revenue is primarily derived from its Rail Vehicle Systems segment, contributing €4.32 billion, and its Commercial Vehicle Systems segment, which accounts for €3.69 billion.

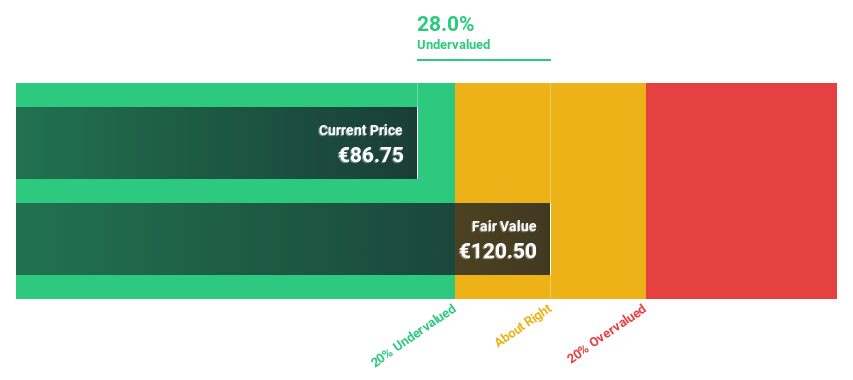

Estimated Discount To Fair Value: 26.8%

Knorr-Bremse, currently trading at €80.15, is undervalued with a fair value estimate of €109.45. Despite a slight decline in H1 2025 net income to €275 million and basic EPS to €1.7, the company is expected to achieve significant annual earnings growth of 23.7% over the next three years, outpacing the German market average. However, revenue growth remains modest at 4.8% annually with an unstable dividend track record and restructuring costs projected at approximately €75 million for 2025.

- In light of our recent growth report, it seems possible that Knorr-Bremse's financial performance will exceed current levels.

- Take a closer look at Knorr-Bremse's balance sheet health here in our report.

Seize The Opportunity

- Click through to start exploring the rest of the 207 Undervalued European Stocks Based On Cash Flows now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Knorr-Bremse might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:KBX

Knorr-Bremse

Develops, produces, and markets brake systems for rail and commercial vehicles and other safety-critical systems worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives