Assessing Abivax (ENXTPA:ABVX) Valuation After Strong Year-To-Date Gains And Recent Pullback

Reviewed by Simply Wall St

ABIVAX Société Anonyme (ENXTPA:ABVX) has had a mixed run lately, slipping over the past week but still sitting comfortably above its level from the past 3 months and year to date.

See our latest analysis for ABIVAX Société Anonyme.

Despite a 15.7% seven day share price pullback, ABIVAX Société Anonyme still boasts a powerful year to date share price return and robust one year total shareholder return, which may suggest that longer term momentum is still very much alive.

If ABIVAX has piqued your interest, it is also worth seeing what else is happening across healthcare by exploring healthcare stocks for fresh stock ideas.

Yet with the share price now hovering above analysts’ targets and the company still loss making despite strong growth, investors must ask whether ABIVAX is undervalued today or whether the market already anticipates its future expansion.

Price to Book of 14.9x: Is it justified?

ABIVAX Société Anonyme last closed at €97.60, and its rich price to book ratio of 14.9 times points to a market that is pricing in aggressive expectations compared to peers.

The price to book ratio compares a company’s market value with the accounting value of its net assets. This is a common yardstick for early stage or loss making biotechs where earnings are not yet a reliable guide. A high multiple here suggests investors are focusing on future potential rather than today’s balance sheet.

In ABIVAX’s case, the 14.9 times price to book sits far above both the French Biotechs industry average of 2.6 times and the peer average of 6.6 times. This implies that the market is assigning a substantial premium to its pipeline and forecast revenue growth while overlooking the lack of current profitability.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to Book of 14.9x (OVERVALUED)

However, investors should not ignore ABIVAX’s steep losses and premium valuation, as clinical or regulatory setbacks could quickly unwind the current optimism.

Find out about the key risks to this ABIVAX Société Anonyme narrative.

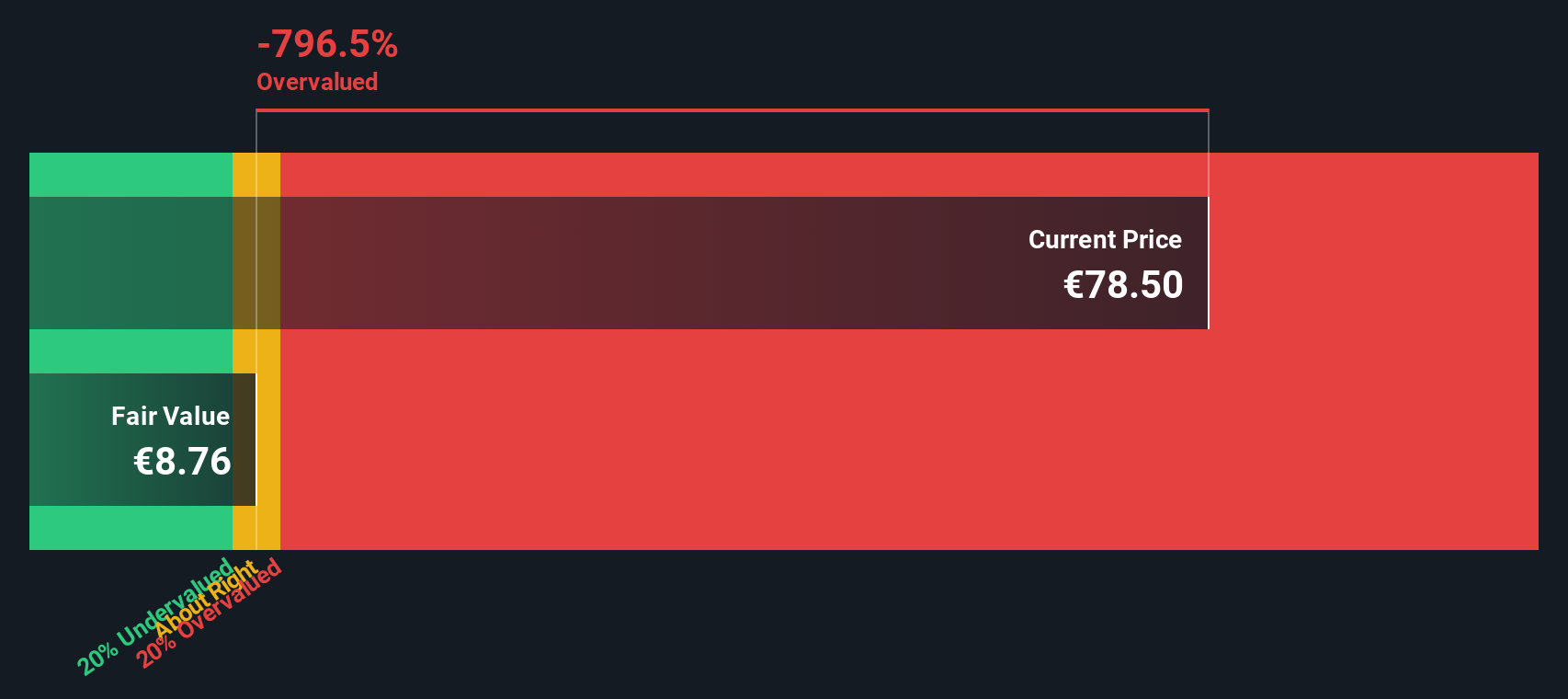

Another View Using Our DCF Model

Our DCF model paints a starkly different picture, suggesting fair value nearer €13.91, well below the current €97.60. This pricing points to extreme overvaluation. Is the market correctly pricing a breakthrough, or are expectations running far ahead of fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out ABIVAX Société Anonyme for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own ABIVAX Société Anonyme Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can quickly build a personalized story in minutes, Do it your way.

A great starting point for your ABIVAX Société Anonyme research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall St Screener to uncover focused stock ideas that match your strategy before the market moves without you.

- Capture high potential growth by scanning these 24 AI penny stocks that are powering the next wave of intelligent technology.

- Strengthen your income strategy with these 13 dividend stocks with yields > 3% that can help support more reliable cash flow from your portfolio.

- Capitalize on market mispricing by targeting these 916 undervalued stocks based on cash flows that may offer attractive upside based on fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ABVX

ABIVAX Société Anonyme

A clinical-stage biotechnology company, focuses on developing therapeutics that harness the body’s natural regulatory mechanisms to stabilize the immune response in patients with chronic inflammatory diseases.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion