- France

- /

- Entertainment

- /

- ENXTPA:VIV

Here's Why We're Wary Of Buying Vivendi's (EPA:VIV) For Its Upcoming Dividend

Readers hoping to buy Vivendi SE (EPA:VIV) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is one business day before a company's record date, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade takes at least two business day to settle. This means that investors who purchase Vivendi's shares on or after the 26th of April will not receive the dividend, which will be paid on the 28th of April.

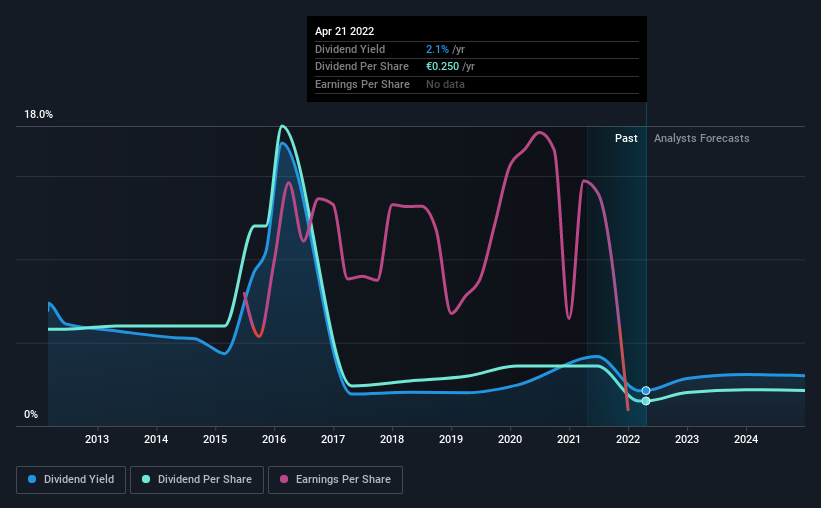

The company's upcoming dividend is €0.25 a share, following on from the last 12 months, when the company distributed a total of €0.25 per share to shareholders. Last year's total dividend payments show that Vivendi has a trailing yield of 2.1% on the current share price of €11.77. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for Vivendi

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Vivendi paid a dividend last year despite being unprofitable. This might be a one-off event, but it's not a sustainable state of affairs in the long run. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If cash earnings don't cover the dividend, the company would have to pay dividends out of cash in the bank, or by borrowing money, neither of which is long-term sustainable. Over the last year it paid out 55% of its free cash flow as dividends, within the usual range for most companies.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings fall far enough, the company could be forced to cut its dividend. Vivendi was unprofitable last year, but at least the general trend suggests its earnings have been improving over the past five years. Even so, an unprofitable company whose business does not quickly recover is usually not a good candidate for dividend investors.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Vivendi's dividend payments per share have declined at 13% per year on average over the past 10 years, which is uninspiring.

We update our analysis on Vivendi every 24 hours, so you can always get the latest insights on its financial health, here.

To Sum It Up

Is Vivendi an attractive dividend stock, or better left on the shelf? We're a bit uncomfortable with it paying a dividend while being loss-making. However, we note that the dividend was covered by cash flow. It's not an attractive combination from a dividend perspective, and we're inclined to pass on this one for the time being.

Although, if you're still interested in Vivendi and want to know more, you'll find it very useful to know what risks this stock faces. Case in point: We've spotted 1 warning sign for Vivendi you should be aware of.

If you're in the market for strong dividend payers, we recommend checking our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VIV

Vivendi

Operates in the content, media, and entertainment industries in France, rest of Europe, the Americas, Asia/Oceania, and Africa.

Moderate growth potential with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026