- France

- /

- Entertainment

- /

- ENXTPA:UBI

Ubisoft (ENXTPA:UBI) Valuation in Focus After Removal from Euronext 150 Index

Reviewed by Simply Wall St

Ubisoft Entertainment (ENXTPA:UBI) was recently removed from the Euronext 150 Index, a shift that tends to spark attention among investors. Changes to index membership such as this often prompt institutional portfolio rebalancing and adjusted trading volumes.

See our latest analysis for Ubisoft Entertainment.

Ubisoft’s removal from the Euronext 150 Index arrives after a tough period for shareholders, with a steep 1-year total shareholder return of -51.69% and momentum fading further amid a 49.28% share price decline since the start of this year. Despite recent gains in annual net income growth, the market seems cautious as trading volumes react to news flow and shifting confidence.

If recent index changes have you rethinking your watchlist, now is a smart time to discover fast growing stocks with high insider ownership.

With such dramatic declines in both share price and shareholder returns, and considering a significant discount to analyst price targets, the crucial question arises: is Ubisoft now undervalued, or is the market fairly reflecting its future prospects?

Most Popular Narrative: 47.8% Undervalued

Based on the most followed narrative's fair value, Ubisoft shares are trading at a steep discount compared to where the crowd believes they should be. At €6.52 per share, the market sits far below that valuation, which could set the stage for a surprising turnaround.

The launch of Assassin's Creed Shadows demonstrated strong early sales and engagement, suggesting future revenue boosts as the game continues to perform well and receives ongoing content updates and expansions. This can positively impact revenue and net margins.

What is really behind this sharp valuation gap? There is a bold projection of accelerating earnings and margin expansion. These numbers defy the current sentiment. The market is not pricing in some aggressive growth assumptions and high-stakes financial targets. Want to see what is fueling this optimism? The details could flip your view on Ubisoft’s future.

Result: Fair Value of €12.49 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, revenue growth could disappoint if major new releases underperform. In addition, heavy cash flow consumption may limit Ubisoft’s flexibility to deliver on ambitious targets.

Find out about the key risks to this Ubisoft Entertainment narrative.

Another View: Discounted Cash Flow Perspective

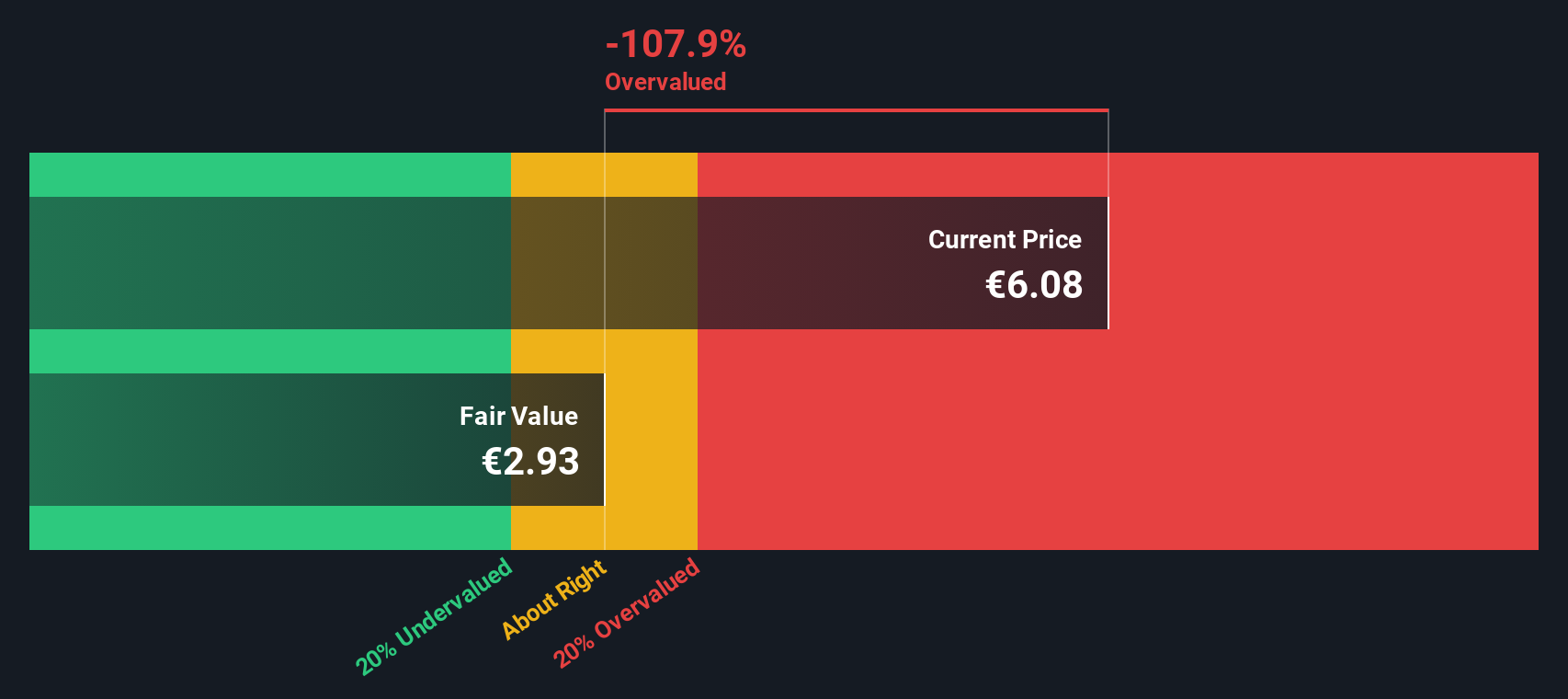

Looking at Ubisoft through the lens of our DCF model tells a very different story. This approach estimates a fair value of just €2.94 per share, which is well below the current share price and sharply contrasts with analyst optimism. Could this more cautious outlook suggest extra risk?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ubisoft Entertainment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 849 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ubisoft Entertainment Narrative

If these viewpoints do not fit your perspective or you enjoy hands-on research, you can quickly craft your own take using all the available data yourself in just a few minutes. Do it your way

A great starting point for your Ubisoft Entertainment research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always keep an eye out for fresh opportunities. Don’t just watch from the sidelines; seize the chance to expand your portfolio with ideas others might overlook. The Simply Wall Street Screener is your shortcut to powerful stock picks built on data, trends, and performance.

- Catch the momentum of artificial intelligence by reviewing these 26 AI penny stocks shaping industries with innovative applications and business models positioned for the future.

- Boost your income potential and stability by targeting these 20 dividend stocks with yields > 3% that have historically delivered attractive yields above 3%.

- Spot unrecognized bargains before the crowd by starting with these 849 undervalued stocks based on cash flows selected for their strong fundamentals and discounted valuations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:UBI

Ubisoft Entertainment

Produces, publishes, distributes, and operates video games for consoles, PC, smartphones, and tablets in both physical and digital formats in Europe, North America, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives