Read This Before You Buy Publicis Groupe S.A. (EPA:PUB) Because Of Its P/E Ratio

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

This article is written for those who want to get better at using price to earnings ratios (P/E ratios). To keep it practical, we'll show how Publicis Groupe S.A.'s (EPA:PUB) P/E ratio could help you assess the value on offer. Publicis Groupe has a price to earnings ratio of 11.25, based on the last twelve months. That is equivalent to an earnings yield of about 8.9%.

View our latest analysis for Publicis Groupe

How Do I Calculate Publicis Groupe's Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Publicis Groupe:

P/E of 11.25 = €45.11 ÷ €4.01 (Based on the trailing twelve months to December 2018.)

Is A High P/E Ratio Good?

A higher P/E ratio implies that investors pay a higher price for the earning power of the business. All else being equal, it's better to pay a low price -- but as Warren Buffett said, 'It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.'

How Growth Rates Impact P/E Ratios

When earnings fall, the 'E' decreases, over time. That means even if the current P/E is low, it will increase over time if the share price stays flat. Then, a higher P/E might scare off shareholders, pushing the share price down.

Publicis Groupe saw earnings per share improve by -5.3% last year. And it has bolstered its earnings per share by 1.8% per year over the last five years.

Does Publicis Groupe Have A Relatively High Or Low P/E For Its Industry?

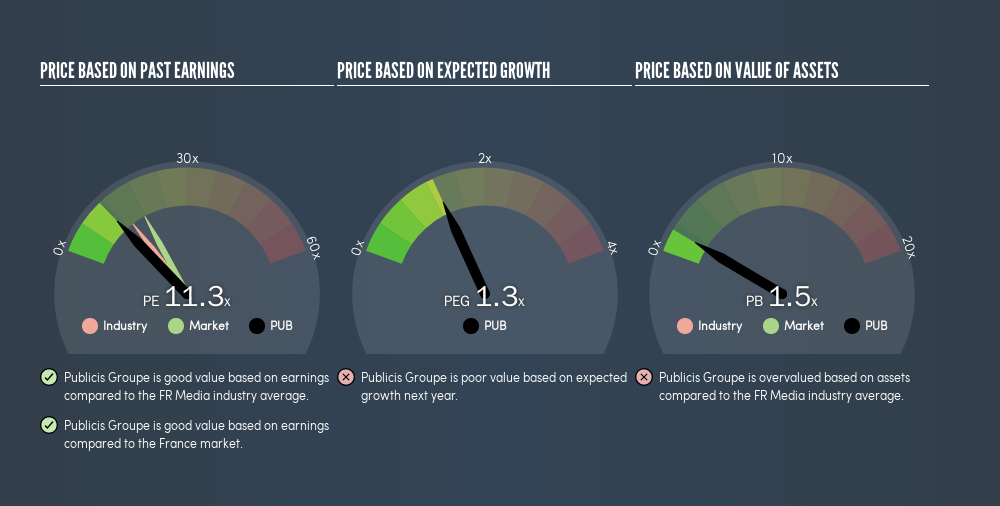

The P/E ratio essentially measures market expectations of a company. The image below shows that Publicis Groupe has a lower P/E than the average (13.9) P/E for companies in the media industry.

This suggests that market participants think Publicis Groupe will underperform other companies in its industry.

Remember: P/E Ratios Don't Consider The Balance Sheet

Don't forget that the P/E ratio considers market capitalization. That means it doesn't take debt or cash into account. Hypothetically, a company could reduce its future P/E ratio by spending its cash (or taking on debt) to achieve higher earnings.

While growth expenditure doesn't always pay off, the point is that it is a good option to have; but one that the P/E ratio ignores.

Publicis Groupe's Balance Sheet

The extra options and safety that comes with Publicis Groupe's €266m net cash position means that it deserves a higher P/E than it would if it had a lot of net debt.

The Verdict On Publicis Groupe's P/E Ratio

Publicis Groupe's P/E is 11.3 which is below average (17.8) in the FR market. Earnings improved over the last year. And the net cash position gives the company many options. So it's strange that the low P/E indicates low expectations. Since analysts are predicting growth will continue, one might expect to see a higher P/E so it may be worth looking closer.

Investors have an opportunity when market expectations about a stock are wrong. If it is underestimating a company, investors can make money by buying and holding the shares until the market corrects itself. So this free visual report on analyst forecasts could hold the key to an excellent investment decision.

You might be able to find a better buy than Publicis Groupe. If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:PUB

Publicis Groupe

Provides marketing, communications, and digital business transformation services in North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion