Is Publicis Groupe a Value Opportunity After Recent Data and Tech Focus Gains?

Reviewed by Bailey Pemberton

- Wondering if Publicis Groupe is quietly turning into a value opportunity, or if the market has already priced in the upside?

- The stock has edged up about 1.5% over the last week and 5.5% over the past month, even though it is still down roughly 13.9% year to date and 10.2% over the last year after a very strong 3 and 5 year run.

- Recent headlines have focused on Publicis tightening its focus on high margin data and tech led services and securing new global client mandates, reinforcing its position as a major player in the advertising and marketing ecosystem. At the same time, the broader conversation around ad spending, digital transformation and AI driven marketing tools has kept investors debating how much future growth is already reflected in the share price.

- Putting numbers to that debate, Publicis scores a strong 6/6 on our valuation checks. This suggests it screens as undervalued across every metric we track. Next, we will unpack those methods one by one, before finishing with a more holistic way to think about what the stock may be worth.

Find out why Publicis Groupe's -10.2% return over the last year is lagging behind its peers.

Approach 1: Publicis Groupe Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model takes estimates of a company’s future cash flows and discounts them back to today, aiming to capture what those euros are truly worth in the present.

For Publicis Groupe, the latest twelve month Free Cash Flow is about €2.1 billion. Analysts provide detailed forecasts for the next few years, which are then extended by Simply Wall St to build a ten year view. On this basis, annual Free Cash Flow is projected to rise steadily toward roughly €2.9 billion by 2035, reflecting moderate but consistent growth as the business scales its data and technology focused operations.

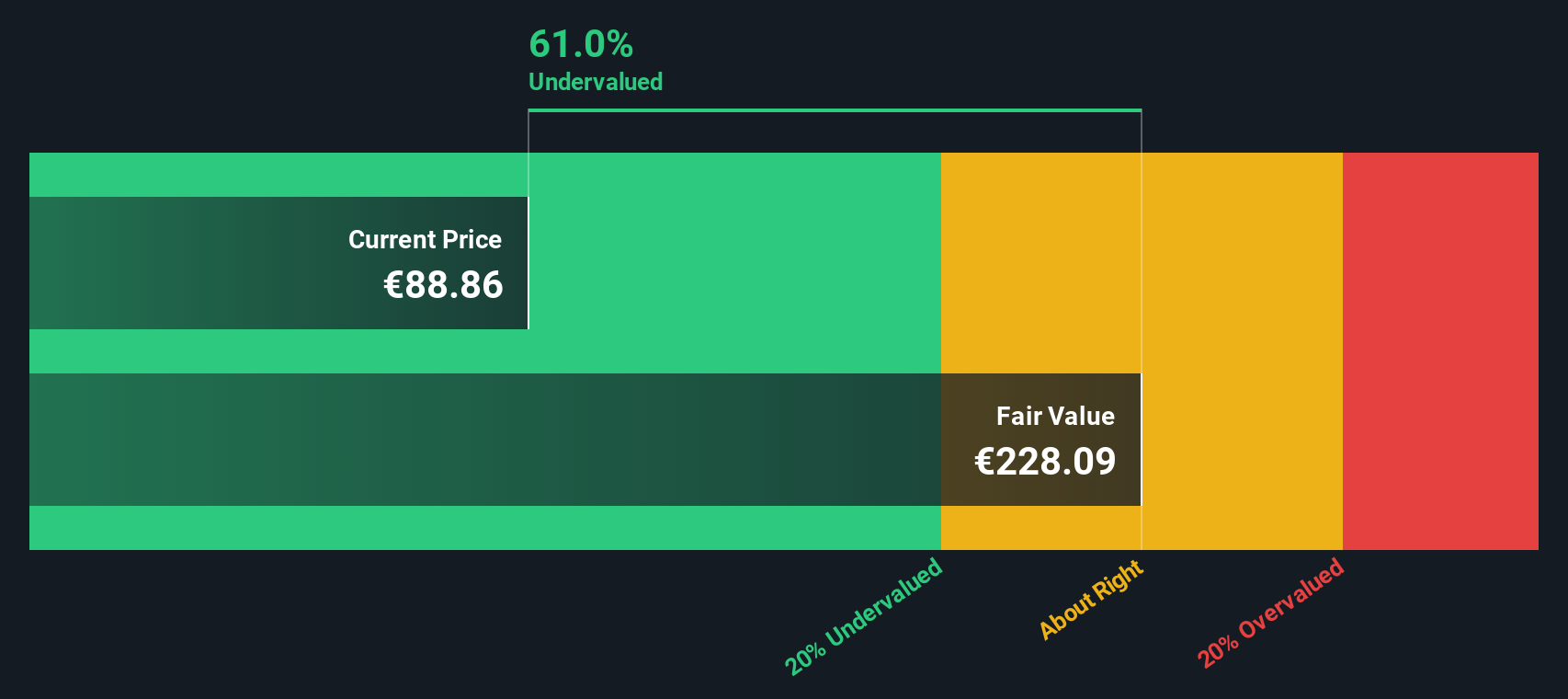

Feeding these projections into a two stage Free Cash Flow to Equity model yields an estimated intrinsic value of about €227.93 per share. Compared with the current share price, the DCF implies roughly a 61.0% discount. This indicates that the market may be pricing Publicis below what its future cash generation might justify.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Publicis Groupe is undervalued by 61.0%. Track this in your watchlist or portfolio, or discover 913 more undervalued stocks based on cash flows.

Approach 2: Publicis Groupe Price vs Earnings

For profitable, relatively mature businesses like Publicis Groupe, the Price to Earnings (PE) ratio is a practical way to gauge valuation, because it relates what investors pay for each share directly to the company’s current earnings power. In general, faster growth and lower perceived risk justify a higher PE, while slower growth or greater uncertainty should lead to a lower, more conservative multiple.

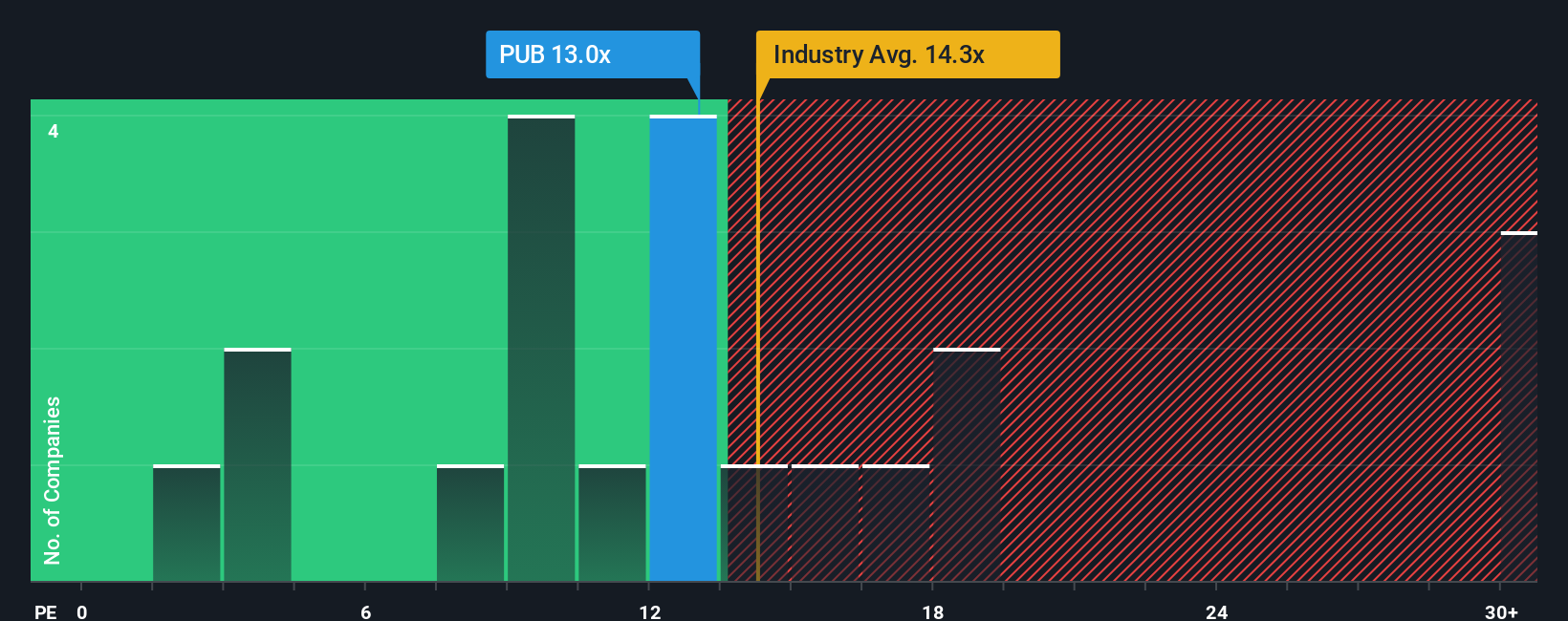

Publicis currently trades on about 13.0x earnings, below both the broader media industry average of roughly 16.3x and the peer group average of about 22.6x. To go a level deeper, Simply Wall St calculates a proprietary “Fair Ratio” of 14.6x for Publicis, which represents the PE multiple the company might reasonably deserve given its earnings growth profile, industry positioning, margins, size and specific risk factors.

This Fair Ratio offers a more tailored benchmark than simple comparisons with peers or sector averages because it adjusts for the unique mix of growth, profitability and risk in Publicis’s business. Set against the current 13.0x PE, the 14.6x Fair Ratio suggests the shares still trade at a discount to where they might be valued if those fundamentals were fully reflected.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1463 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Publicis Groupe Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of a company’s story with concrete numbers like future revenue, earnings, margins and ultimately a Fair Value estimate.

On Simply Wall St, a Narrative is your own investment storyline for a company, where you spell out what you believe will drive the business, translate that view into a financial forecast, and then see the Fair Value that falls out of those assumptions alongside the current Price.

Narratives live inside the Community section of the platform, are easy to create or follow, and are dynamically updated as new information comes in. When news or earnings change the outlook, the Fair Value in that Narrative adjusts automatically and helps you reassess whether to buy, hold or sell.

For example, one Publicis Groupe Narrative currently pegs Fair Value at about €96.64, while a more optimistic one sees it closer to €113.25. This illustrates how different but clearly explained perspectives on growth, margins and risk can coexist and give you a transparent range of outcomes to compare against today’s share price.

Do you think there's more to the story for Publicis Groupe? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PUB

Publicis Groupe

Provides marketing, communications, and digital business transformation services in North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion