3 European Dividend Stocks To Consider With Up To 4.7% Yield

Reviewed by Simply Wall St

The European market has experienced some volatility recently, with the pan-European STOXX Europe 600 Index declining by 1.10% as investors took profits after record highs and were affected by political turmoil in France and international trade tensions. Despite these challenges, dividend stocks can offer a stable income stream, making them an attractive option for investors seeking to navigate uncertain economic conditions while potentially benefiting from consistent returns.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.29% | ★★★★★★ |

| Sulzer (SWX:SUN) | 3.36% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.79% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.63% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.17% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.26% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.75% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.68% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.31% | ★★★★★☆ |

| Bravida Holding (OM:BRAV) | 4.02% | ★★★★★★ |

Click here to see the full list of 228 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

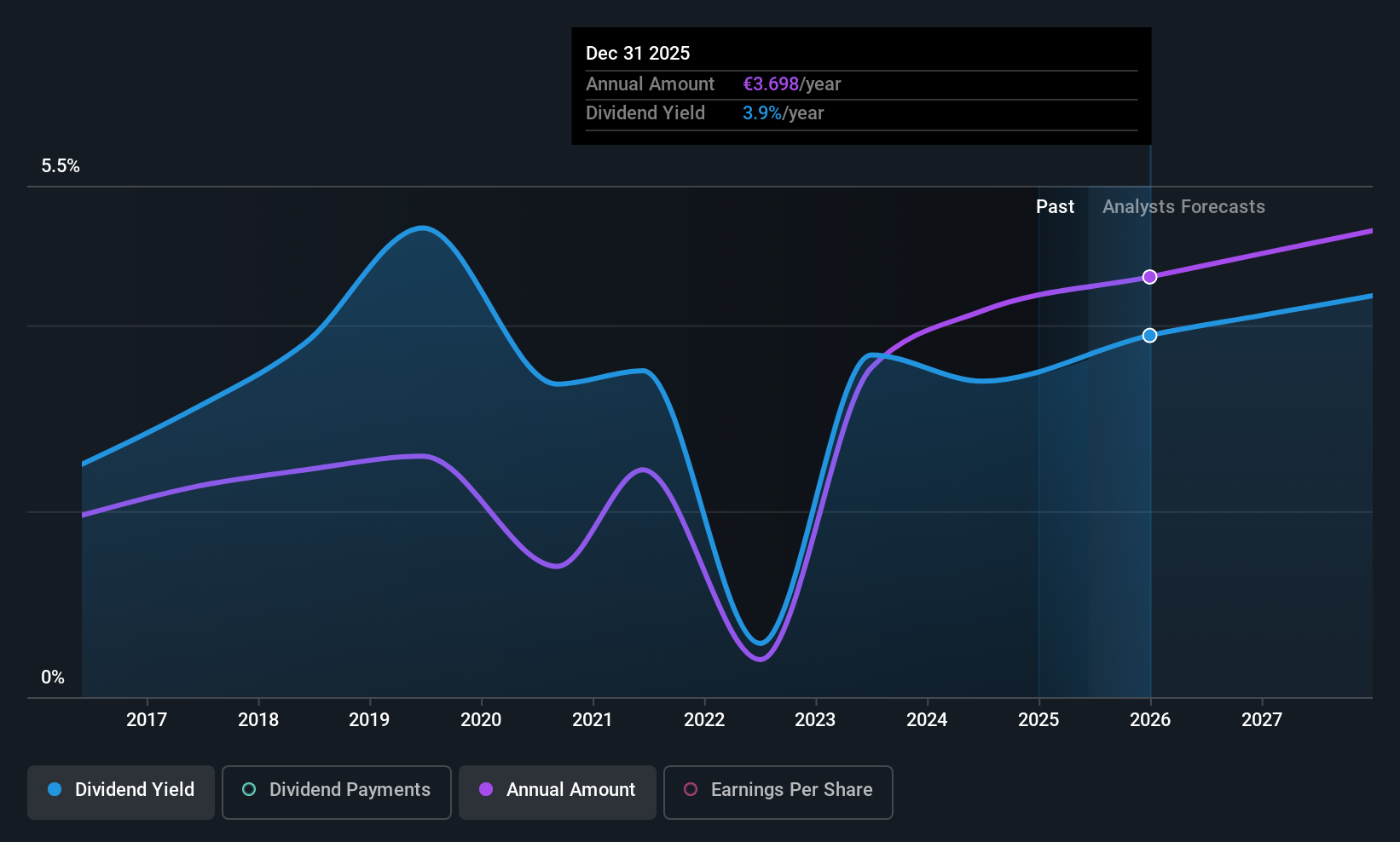

Publicis Groupe (ENXTPA:PUB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Publicis Groupe S.A. is a global company offering marketing, communications, and digital business transformation services across various regions including North America, Europe, the Asia Pacific, Latin America, Africa, and the Middle East with a market cap of approximately €21.60 billion.

Operations: Publicis Groupe generates revenue of €16.86 billion from its advertising and communication services across multiple regions worldwide.

Dividend Yield: 4.2%

Publicis Groupe's dividend payments have been volatile over the past decade, with an unreliable track record. However, dividends are well covered by earnings and cash flows, indicated by a payout ratio of 52.8% and a cash payout ratio of 43.5%. Despite trading significantly below estimated fair value, its dividend yield of 4.18% is lower than the French market's top tier. Recent upgrades in earnings guidance suggest potential for improved financial performance this year.

- Navigate through the intricacies of Publicis Groupe with our comprehensive dividend report here.

- Our valuation report here indicates Publicis Groupe may be undervalued.

Olvi Oyj (HLSE:OLVAS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Olvi Oyj is a beverage company that manufactures and sells alcoholic and non-alcoholic beverages across Finland, Estonia, Latvia, Lithuania, Denmark, and Belarus with a market cap of €636.69 million.

Operations: Olvi Oyj generates revenue primarily from its alcoholic beverages segment, which accounts for €659.75 million.

Dividend Yield: 4.2%

Olvi Oyj's dividend payments have shown consistent growth and stability over the past decade, although they are not fully covered by cash flows, with a high cash payout ratio of 105.8%. Despite trading at a significant discount to its estimated fair value, recent earnings results indicate a decline in net income and EPS compared to the previous year. The dividend yield of 4.23% is lower than Finland's top-tier payers but remains well-covered by earnings given a payout ratio of 47%.

- Click to explore a detailed breakdown of our findings in Olvi Oyj's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Olvi Oyj shares in the market.

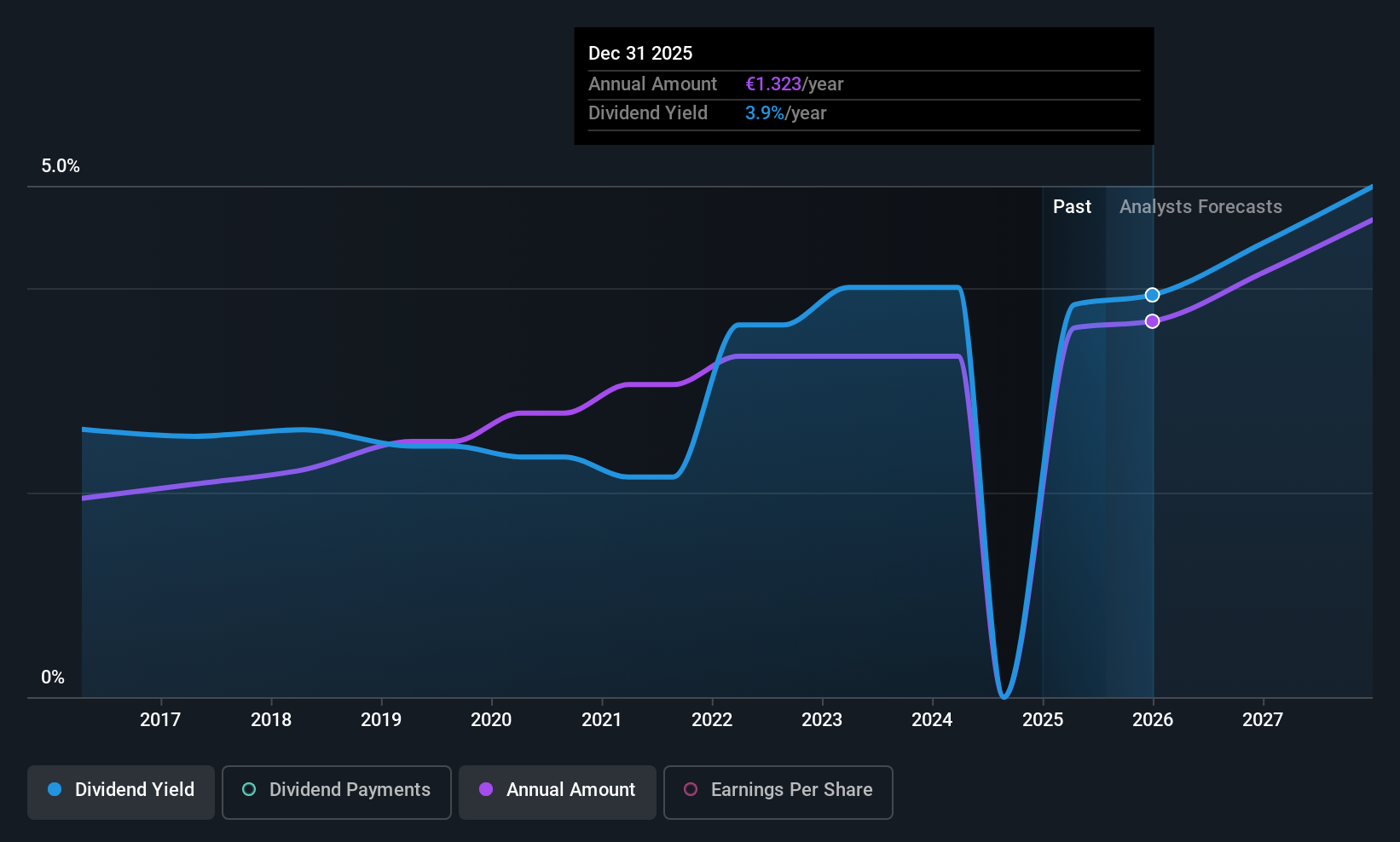

Sparebanken Norge (OB:SBNOR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sparebanken Vest is a financial services company offering banking and financing services in Vestland and Rogaland, Norway, with a market cap of NOK19.74 billion.

Operations: Sparebanken Vest generates revenue from several segments, including NOK392 million from its Estate Agency Business, NOK395 million from Bulder Bank under Banking Operations, NOK3.44 billion from the Retail Market in Banking Operations, and NOK2.44 billion from the Corporate Market in Banking Operations.

Dividend Yield: 4.7%

Sparebanken Norge's dividend yield of 4.72% is below Norway's top-tier payers, but its payout ratio of 48.3% indicates dividends are well-covered by earnings and forecasted to remain sustainable at 68.4%. Despite a history of volatility in dividend payments, recent earnings growth and a low price-to-earnings ratio suggest good value compared to peers. However, reliance on external borrowing for funding introduces higher risk, as evidenced by recent debt issuances totaling over NOK 8 billion and SEK 500 million.

- Unlock comprehensive insights into our analysis of Sparebanken Norge stock in this dividend report.

- Upon reviewing our latest valuation report, Sparebanken Norge's share price might be too pessimistic.

Where To Now?

- Investigate our full lineup of 228 Top European Dividend Stocks right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:SBNOR

Sparebanken Norge

Sparebanken Vest, a financial services company, provides banking and financing services in the counties of Vestland and Rogaland, Norway.

Reasonable growth potential with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives